Best Real Estate Sector Stocks in India

Posted by : Ketan Sonalkar | Thu Jun 05 2025

Real Estate Sector Stocks

India’s real estate landscape has transformed into a captivating tapestry of promising avenues, woven with threads of urbanization, rising incomes, and government initiatives. The spotlight now shines brightly on real estate stocks, offering investors a vibrant canvas to paint their financial aspirations.

This blog delves into the heart of this dynamic sector, unveiling the “top real estate stocks in India“- the top contenders in the Indian real estate stock market. But before we embark on this investment journey, let’s equip ourselves with the necessary tools.

Navigating the Terrain: Key Considerations for Investment in Real Estate Stock

Investing in real estate sector stocks, like traversing any terrain, requires careful consideration. Here are some crucial factors to serve as your compass:

- Market Pulse: Take the temperature of the real estate market. Gauge supply and demand dynamics, price trends, and overall market sentiment. A well-informed investor navigates with confidence.

- Project Portfolio and Growth Potential: Scrutinise the company’s project portfolio. Is it diverse, spanning residential, commercial, or mixed-use development? Does it showcase adaptability and cater to evolving market needs? Growth prospects, fueled by market demand, geographical presence, and the company’s ability to innovate, are vital indicators of future success.

- Location Matters: Where are the properties located? Proximity to amenities, infrastructure development, economic growth potential, and rental demand are all essential factors to consider. Remember, location can be the golden key that unlocks returns.

- Financial Fortitude: Assess the company’s financial health. Analyze revenue growth, profitability, debt levels, and dividend payments. A financially strong company offers a sturdier foundation for your investment.

- Leadership Matters: The captain steers the ship. Evaluate the expertise and track record of the management team. Do they possess the vision and skill to navigate market challenges and create shareholder value?

- Regulatory Landscape: Stay abreast of the ever-evolving regulatory framework governing the real estate industry. Understanding legal requirements and policy changes can help mitigate risks and ensure compliance.

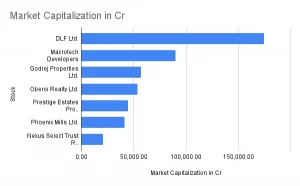

Top Contenders: Unveiling the Champions of Indian Real Estate Stocks

Now, let’s meet the frontrunners in this exciting arena:

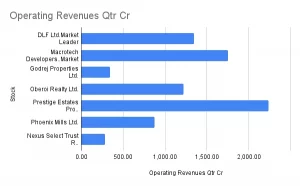

- DLF: A titan of the industry, DLF boasts an extensive portfolio of residential, commercial, and retail properties. Renowned for its high-quality projects like DLF Cyber City and DLF Emporio, DLF stands as a pillar of stability and excellence.

- Macrotech Devs: Formerly Lodha Developers, Macrotech Devs has carved a niche in the Mumbai Metropolitan Region, Pune, and Hyderabad. Their focus on residential and commercial projects, along with ventures into warehousing and logistics, makes them a versatile player with promising growth potential.

- Godrej Properties: Sustainability and innovation are the cornerstones of Godrej Properties. Their diverse portfolio, encompassing projects like Godrej Golf Links and Godrej Platinum, caters to a wide range of buyers and investors.

- Oberoi Realty: Luxury redefined – that’s the essence of Oberoi Realty. Their exquisite projects like Oberoi Sky Heights and Oberoi Esquire set the benchmark for opulent living, attracting discerning investors seeking exclusivity and quality.

- Phoenix Mills: This investment holding company is a maestro of diverse real estate assets. Shopping malls, entertainment hubs, commercial spaces, and residential projects like Phoenix Palladium and Phoenix Marketcity form their impressive portfolio, offering investors a multifaceted exposure to the market.

Regulatory changes paved the way for consolidation in this sector

What’s behind the sudden turnaround in these stocks? Multiple factors at play including rising sales, stable interest rates, and favorable government policies are driving this sector. Though the change in this sector is not something that happened recently, the current growth is a culmination of policy decisions taken over the past few years ago, that are reflecting the outcomes now.

Till 2016, the sector was notorious for its malpractices and money laundering. All this changed with the RERA regulation which makes it mandatory for a developer to deposit money from sales for a project in an escrow account for that project only. Another event in the same year was demonetization, which dealt a big blow to many shady transactions done in this sector. The net effect was that unscrupulous players were swept aside while organized players started consolidating their operations.

As a result, at the end of FY23, unsold inventory is at multi-year lows, registrations of home purchases are booming and new home bookings are strong. The winners are a few large and branded players who’ve grown new home bookings at an annualized growth rate of 33% between FY20 and FY23, and the trend is continuing in FY24 as well.

As a result, at the end of FY23, unsold inventory is at multi-year lows, registrations of home purchases are booming and new home bookings are strong. The winners are a few large and branded players who’ve grown new home bookings at an annualized growth rate of 33% between FY20 and FY23, and the trend is continuing in FY24 as well.

The sales growth is also driven due to different categories of buyers. Post the pandemic, the share of non-resident Indians (NRIs) in the Indian property market has doubled and almost 20% of the sales for many real estate developers are now coming from outside the country. The US is one of the biggest markets and buyers from the Middle East and Southeast Asia are also queuing up to buy property in India.

Growth across different segments of buyers driving demand

On the other hand, the growth of residential real estate across India’s top markets among Tier I and Tier II cities is being driven by the evolving priorities of the millennials. Now in their 30s and early 40s, they are increasingly making home purchases. Coupled with higher spending power, their preferences are shaping the demand for homes that reflect the owners’ personalities and lifestyles.

Another segment that is seeing traction is the “real estate stocks”- luxury housing segment. The surge in demand for luxury properties has led to an increase in prices, particularly in major metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai. However, despite the increase in prices, luxury real estate remains a popular investment option for HNIs in India. Many of them consider it as a means to diversify their investment portfolio.

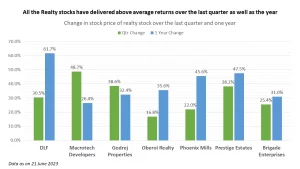

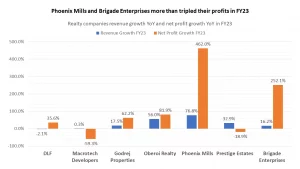

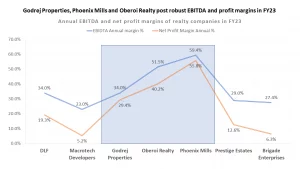

The outperformance in the real estate sector is reflected in the splendid FY23 results. Barring Macrotech and Prestige Estates, all the other companies grew their profits substantially over FY22. Highlight being Phoenix Mills which delivered 462% growth in annual profits. Business models of developers also define their performance. Phoenix Mills’ phenomenal rise in profits is on account of a model that has a higher percentage of rental assets, while some others who are heavily dependent on sales go through prolonged periods with unsold inventories impacting profitability. Most players maintained stable ratios for EBITDA and net profit margins in FY23.

Many new projects in the pipeline add to the future potential of this sector

DLF is planning to launch around 11 million square feet of development with a sales potential of almost Rs 19,700 crore this fiscal year and in addition, has a launch inventory of around Rs 7,400 crore. This gives the company a potential of almost Rs 27,000 crore worth of real estate inventory.

Phoenix Mills’ two malls, one in Ahmedabad and the other in Indore became operational in the last quarter and have already leased out 90% of the retail spaces. Malls in Pune and Bangalore are expected to commence operations in the next quarter.

Godrej Properties intends to launch projects with a development area of 20 million square feet in FY24, which include key projects at Ashok Vihar in Delhi, Worli, and Mahalaxmi in Mumbai.

Godrej Properties intends to launch projects with a development area of 20 million square feet in FY24, which include key projects at Ashok Vihar in Delhi, Worli, and Mahalaxmi in Mumbai.

Others too have many projects at various stages of development or are in the process of finalization of land deals for new projects. All these projects give visibility to the sales potential for the real estate players in FY24.

The real estate sector stocks have been the best sector since the beginning of this year and there are high chances that it may continue its run and emerge as the top-performing sector of the calendar year 2023.

A Glimpse into the Horizon of the Future Potential

The Indian real estate stocks market paints a picture of immense potential. Government initiatives like PM Awas Yojana and the approval of the REIT platform further fuel optimism. As the sector continues to evolve, investors who meticulously analyze companies, considering factors like project portfolio, market reputation, and growth prospects, stand to reap the rewards of this dynamic landscape.

Realty as a sector has been an underperformer for the last decade. However, this seems to be changing, and this is likely to emerge as one of the best sectors to invest in long-term, helping investors create wealth over the next few years. The signs of this are already visible in this financial year. With careful research, informed decisions, and a keen eye for potential, you can navigate this terrain with confidence and paint your masterpiece of financial success in the vibrant world of the Indian best real estate stocks in India.

Realty as a sector has been an underperformer for the last decade. However, this seems to be changing, and this is likely to emerge as one of the best sectors to invest in long-term, helping investors create wealth over the next few years. The signs of this are already visible in this financial year. With careful research, informed decisions, and a keen eye for potential, you can navigate this terrain with confidence and paint your masterpiece of financial success in the vibrant world of the Indian best real estate stocks in India.

Related Posts

ITC Share Price Falls 18.80% YoY: What Went Wrong & What’s the Target

Clear Max Envior Energy Solutions IPO Review 2026: GMP Rises 0.66%, Key Investor Insights

Shree Ram Twistex IPO Review 2026: GMP Rises 4.81%, Key Investor Insights

Embassy Developments Share Price Falls 52.67% YoY: What Went Wrong & What’s the Target

Accord Transformer & Switchgear IPO Review 2026: GMP Rises 21.74%, Key Investor Insights