Mankind Pharma IPO Analysis

Posted by : Sheen Hitaishi | Wed Apr 26 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1682508124292{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]

Mankind Pharma is a pharmaceutical company established in 1991 and a leading India-focused formulation player, deriving 98% of its total sales from branded formulations. With its extensive marketing network spanning across the country, the company has established a strong presence in the Indian market. Additionally, Mankind Pharma boasts an impressive 25 manufacturing facilities strategically located throughout India, which enables them to efficiently produce and distribute their products to customers in a timely manner.

It has launched its Initial Public Offering (IPO), which involves offering approximately 4 crore equity shares for sale through an Offer for Sale (OFS).

The upcoming issue will open for subscription on April 25 and will be available for bidding by the public until April 27. Interested investors can bid for lots of 13 shares or multiples thereof, with a price band of Rs 1,026–1,080 per share. At the higher end of the price band, the issue size is expected to be in the range of Rs 4,110–4,326 crore, as the Delhi-based company is eyeing a market value of Rs 43,000 crore. However, its upcoming IPO is an Offer for Sale (OFS), meaning no new capital will be raised as the shares being sold are owned by current shareholders.

The issue is priced at a slightly higher P/E ratio of 32–33 times FY23 earnings compared to the industry average. The company has allocated 35% of the net offer to individual investors, 50% to qualified institutional buyers, and 15% to non-institutional buyers.

Between FY20 and FY22, the company’s revenue grew at a compound annual growth rate (CAGR) of 15%, while adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) increased by nearly 18%. The company’s revenue is heavily concentrated in India, accounting for 98% of its total revenue.

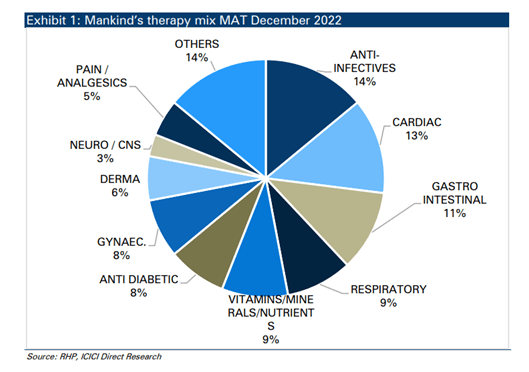

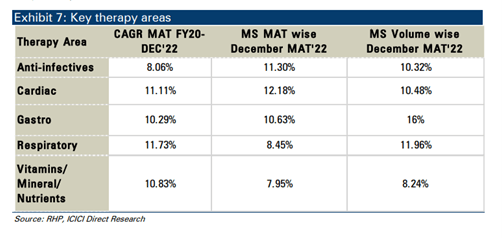

Mankind is the fourth-largest player in the domestic market, with a presence across therapy areas like anti-infectives, cardiac, gastro-intestinal, respiratory, and consumer healthcare segments like condoms, acne preparations, emergency contraceptives, and pregnancy tests, among others.

As of December 2022, it employed 4,121 manufacturing workers across 25 manufacturing locations and four R&D laboratories in India. It has a field team of 3,561 field managers and 11,691 medical representatives across India.

OUR TAKE

Mankind has constantly outperformed the IPM (Indian Pharmaceutical Market) and has seen regular, steady growth. Its brands have enabled them to consistently generate the highest share of drug prescriptions in the IPM from FY18 to FY22. Additionally, they were placed second by market share for MAT (Moving Annual Total) in December 2022 in its covered markets.

The company also manufactures key APIs for some of its key products and is vertically integrated to some extent. Some of its manufacturing facilities are supported by its own packing material sites. Their raw material suppliers are primarily located in India and China. For FY2020 to FY2022 and in the nine months ended December 2022, no single raw material supplier accounted for more than 5% of total expenses. 93.08% of the raw material is sourced domestically, 4.95% comes from China, and the balance, 1.97%, comes from other countries.

Since it is highly focused on India as a geography, it is less likely to witness medium-term headwinds such as excessive competition in regulated markets such as the US and Europe, currency risks, and the economic slowdown or recession that are being faced by the players doing business globally.

Being India-focused and having a substantial market share in some of the segments, the IPO is worth considering for investors who are looking to allot a portion of their funds to a pharma company with a strong market presence.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly Update[/vc_column_text][/vc_column][/vc_row]

Related Posts

Weekly Update- 02 January 2026

Victory Electric Vehicles International IPO GMP & Review: Apply or Avoid?

Best Small-Cap Mutual Funds for high growth potential

Best Mutual Funds To Invest in India For High Returns

Modern Diagnostic IPO Allotment Status Check Online: GMP, Subscription, Price, and More