EV Stocks to Invest in India

Posted by : Ketan Sonalkar | Thu Apr 25 2024

Best EV Stocks in India

The huge demand for the Electric Vehicle (EV) sector that is being witnessed in India today is like moving into a world of innovation, sustainability, and potentially lucrative opportunities. The following comprehensive guide seeks to navigate the intricacies of EV stocks in India, explore market trends, and give insight into the key determinants of investment decisions. When it comes to the best EV stocks in India, we will cover industry dynamics, forces driving its growth, and a comprehensive analysis of top firms.

What are EV Stocks?

Electric vehicle stocks, commonly referred to as EV stocks, represent ownership shares in companies actively involved in the development, manufacturing, and production of electric vehicles. In the Indian context, these companies contribute to the production of two-wheelers, buses, and cars in the expanding EV sector. The increasing global emphasis on sustainable transportation has propelled the demand for these EV sector stocks in India.

Overview of the EV Industry

Growing interest in electric vehicles (EVs) is driven by the urgency for climate change action. With the Environmental Pollution Index showing that India ranks 168 out of 180 countries; there are ambitious government plans to achieve 100% electrification by 2030. This commitment has catalyzed a significant increase in investments and interest, particularly in electric vehicle stocks in India.

Why EV Stocks Are Worth Investing In?

An increased stay of electric vehicles in the market makes it particularly interesting to invest in Best EV stocks in India. The sector is poised for huge growth due to the support by the government and subsidies. An illustrative example is how Maharashtra government introduced subsidies that led to highest ever sales of EVs in 2017.

Growth and Opportunities

The EV market has vast growth prospects and opportunities. The probable rise in stock prices as a result of increased government focus on promoting electric vehicles can provide investors with attractive returns. Also, government subsidies foster a favorable ecosystem that encourages more EV adoptions thereby stimulating sectoral expansion.

Best EV Stocks in India to Consider

One needs to know the leading companies within the Indian electric vehicle sector for a rational investment decision. Here are the top five industry leaders among which you can find your Best EV stocks in India:

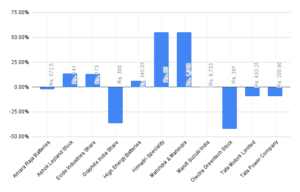

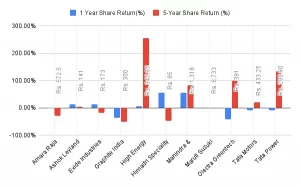

| S.no | Stock Name | Market Capitalization(in Cr) | P/E Ratio | 5 Years Returns (%) |

| 1. | Reliance Industries Ltd. | 19,85,920.7 | 28.38 | 120.09 |

| 2. | TVS Motor Company Ltd. | 97,190.9 | 59.43 | 286.95 |

| 3. | Tata Motors Ltd. | 3,38,472.96 | 17.45 | 333.32 |

| 4. | Indian Oil Corporations Ltd. | 2,40,414.08 | 5.13 | 60.31 |

| 5. | Mahindra and Mahindra Ltd. | 2,57,429.12 | 23.09 | 198.42 |

Read more: 6 Best Sectors to Invest in Long-Term

Certain divisions in the electric automobile industry provide a more nuanced view for potential investors:

- Vehicle Producers

Organizations engaged in assembling electric cars fall into this classification. Notable actors include Tata Motors, Mahindra Electrics, and Hero Electric. Their strong presence on the exchange floor stems from their holistic method of assembling EVs by sourcing components from diverse companies and makers.

- Battery Manufacturers

Producers crafting power packs for electric vehicles constitute a pivotal division. Establishments like Amara Raja Batteries, Exide Industries, Tata Group, Hero Moto Corp, and Maruti Suzuki are important players to watch, as their names regularly surface on lists of electric automobile stocks.

Auto Parts and EV Software Development

Companies involved in developing programming and electronics for EVs, as well as crafting spare parts, comprise this division. Motherson Sumi Systems Limited and Tata ELXSI Limited are esteemed names among the best stocks in the electric automobile sector.

Charging stations are key for electric vehicles since that’s how they power up. So some big players in India’s electric car stock market are the companies putting together networks of charging stations across cities. A few examples are Delta Electronics India, Quench Chargers, Mass-Tech, and BrightBlu.

Before you invest in any electric vehicle-related stocks in India there are a bunch of industry-specific stuff you should think about:

See who the top stocks are and the electric car market’s supposed to grow a lot, but you still gotta pick the right companies to invest in. Do your homework on the industry leaders and get a handle on the competition before you buy any 2023 EV stocks. That’ll set you up for maximum profits if you make informed choices on the best EV stocks in India.

Don’t just look at the past. In a market as new and fast-changing as EVs, counting on historical data can be misguiding. Instead of only looking at a stock history, focus more on its potential for financial growth in the future. Since electric cars are so new the past numbers might not show the full picture anyway.

Investigate Company M&A’s Exploring the mergers and acquisitions of a company is essential to accurately assessing the potential of a stock, especially in the evolving electric vehicle market in India. By understanding the various types of M&A transactions, such as full consolidations or financial partnerships, investors can make informed decisions about the Best EV stocks in India for 2024.

Monitor Government Investment Trends Monitoring government investment activity is crucial in gauging the success of a particular market or industry. With the Indian government’s increased efforts to promote the use of electric vehicles, the future looks promising for EV stocks. Aligning investments with government priorities offers the confidence of a stable and profitable investment.

Eliminate Underperforming Stocks from Your Portfolio The stock market is known for its unpredictability, making it difficult to determine which stocks will thrive and which ones will flounder. When a stock fails to meet expectations, it’s advisable to remove it from your portfolio. A more robust investment strategy involves replacing underperforming stocks with those that show greater growth potential in the top EV stocks in India.

Conclusion

To conclude, the Best EV Stocks in Indian market offer promising opportunities for investors seeking sustainable and profitable ventures. With government initiatives promoting the adoption of EVs and an increasing focus on environmental consciousness, this sector has become an attractive avenue for investments. By carefully considering the factors discussed above and staying updated on the performance of the Best EV stocks in India, investors can make well-informed decisions aligned with their financial goals. The ever-evolving nature of the EV market promises an exciting journey filled with potential rewards for those who venture into Indian electric vehicle stocks.

You may also like: Banking Stocks Climb After RBI Holds Rates Steady

Disclaimer: This is for general information and education purposes only. The Securities quoted (if any) are for illustration only and are not recommendatory. Past performance does not guarantee any future returns. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. For more details/disclosures, visit at Univest mobile application.