Cement Sector – Growth of Infrastructure, housing set to fuel demand in FY24

Posted by : Sheen Hitaishi | Mon Aug 14 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1692020299555{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]The Indian cement industry is the second largest in the world after China, with a total installed capacity of 500 million tons (MT) and an annual production of about 350 MT of cement. The industry is highly competitive, featuring numerous domestic and multinational operators. The top 10 companies account for nearly 60% of the total production.

According to a report by ICRA, the domestic cement industry is expected to experience volumetric growth of 7-8% in FY24, driven by increased demand from the housing and infrastructure sectors.

A positive start to FY24 after a challenging FY23

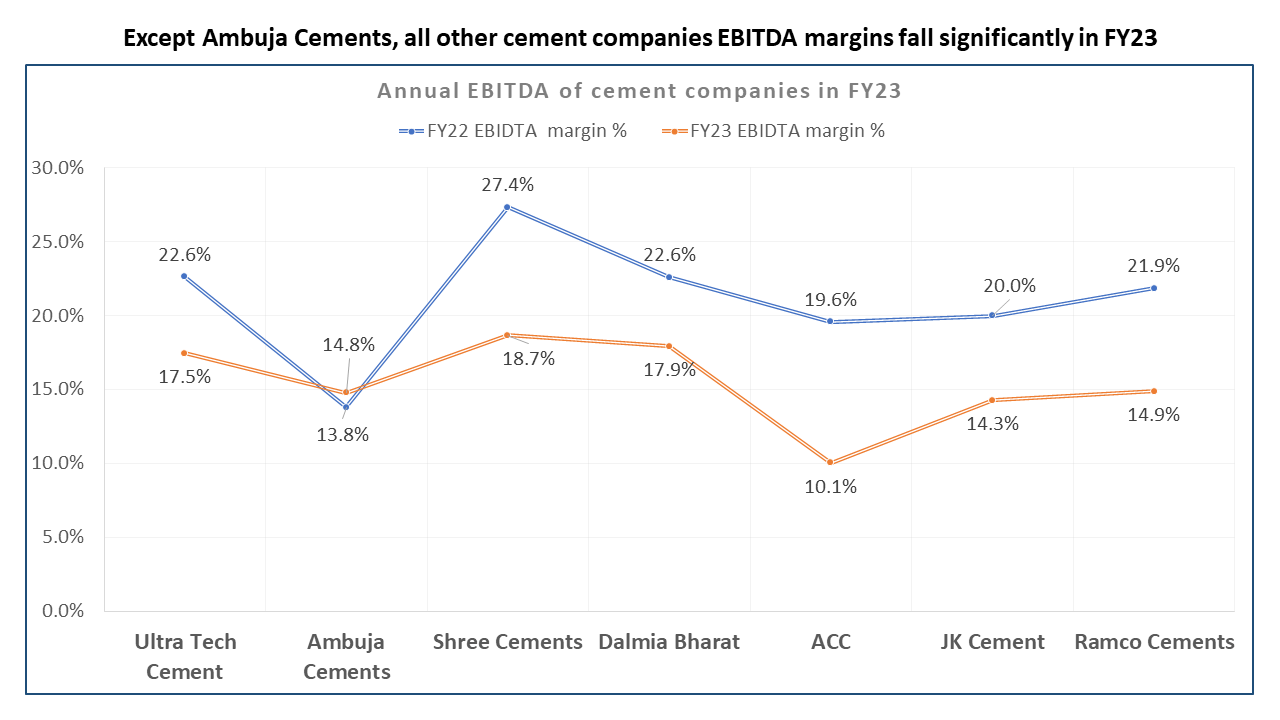

The cement industry witnessed a contraction in its margins during FY23, despite experiencing increasing demand, primarily due to the high cost of raw materials and fuel. The easing of these input costs is expected to facilitate an enhancement in the cement industry’s operating profits by 14-18% YoY, reaching Rs 900-950 per MT in FY24, as per the data shared in the ICRA report.

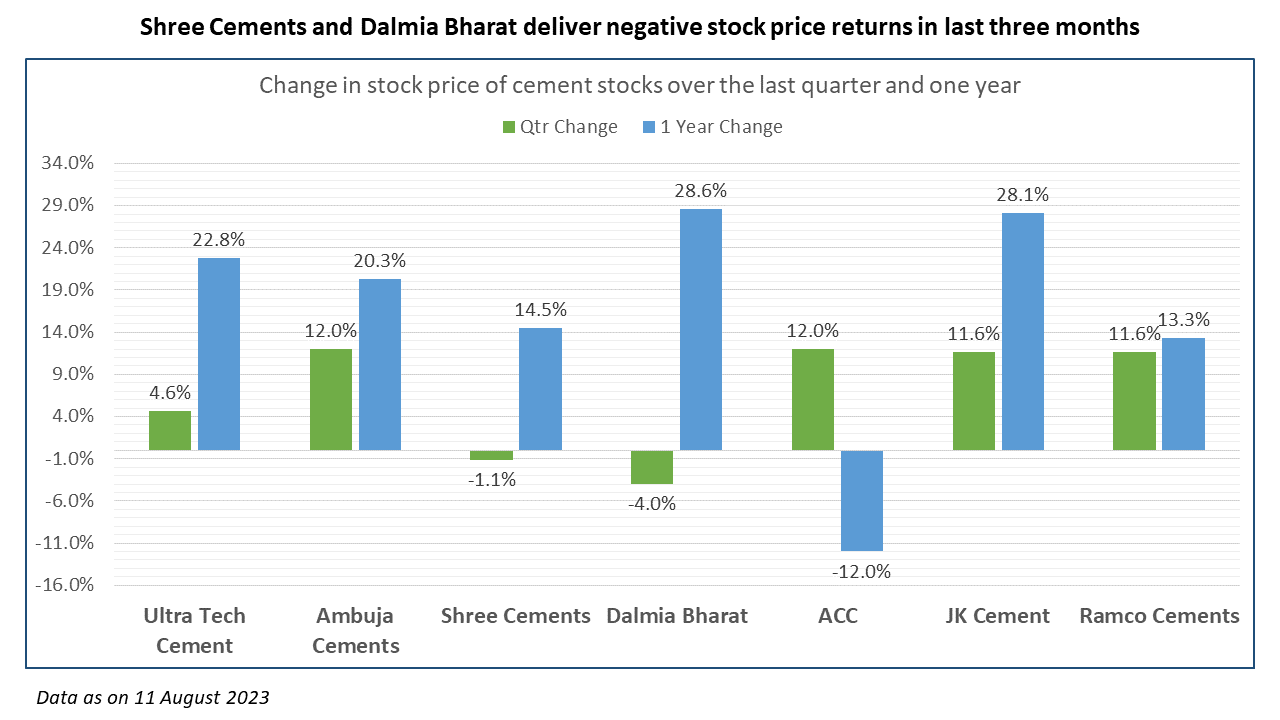

The stock prices of cement companies have yielded average returns over the past year, with the exception of ACC, which has experienced negative returns. Other companies have generated returns ranging from 13% to 28%.

The stock price trends of the last three months suggest a growing buying interest in these stocks, as several companies have seen their stock prices rise by more than 10% during this period.

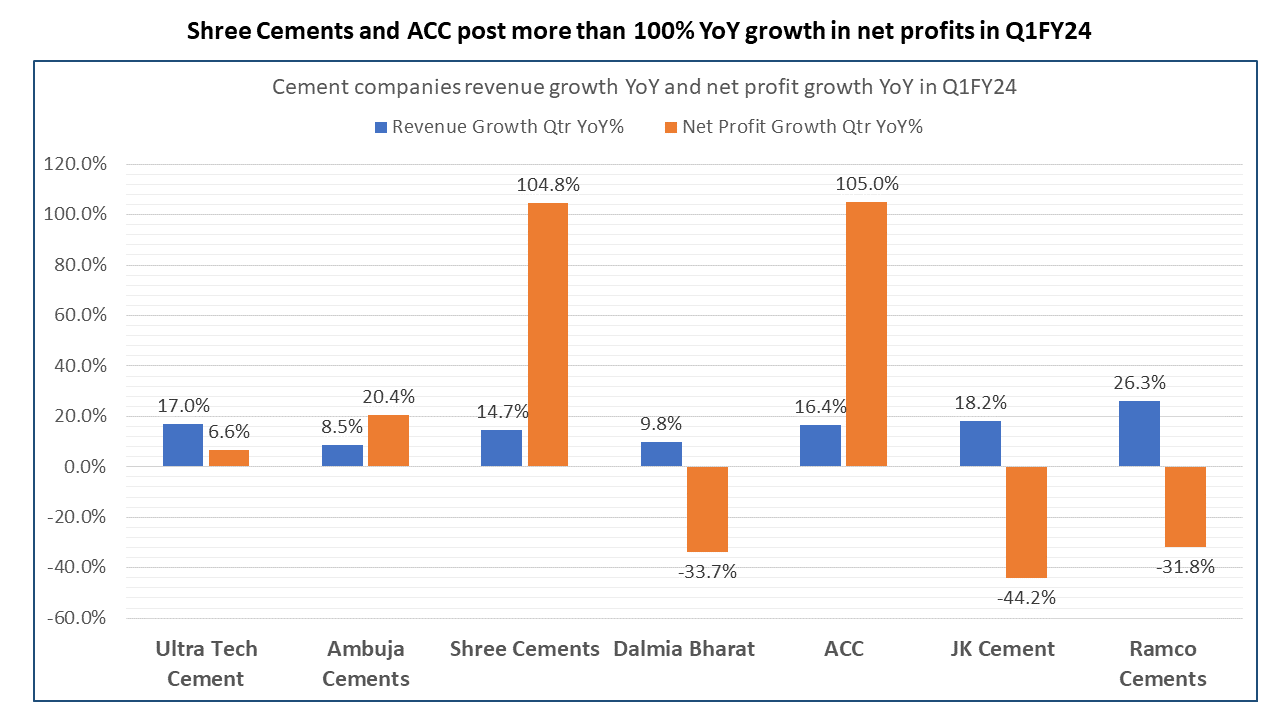

An analysis of the Q1 results for this fiscal year reveals that two cement stocks have more than doubled their YoY net profits. These stocks are Shree Cements and ACC. Conversely, Dalmia Bharat, JK Cement, and Ramco Cements have experienced a decline in profitability on a YoY basis.

Among the weaker performers, Dalmia Bharat reported a loss of market share in eastern India due to a lack of price discipline. In contrast, at an all-India level, Dalmia Cement’s peers in the industry—UltraTech Cement, Shree Cement, and ACC—all demonstrated significantly higher growth rates, outpacing both Dalmia’s growth and the industry average.

Some of the cement companies that outpaced industry growth achieved this feat even within an environment of inflation in raw material costs. Consequently, this situation had an impact on the EBITDA margins of these companies during FY23. When comparing these margins with the margins of FY22, with the exception of Ambuja Cements, the others experienced a decline in margins by over 5% in FY23.

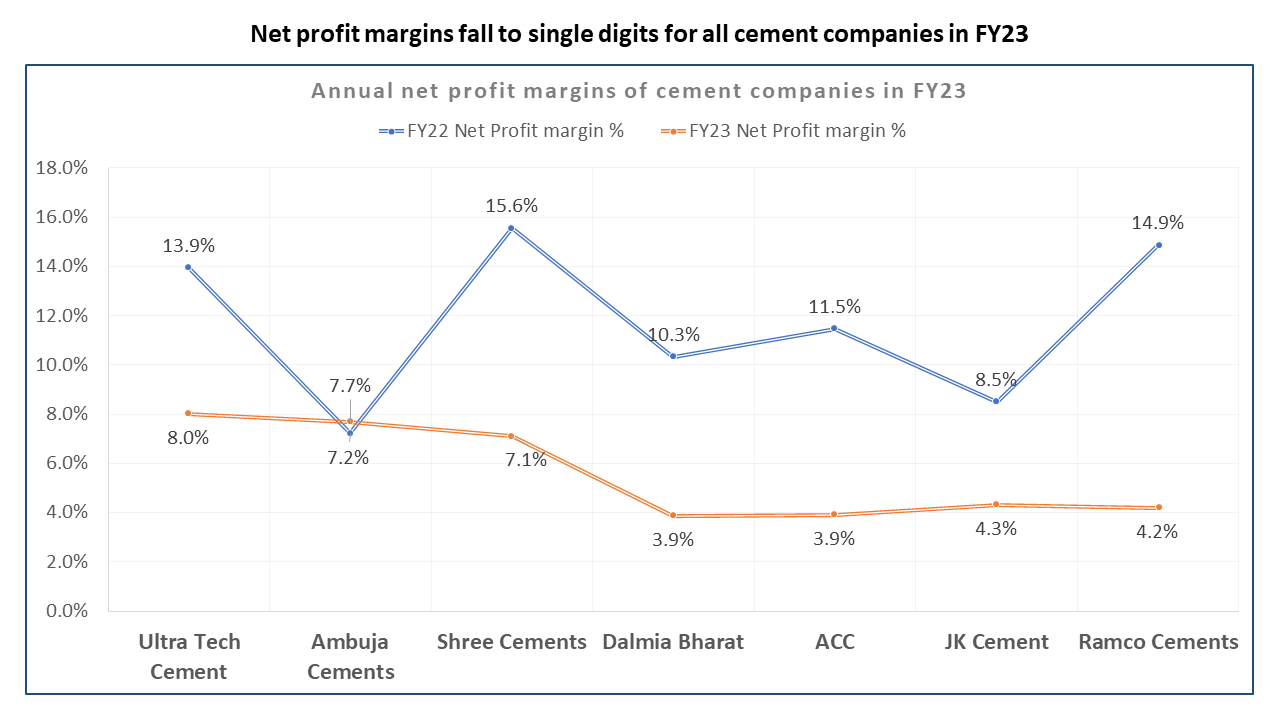

Likewise, this has also directly impacted net profit margins, which decreased from mid-teens (with Shree Cements being the highest at 15.6% in FY22) to single-digit figures in FY23. Nevertheless, with the decline in raw material prices anticipated in FY24, these figures are expected to rebound for the industry as a whole in FY24.

The cement industry is currently witnessing intense competition for leadership. While UltraTech currently holds the lead, Adani Cements (consisting of ACC and Ambuja) is in expansion mode, having made its first acquisition barely a year after entering the cement business. In July 2023, Adani Cements announced the acquisition of Sanghi Industries’ cement business.

Gautam Adani, Chairman of the Adani Group, commented on the acquisition of Sanghi Industries, stating, “This landmark acquisition marks a significant step forward in Ambuja Cements’ journey of accelerated growth,” and further added, “Through this partnership with SIL, Ambuja is poised to broaden its market presence, enhance its product portfolio, and strengthen its position as a leader in the construction materials sector.”

With this acquisition, the Adani Group is well on track to achieve its target of reaching a cement manufacturing capacity of 140 MTPA by 2028, ahead of schedule. Leveraging SIL’s billion-tonne limestone reserves, they aim to increase the cement capacity at Sanghipuram to 15 MTPA within the next two years. Additionally, they plan to invest in expanding the captive port at Sanghipuram to accommodate larger vessels, with the aim of making SIL the lowest-cost producer of clinker in the country.

Not to be outdone, UltraTech’s expansion program is progressing as planned. After commissioning 12.4 MTPA of grey cement capacity in FY23, UltraTech has further commissioned 4.3 MTPA capacity in the current financial year. This brings UltraTech’s total grey cement manufacturing capacity to 137.85 MTPA, including an overseas capacity of 5.4 MTPA.

In summary, cement stocks have provided satisfactory returns for investors in the past year, and Q1 results have been favorable for some companies. With the ongoing growth in government infrastructure, housing, and other projects, the demand for cement is expected to persist. However, in FY24, only companies that exercise financial prudence and manage to restore their EBITDA and profit margins by the end of the financial year will likely maintain a competitive edge.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly update[/vc_column_text][/vc_column][/vc_row]

Related Posts

Weekly Update- 6 Feburary 2026

Marushika Technology IPO Review 2026: GMP Rises Flat, Key Investor Insights

Highway Infrastructure Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

Euro Pratik Sales Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

Vikas Lifecare Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here