LIC reported stellar Q2FY23 numbers

Posted by : Sheen Hitaishi | Tue Nov 22 2022

Life Insurance Corporation (LIC) is the largest insurance provider company in India. It has a market share of above 66.2% in new business premium. The company offers participating insurance products and non-participating products like unit-linked insurance products, saving insurance products, term insurance products, health insurance, and annuity & pension products. The insurance giant recently announced their Q2FY23 results on 13th November 22.

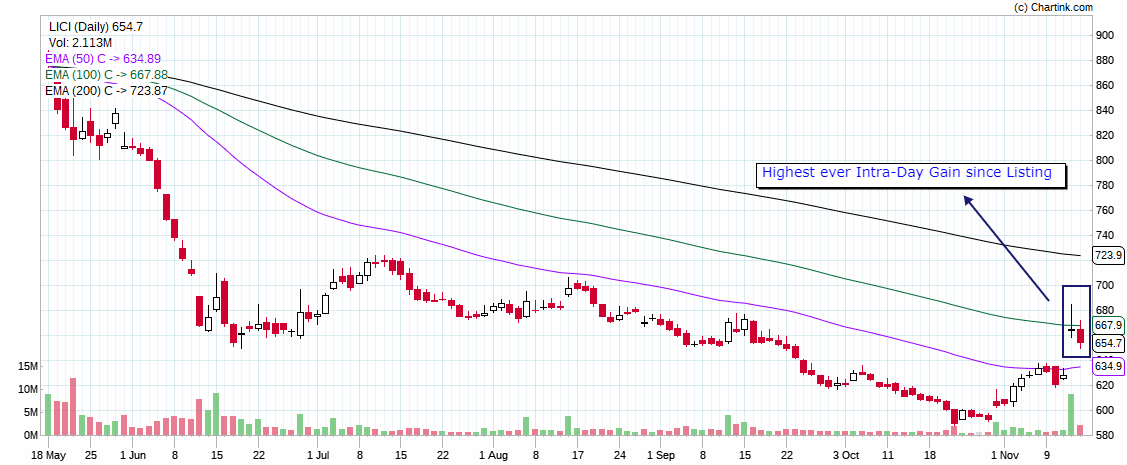

This quarter LIC reported a very healthy performance in Q2FY23 with robust double-digit growth across several parameters along with a multi-fold rise in net profits. All this has brought the LIC into the limelight as its share price went on to gain 9% intra-day, the highest ever since listing in 2022. So, let’s now analyse the reason behind the same by looking at Q2FY23 numbers and checking if it offers any investment opportunity as several brokers have initiated a buy rating on the stock.

LIC results in Q2FY23: Multi-Fold increase in PAT with APE and VNB trajectory on a strong footing

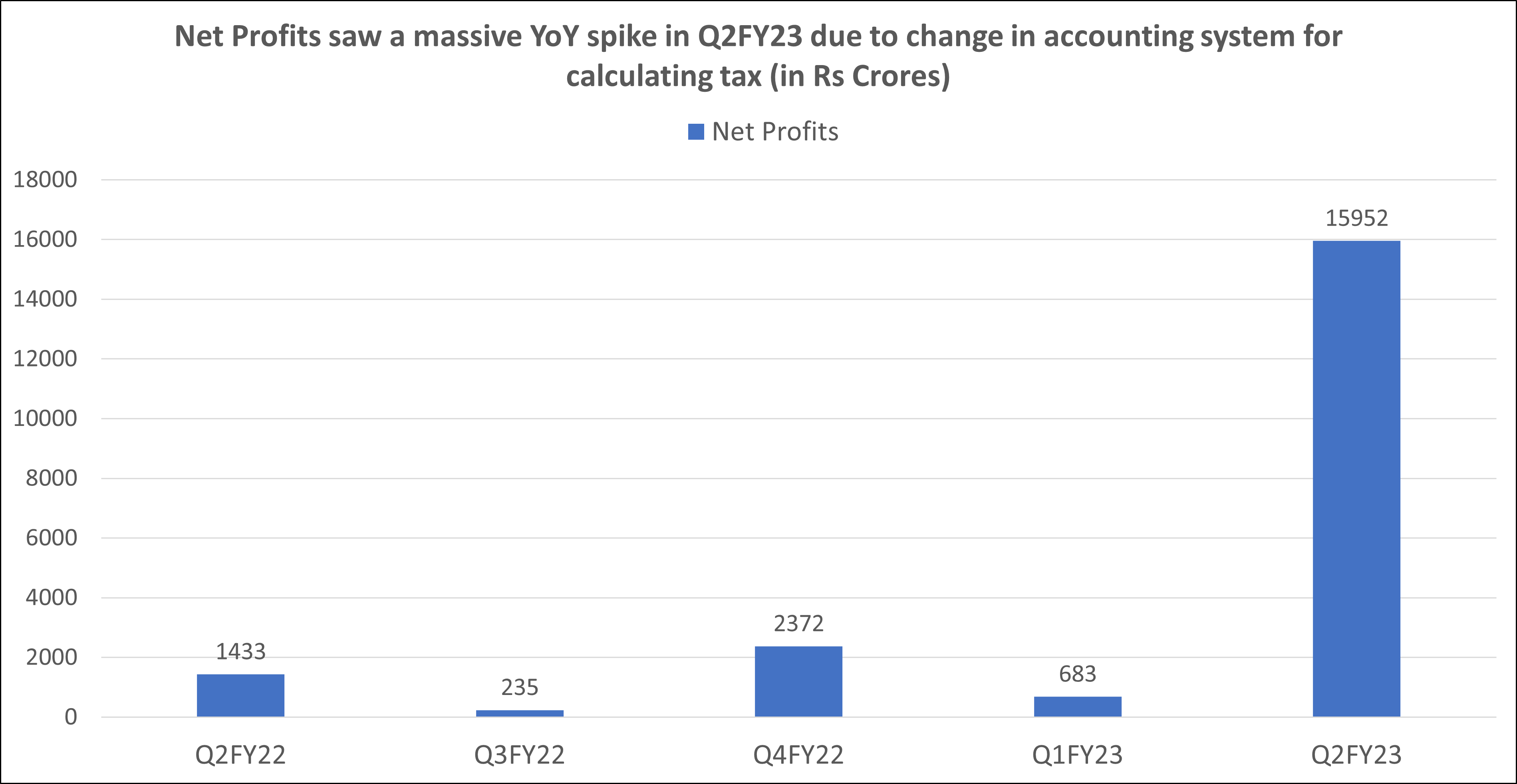

The company reported a net profit of Rs 15,592 crores for Q2FY23. The profit increased multi-fold from Rs 1,433 crores in Q2FY22. The jump in profit was mainly because of a change in the way the company computes profits. Whereas sequentially the net profit increased from Rs 682.9 crores.

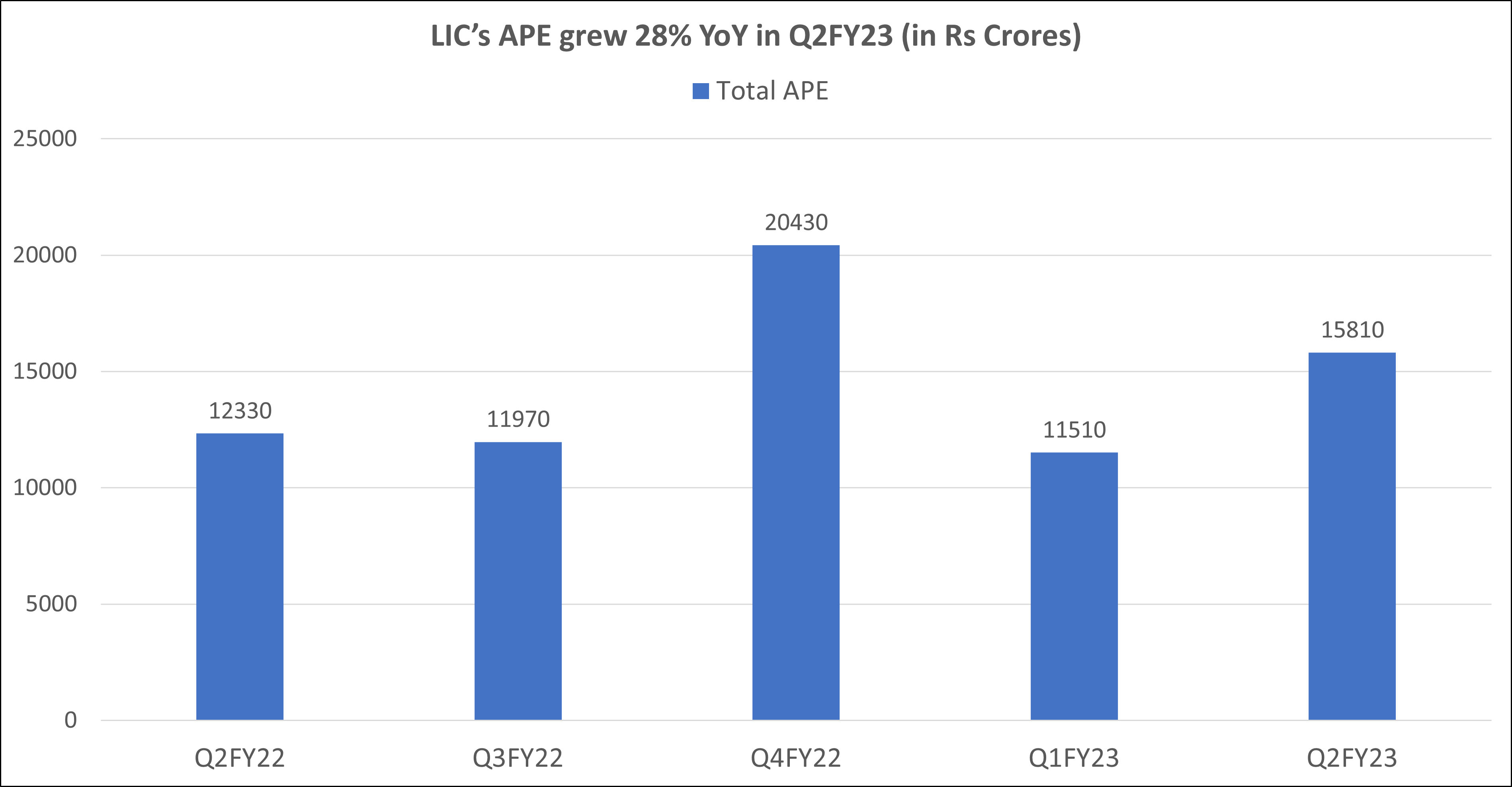

This strong financial performance of LIC was on the back of 48% YoY growth in APE to Rs 25,200 crores in H1FY23. Further, VNB grew 132% YoY to Rs 3,680 crores as VNB margin improved by 530 bp to 14.6% in H1FY23. Whereas VNB margin rose 160 bp QoQ to 15.2% in Q2FY23.

You may also like: Bajaj Finance Q2FY23 results

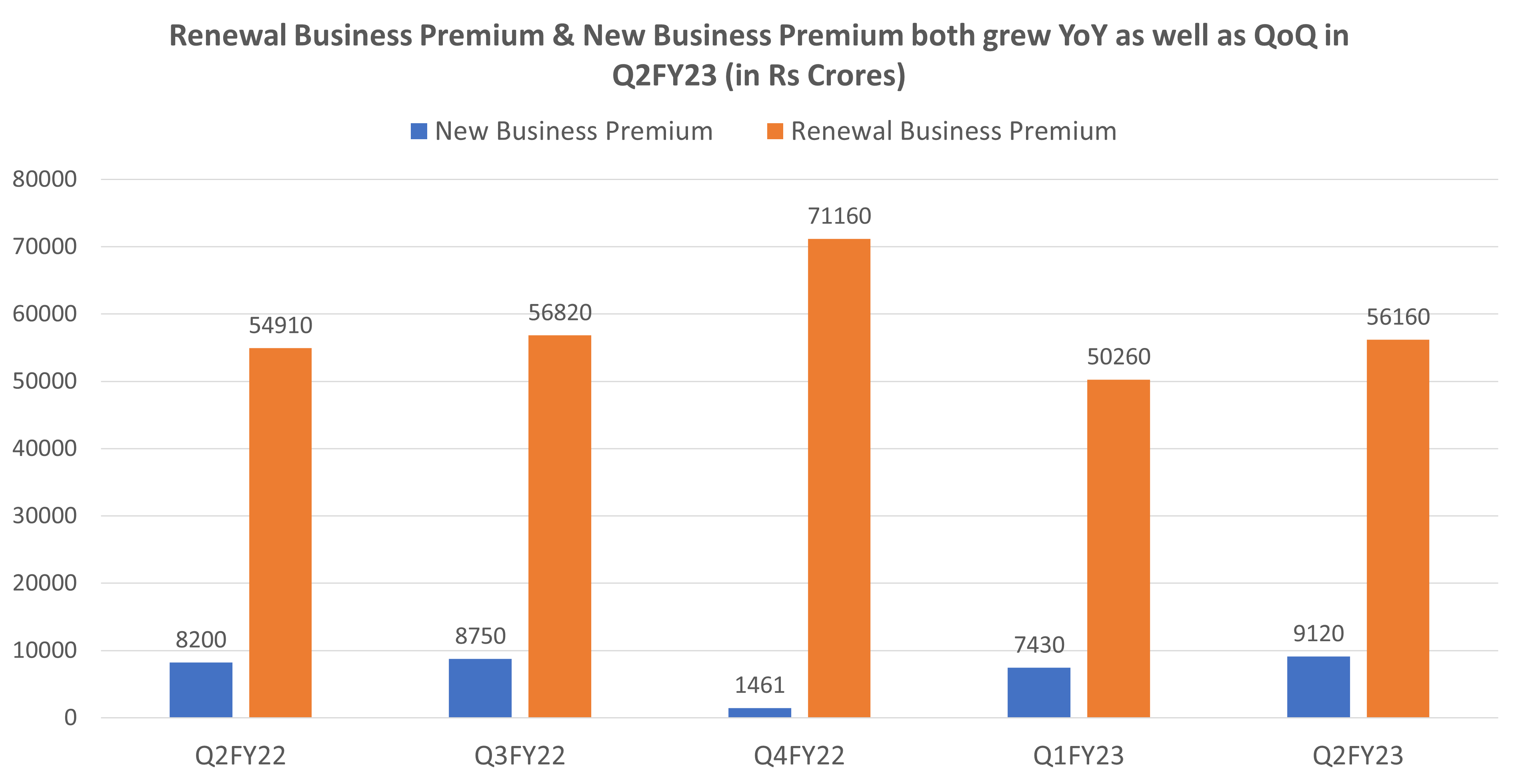

LIC results Q2FY23: NBP & RBP both saw robust growth

LIC has reported a 27% YoY growth in net premium, led by a 53%/2% growth in the New/Renewal business. Total NBP (new business premium) grew 51% YoY to INR780b in 2QFY23, led by 71% growth in the Group segment. However, the same was partially offset by a 2% YoY decline in Individual NBP.

First-year premium, an indication of business growth, came in at Rs 9,124.7 crores for the quarter compared with Rs 8,198.30 crores a year ago. Further, net premium income was Rs 1.32 lakh crore, compared with Rs 1.04 lakh crore in the year-ago period.

LIC results in Q2FY23: VNB growth was very high for LIC

Further, VNB growth for LIC was driven by an increase in the non-par mix and a gradual increase in surplus distribution toward shareholders. The company has seen that a product-mix-driven increase in VNB margin is a straightforward objective as seen from industry peers.

The 160 bp QoQ increase in VNB margin was due to a higher margin in the Group segment and Individual PAR business. However, the same was partially offset by a 470 bps QoQ decline in the margin in the individual non-PAR segment, led by a revision in Annuity rates to make it more competitive v/s its peers. Within the Group segment, a higher share of Annuity drove the 230 bps QoQ expansion in the margin to 17.6% in H1FY23.

This quarter, the company has launched two new products – Dhan Sanchay and Bima Ratna, the latter being a channel-specific product only for bancassurance. The company has also tied up with Policy Bazaar, catalysing policy sales through online channels. The company’s Ananda app, launched during COVID-19 to aid agents to do business without face-to-face interactions, is now integrated with WhatsApp and has brought down time to policy conclusion to less than 8 minutes.

Univest View along with Technical Analysis:

Life Insurance Corporation of India’s share price zoomed more than 9% intraday on November 14, as investors cheered the state-owned insurer’s robust September quarter results. Whereas the LIC share was in the downtrend from the beginning post listing. While its 50 EMA is still below 100 & 200 EMA indicating bearishness. Brokerages have now updated their stance for LIC and are now bullish.

Motilal Oswal said, “We now expect LICI to deliver a 20% CAGR in APE over FY22-24, thus enabling 28% VNB CAGR. We expect operating RoEV to remain modest at 11.8%, given its lower margin profile than private peers. We maintain our Buy rating.”

ICICI Securities said, “Concerns on equity sensitivity to EV is overdone and the relative ease

of increasing VNB margin through change in mix is under-appreciated. Therefore, investors

can initiate with BUY and target price of Rs 917.”

While on the Univest App, the LIC stock has yet to be rated. While investors who have subscribed to LIC shares at the time of listing and are still holding them can wait for it to make a come back to the same levels and may therefore want to make an exit post that. While fresh investors can remain away from the company for a some more time till it

continues to report the similar performance in the next quarter as well or gives a trend reversal on the charts.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: SBI results

Related Posts

Yes Bank Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

IDBI Bank Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

ICICI Bank Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

HDFC Bank Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

South Indian Bank Q3 Results 2026 Highlights: Net Profit Surged by 9.00% & Revenue Up 6.00% YoY