Fundamentally strong stocks in focus this week

Posted by : Sheen Hitaishi | Sat Mar 18 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1679161617776{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]While the markets have been correcting for the last three months, and many sectors and stocks have seen a fall from their recent highs. Under these circumstances, there are a few fundamentally sound stocks, with a strong past record, as well as visibility of growth on the horizon, which are now available at a lower price for investors to invest in. Let us look at two such stocks, Persistent Systems and Mahindra & Mahindra, where investors can use the drop in stock prices to accumulate at these levels.

Persistent Systems

Persistent Systems is a mid-sized IT services company that has displayed a consistent track record with growth across key financial metrics over the past few years. In mid-February 2023, the stock reached its all-time high of Rs 5062 per share. Post which the stock has declined and ended this week at a price of Rs 4550, a fall of nearly 10% from its peak. This price drop is an advantage to long-term investors as the stock has strong growth potential in the coming quarters and might be one of the outperformers from the IT pack.

Consistent growth across key metrics for every quarter

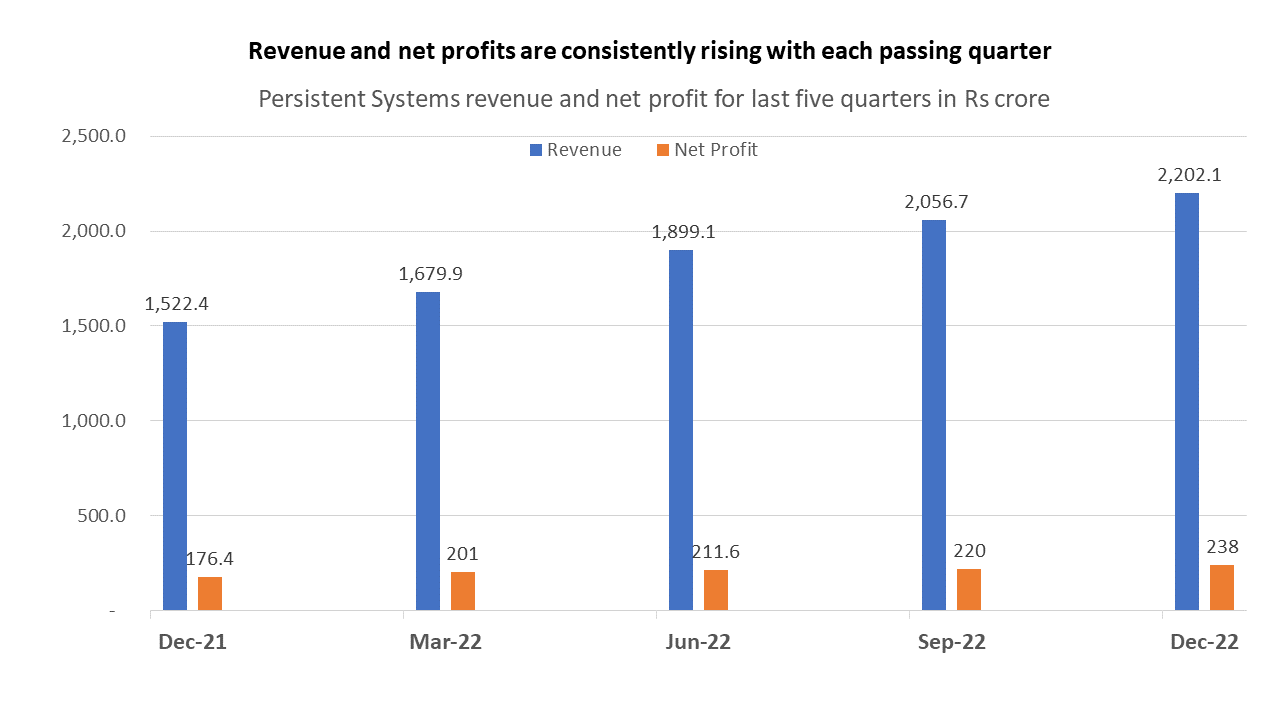

The company has displayed a consistent track record of growth in revenue and net profits for the past five quarters, indicating its strong performance over time.

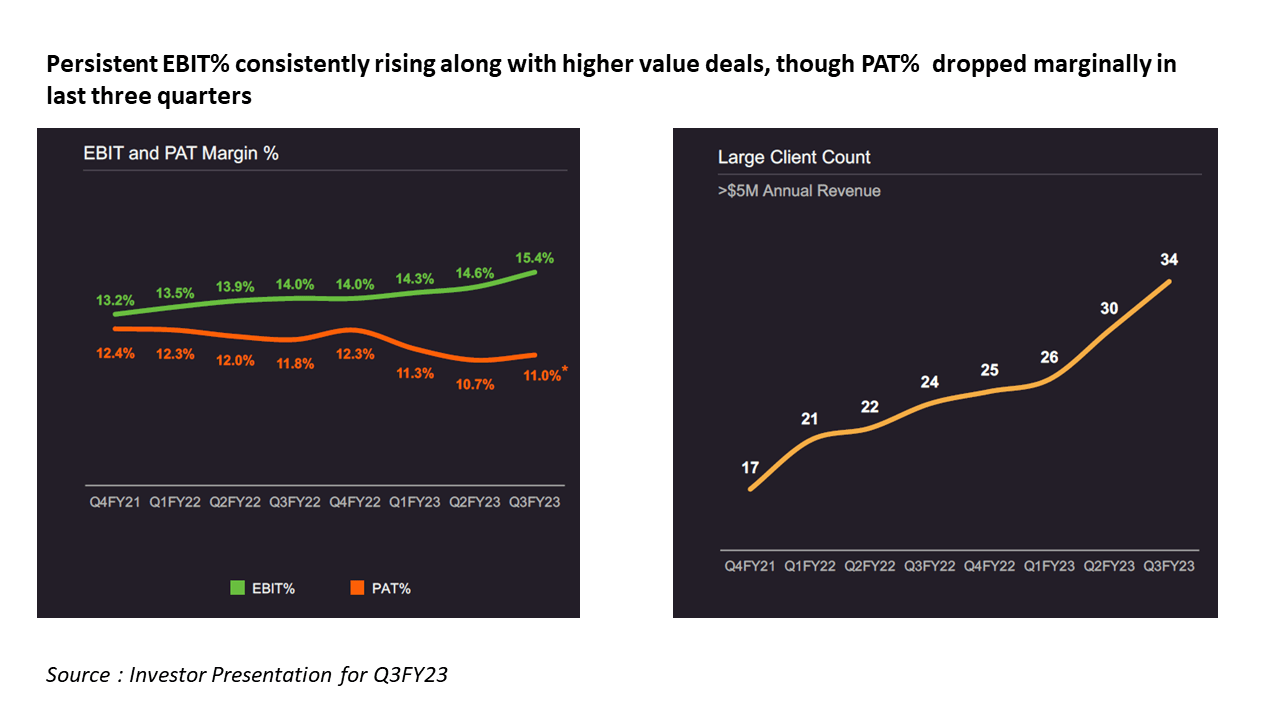

The Q3FY23 results for Persistent Systems exceeded street expectations, with a 3.5% growth in constant currency (CC) terms. In USD terms, the revenue grew 3.4% QoQ, driven by robust growth in the IP business (+8.6% QoQ), while services grew at a slower pace of 3.0% QoQ. The EBITDA margin was impressive, standing at 18.5%.

In addition to a 3.5% growth in constant currency (CC) terms, the Q3FY23 results for Persistent Systems had other key highlights. The company achieved a US$1 billion revenue on a quarterly annualised basis and is aiming for US$2 billion annual revenue in the medium term. Furthermore, it acquired five companies in FY22, building capabilities in payments, cloud, and other areas, and is looking for further acquisitions in the coming years.

Persistent Systems’ outlook on verticals has improved, and its strengthening engagement with clients is expected to bolster its growth prospects. The TCV stood strong in Q3FY23, with deal wins at $440 million. The management is confident of gaining medium-term demand momentum on the back of the deals it has won in the previous quarter and expects an improvement in the margin front as well.

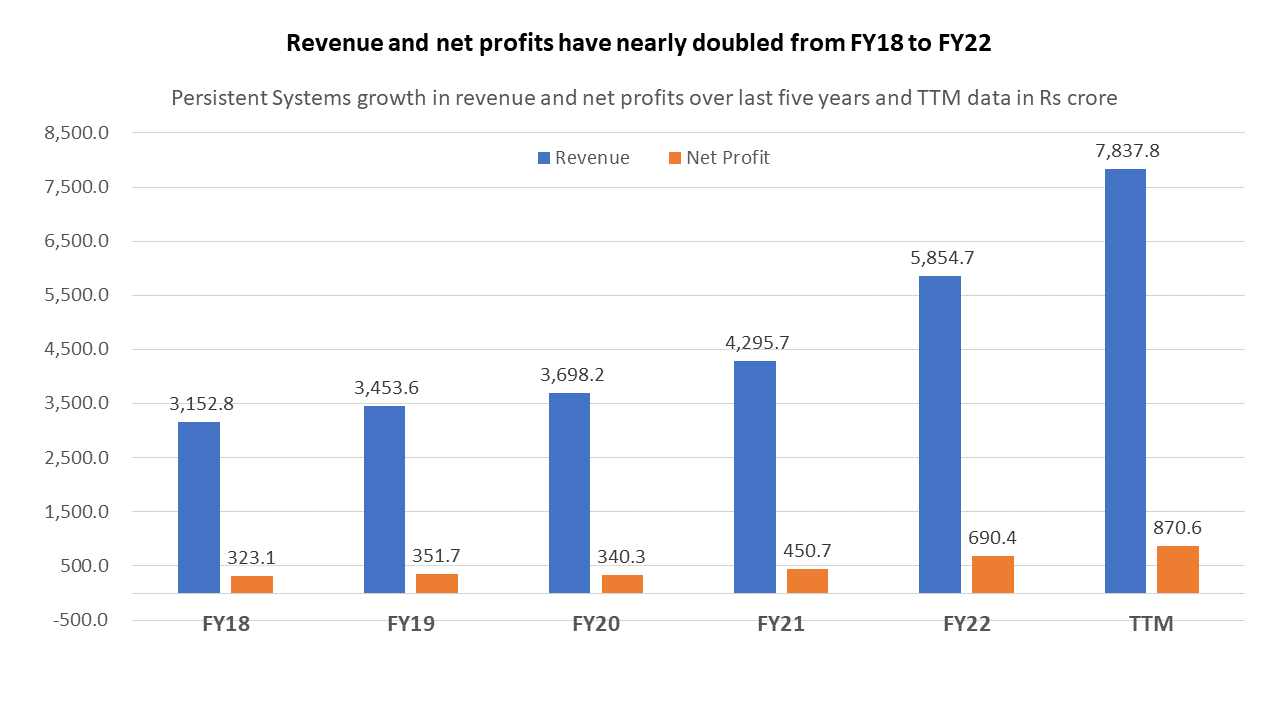

Over the last five years, Persistent Systems has nearly doubled its revenues and net profits. Based on the TTM data as of Q3FY23, it is likely that FY23 will see the highest yearly growth in revenues and net profits. The management is optimistic about future growth, with plans for vendor consolidation, securing large deals, recovering from the top two clients, and acquiring new businesses as building blocks to achieve these objectives.

Mahindra and Mahindra

Mahindra & Mahindra (M&M) is the flagship company of the Mahindra Group, with a diverse product range that includes SUVs, pickups, commercial vehicles, tractors, electric vehicles, two-wheelers, gen-sets, and construction equipment. In recent years, it has gained leadership in the tractor segment and large SUVs in India.

The M&M stock reached its lifetime high in early February this year at Rs 1388 per share. However, over the last one and a half months, the stock has dropped to Rs 1150 per share at the end of this week, a fall of nearly 16% from its high. Despite this recent decline, investors bullish on the long-term prospects of this company can now acquire its shares at a discounted price.

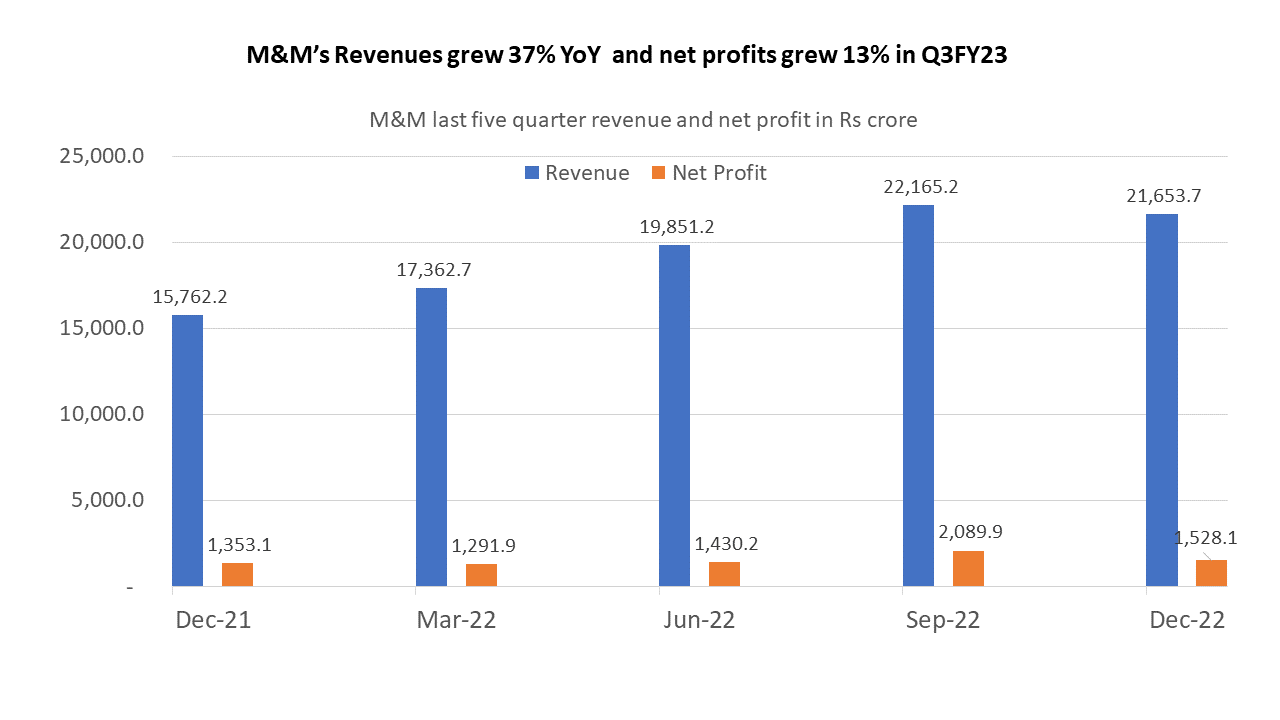

The recent Q3FY23 performance of M&M has been commented on by Dr. Anish Shah, the Managing Director & CEO of M&M Ltd. He stated that the company had another robust quarter, with the Auto division leading the way. The farm division also reported healthy growth with increased market share. M&M’s capital allocation actions continue to show results, and the company remains committed to its journey of growth and returns.

Maintaining leadership in different vehicle categories

M&M has been a market leader in SUVs for the past four consecutive quarters with the highest market share in the SUV segment, thanks to the launch of its latest line of SUVs, including the Thar, XUV700, and the Scorpio-N over the last two years. In the light commercial vehicle (LCV) segment with a load capacity of 2-3.5 tonnes, M&M enjoys leadership with a 60.1% market share in Q3FY23.

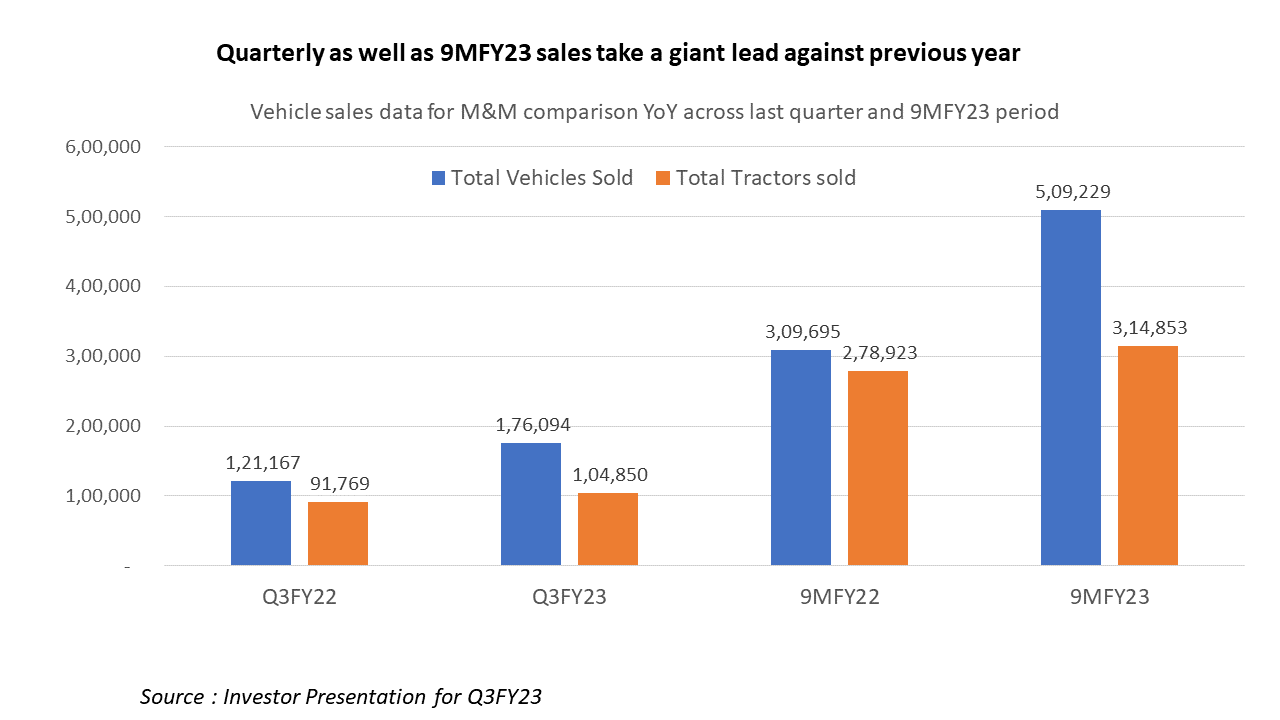

M&M also has a presence in the electric 3-wheeler space, where it makes vehicles used in last-mile delivery. This quarter, the company achieved its highest-ever quarterly billing of 11,801 units. M&M is also the market leader in tractors with a 41.4% market share, which increased by 0.9% in Q3FY23. In Q3FY23, M&M sold around 104,850 tractors, the highest ever in Q3.

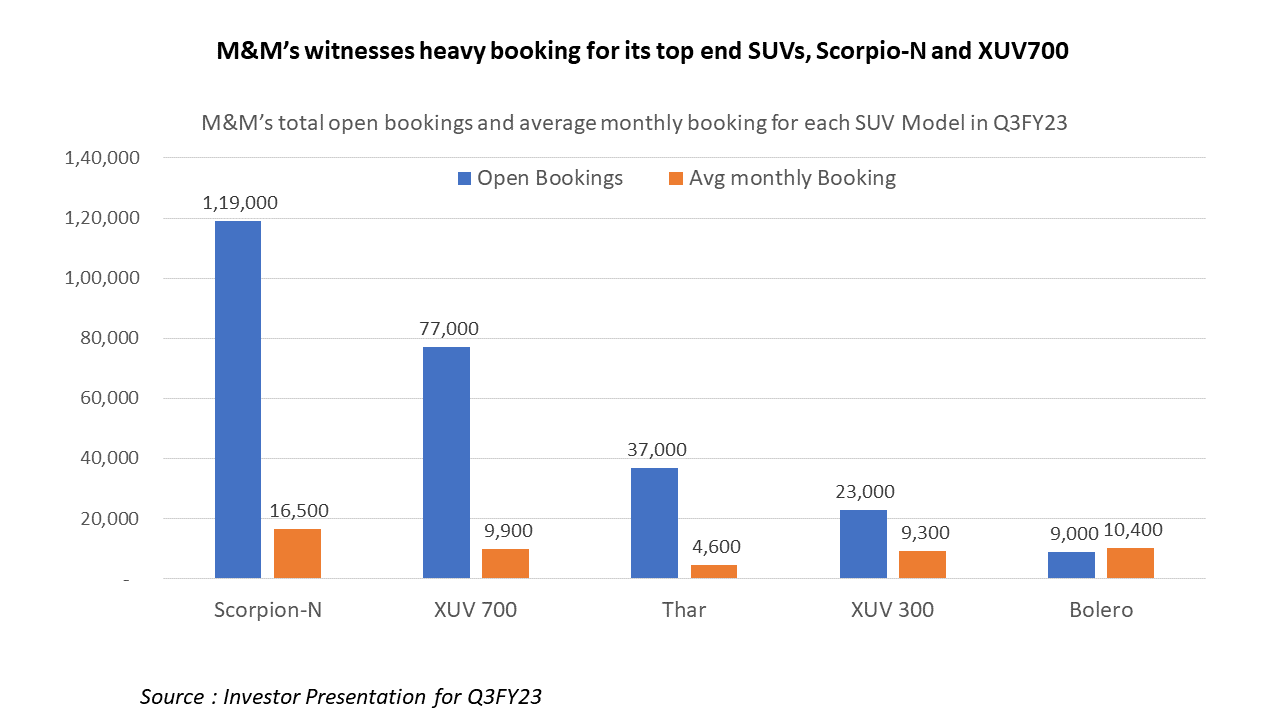

There have been challenges in the last year in the auto industry due to the shortages of semiconductor chips which affected the complete supply chain across the auto industry. The impact on M&M was that they received unprecedented orders on the XUV700 and bookings had a waiting period of more than a year before delivery of vehicles.

This is reflected in the data for open bookings, where Scorpio-N and XUV 700 have the highest open bookings. The average monthly booking for Scorpio-N is the highest among all vehicles.

Another growth trigger for M&M is the launch of its electric car, the XUV400 EV, in January 2023. The company hopes to take on the market leader in this segment, the Tata Nexon EV. Besides, M&M has lined up a number of new EV launches over the next year, indicating that it wants a substantial share of the EV market in India.

Both Persistent Systems and M&M are fundamentally sound companies with a visible runway for growth in the coming quarters. Both have recently corrected from their all-time highs and are available at a discount for investors. Over the next six months to a year, these stocks are expected to deliver above-average returns to their investors.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Stock bought by MFs in February 2023[/vc_column_text][/vc_column][/vc_row]

Related Posts

Best Battery Penny Stocks in India in 2026 for Multibagger Returns

AU Small Finance Bank Q3 Results 2026 Highlights: Net Profit Surged by 26.34% & Revenue Up 15.20% YoY

Zomato Q3 Results 2026 Highlights: Net Profit Surged by 72.88% & Revenue Up 201.85% YoY

Jattashankar Industries Gears Up for Q3 Reveal on 23rd January; Check Key Expectations Here

Umiya Tubes Gears Up for Q3 Reveal on 23rd January; Check Key Expectations Here