Mahindra & Mahindra in top gear with Q2FY23 results

Posted by : Sheen Hitaishi | Wed Nov 16 2022

Mahindra & Mahindra Ltd is one of the most diversified automobile companies in India with a presence across 2-wheelers, 3-wheelers, PVs, CVs, tractors & earthmovers. It has a market cap of Rs 1,58,892 crores and has recently announced their Q2FY23 results on 2nd November 2022.

The company reported a steady performance in Q2FY23 with the highest-ever quarterly PAT, revenue, and margins…On the technical charts, the company has delivered robust returns in the past 6-7 months. Post announcement of such healthy results, the stock price has corrected slightly in consecutive trading sessions. So, let’s analyse their Q2FY23 results in order to understand the reason behind the same and check if this correction brings an opportunity for investors.

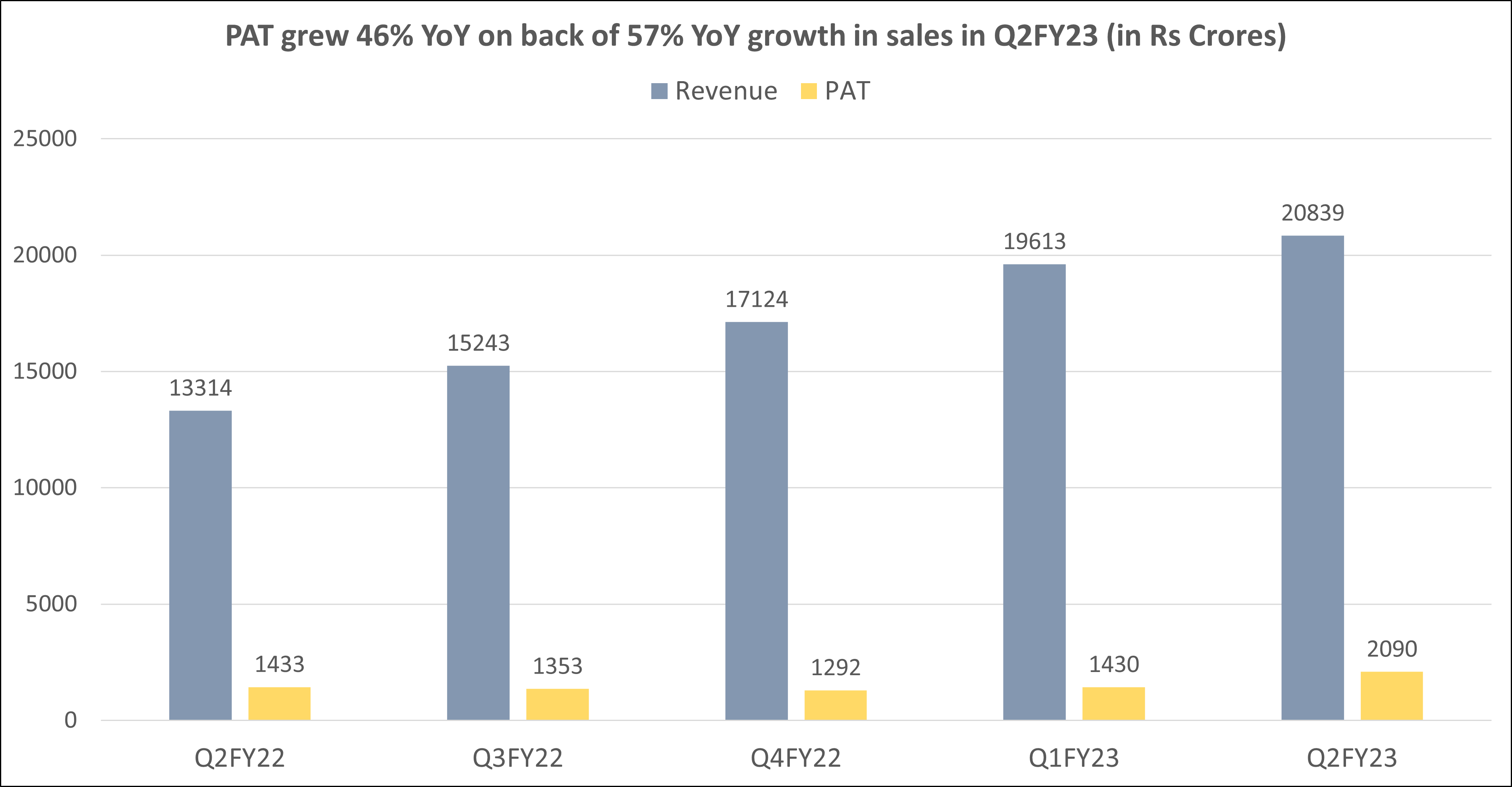

Mahindra & Mahindra results Q2FY23: PAT grew 46% YoY along with 57% YoY growth in revenue, highest ever reported

Mahindra in Q2FY23 has reported a PAT of Rs 2,090 crores, up almost 46% both YoY as well as QoQ from Rs 1,433 crores in Q2FY22 and Rs 1,430 crores in Q1FY22. This was on the back of 57% YoY sales growth, as Standalone net sales for the quarter stood at Rs 20,839 crores, up 6.3% QoQ from Rs 19,613 crores in Q1FY23

Further, Automotive volumes for the quarter were up 17.1% QoQ to 1.8 lakh units while tractor volumes recorded a 21% QoQ decline to 93,540 units (seasonality impact). Even Automotive ASPs were also up 2.2% QoQ to Rs 8.2 lakh/unit with tractor ASPs up by 5% sequentially at Rs 5.9 lakh/unit.

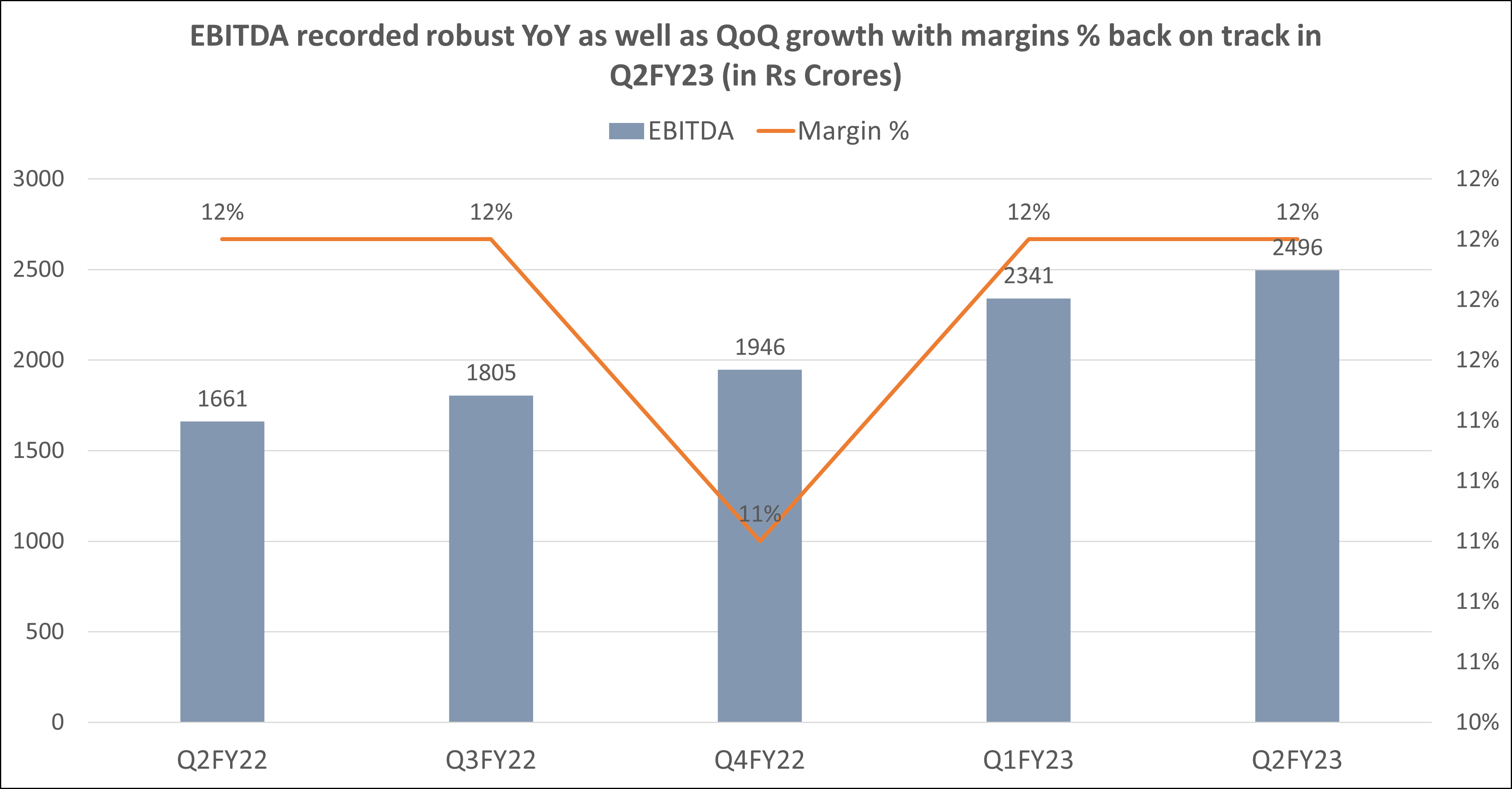

Mahindra & Mahindra results Q2FY23: Margin % back on track

Mahindra’s Q2FY23 EBITDA margin was at 12%, flat QoQ, and was in line with consensus estimates. Whereas gross margin was flat QoQ led by promotional pricing of new SUV launches mitigating the benefit of RM price decline.

While Standalone EBITDA in Q2FY23 stood at Rs 2,496.4 crores. For Q2FY23, the automotive segment posted a 42 bps increase in EBIT margins QoQ to 6.1% while tractor segment EBIT margins grew by 35 bps QoQ to 16.4%.

Mahindra & Mahindra results Q2FY23: Capex plans in action

As the order backlog remains high at >260k with the new Scorpio adding 130k bookings, M&M has planned capacity growth to 39k/49k units per month by Q4FY23/Q4FY24, respectively. In order to significantly increase market share in the key SUV segment, successful model launches, production ramp-up, and an improving chip supply situation are required.

Even the EV portfolio roll-out will begin in January’23 with the XUV400 and include 17 new vehicles (starting in FY24), including LCVs and 3WDs other than SUVs. In FY23–24, the outlook for capital expenditures and investments is steady at Rs 65 billion on average, with periodic asset monetisation programmes boosting cash inflow.

Univest View along with Technical Analysis:

Overall, M&M has reported a remarkable performance in Q2FY23 with improving volumes and growing operating performance. Investors can expect the automotive segment’s volume to rise at a CAGR of 28% over FY2022-25 estimates as suggested by market analysts. Moreover, M&M is one of the preferred picks in the auto space, given: its growing customer preference for SUV and back-to-back successful launches; its leadership position in the tractor industry; proactiveness to leverage the EV trend, which can lead to value unlocking; and well-played out capital allocation strategy.

Also, M&M in charts can be seen consolidating in the beginning of the year till March’22 before starting its upward journey. Post consolidation, it started its upward trend with higher high and higher lows pattern. While recently it can be again seen consolidating for last 2 months while 50 EMA is still above 100 & 200 EMA indicating long term bullishness. Further, the Mahindra has made a new 52 weeks high prior to announcement of Q2FY23 results.

After announcement it retraced slightly on daily charts. Investors can consider this as a normal retraction while the results were in line with expectations. Therefore, the stock still remains bullish and is considered to have been consolidating a bit before resuming it’s uptrend again.

ICICI Securities said, “We value M&M on a revised SoTP-based target price of Rs 1,339.”

Whereas on the Univest app, M&M has a Hold rating along with a strong stance for Fundamentals. While their long-term trend is bullish, their short-term trend remains neutral as per the app. Therefore, existing investors can remain invested while fresh investors can consider entering the stock once the rating on the Univest app becomes Buy and the short-term trend also turns bullish.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Reliance saw O2C margins under pressure in Q2FY23

Related Posts

Defrail Technologies IPO Listing at 24.43% Premium at ₹92.08 Per Share

Bharat Coking Coal IPO Listing at 96% Premium at ₹45.00 Per Share

Private Bank Stocks After Q3 FY26: HDFC Bank, ICICI Bank, Yes Bank or RBL Bank — Where Should Investors Look?

Yes Bank Q3 Results 2026 Highlights: Net Profit rises by 54.6% & Revenue fall 1.5% YoY

HDFC Bank Q3 Results 2026 Highlights: Net Profit rises by 12.1% & Revenue Up 2.4% YoY