Asian Paints Q3FY23 Results : Muted sales growth lead to below expectation results

Posted by : Sheen Hitaishi | Wed Jan 25 2023

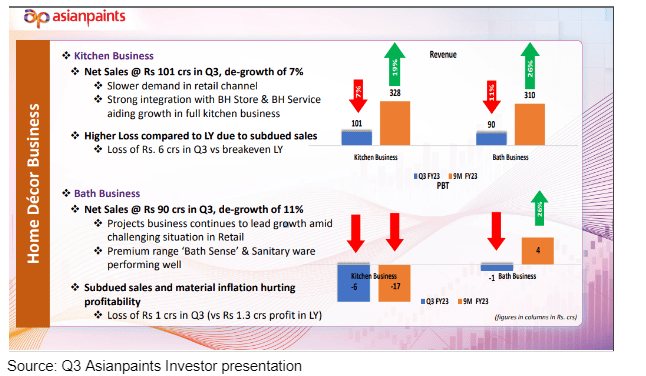

Asian Paints is India’s largest decorative paint company. Asian Paints is engaged in the business of manufacturing, selling and distribution of paints, coatings, products related to home décor, bath fittings and providing related services. The company derives 98% revenue from the paints business while 2% business comes from the home improvement business. It has a market cap of Rs 2,67,402 crores along with a strong distribution network of 70,000 dealers, almost 2x more than the No. 2 player.

Asian Paints Q2FY23: Revenue grew only 6% on a YoY basis

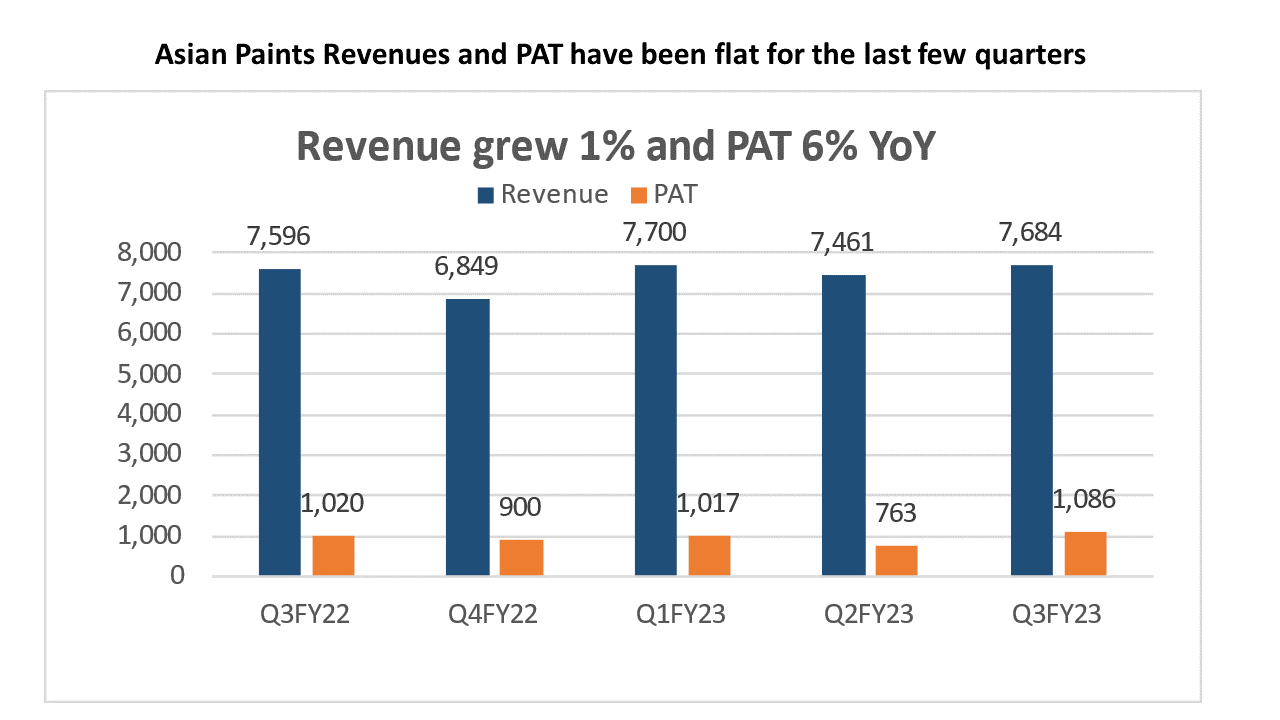

Asian Paints on Thursday reported a consolidated net profit of ₹1,097 crore during the third quarter ended December 2022 (Q3 FY23), up over 6% from ₹1,031 crore in the year ago quarter. The profit was below estimates as muted demand offset the benefits from a correction in raw material costs. Analysts, on average, had expected a profit of ₹1,160 crore, according to Refinitiv IBES data.

Meanwhile, the company’s revenue from operations rose about 1% to ₹7,684 crore as compared to ₹7,596 crore year-on-year (YoY).

The company said that the domestic Decorative Business registered a flat volume and value sales delivery for the quarter, on a very high price increase base in the previous year.

“The extended monsoon in October also affected retailing in the peak festival season, but demand picked up in November and December, leading to a double-digit growth for the decorative business in December,” the company said in a release.

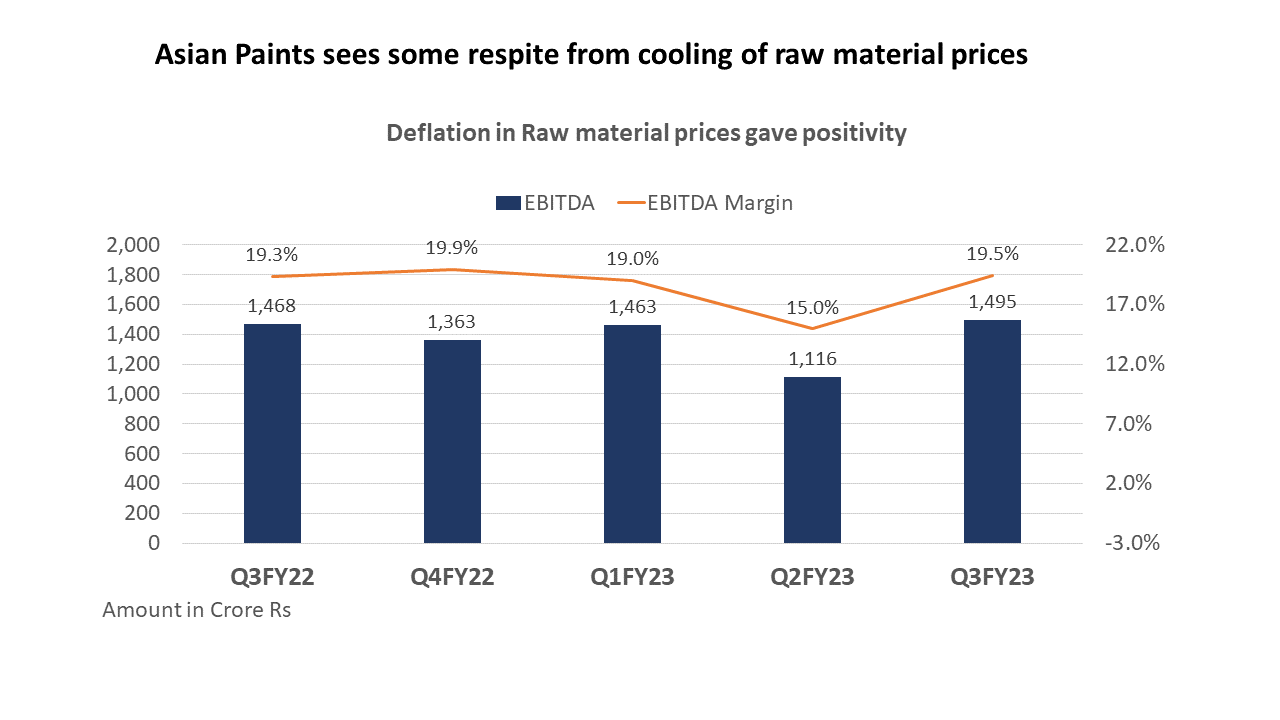

The only positive reason helped them to maintain good net profit is the operating margins, it saw an improvement on a y-o-y basis driven by deflation in some of the raw material prices as well as continued work on driving operational efficiencies across businesses.

The only positive reason helped them to maintain good net profit is the operating margins, it saw an improvement on a y-o-y basis driven by deflation in some of the raw material prices as well as continued work on driving operational efficiencies across businesses.

The below presentation shows how the overall business performed through different business segments. The international business sales has improved 2% and 13.4% in constant currency terms. The other two segments clearly shows that Asianpaint has reduced their market share.

Disruption Alert! Due to competition?

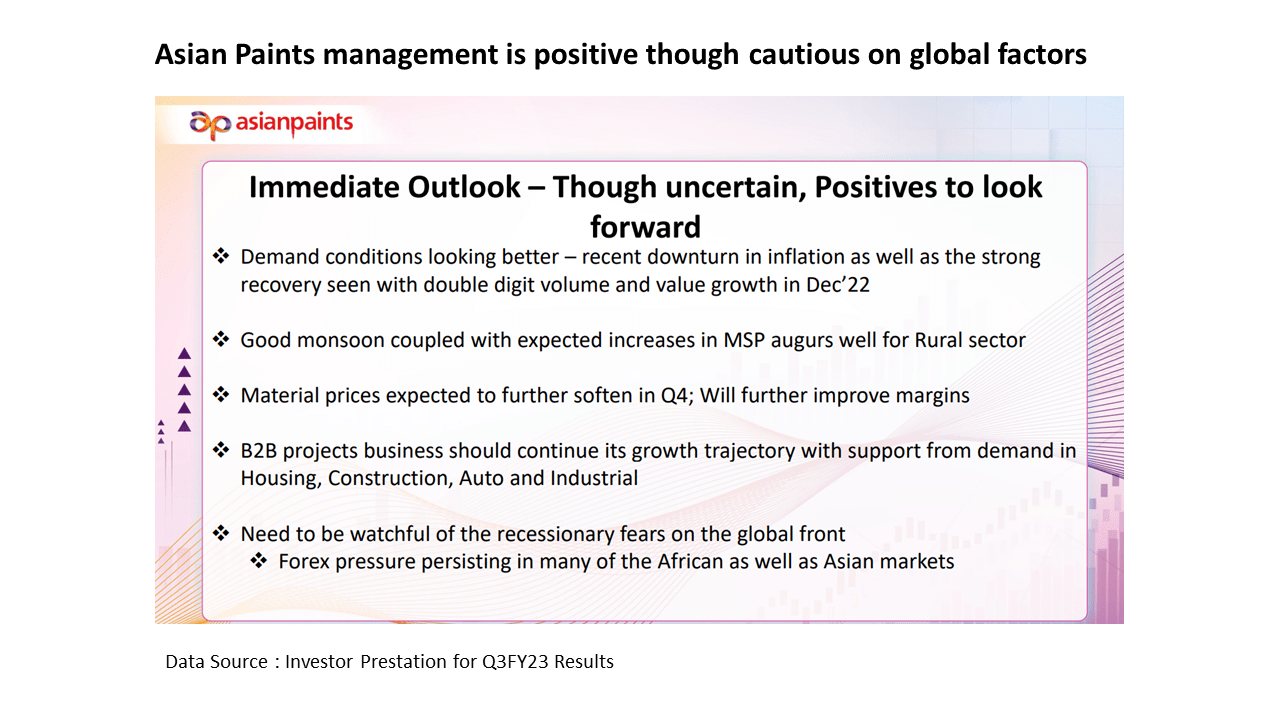

Despite unimpressive stock returns, at FY24 price-to-earnings the Asian Paints stock is trading at a multiple of 52.73x, Bloomberg data showed. Expensive valuations along with worries of disruption due to the entry of newer companies with deep pockets, dims the stock’s re-rating prospects, for now. Further, the company’s FY23 and FY24 earnings per share estimates could see marginal cuts of 4-5%, added analysts.

However Asian Paints seems to have plans in place to retain its market share even in a highly competitive market. It is setting up a new water-based manufacturing facility with a capacity of 4 lac KL per annum with an approx. investment of Rs. 2000 crs for this facility This is expected to be commissioned in 3 years, after acquisition of land.

Apart from this project, brownfield expansion across multiple manufacturing facilities in India for increasing in-house paint capacity by ~30% to 22.7 lac KL per annum besides backward integration in critical & import dependent raw materials.

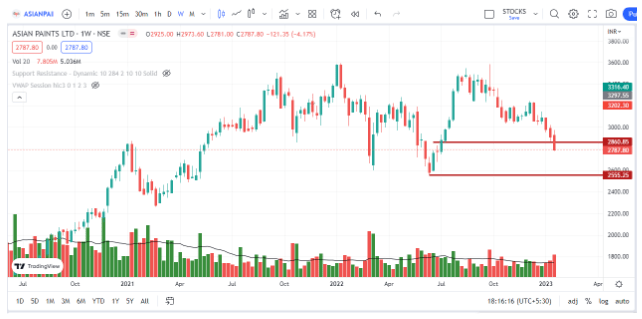

Univest view on Technical Analysis

According to HDFC Securities, the worst of the gross profit margin pressure seems behind for Asian Paints with a moderate raw material basket. The brokerage has a ‘reduce’ rating on the Asian Paints stock with a target price of Rs 2,700 per share.

In the last one year, the Asian Paints counter has lost around 10% of its value, underperforming the Nifty50 benchmark, which has risen 1.2%. Asian Paints shares swung between gains and losses amid volatile trade on Thursday, as investors awaited the paint maker’s financial results for the October-December period due later in the day & it fell 6% with huge volumes. The RSI fell below 50 in both weekly and monthly timeframes, which means there is no upside hope for Asianpaints for a few weeks.

Experts in Univest app is suggesting a ‘HOLD’ rating for a long term investor as the long term trend looks weak. Similarly as the short term trend is also showing weakness Univest advisors recommend to exit from it.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255)

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Federal Bank and Bank of Maharashtra post stellar Q3FY23 numbers

Related Posts

IIFL Finance NCD: Tranche Detail

PNGS Reva Diamond Jewellery IPO Review 2026: GMP Rises 5.70%, Key Investor Insights

IEX Share Price Falls 25.96% YoY: What Went Wrong & What’s the Target

Yashhtej Industries IPO Allotment Status: 1.05x Subscribed, GMP Rises 1.82% — Check Online

Manilam Industries IPO Day 1: Subscription at 0.03x, GMP Flat | Live Updates