Adani Group stocks with strong fundamentals bounce from lows

Posted by : Sheen Hitaishi | Mon Mar 13 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1678191475262{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]It has been a little over a month since the Hindenburg report caused a sharp fall in Adani Group stocks. As the events unfolded over the past month or so, it is becoming clear that investors will always bet their monies on companies with strong fundamentals. Even in the case of the Adani Group stocks, this holds true where the stocks with strong fundamentals have recovered substantially from their lows around a month ago and have seen investments being infused by global investors.

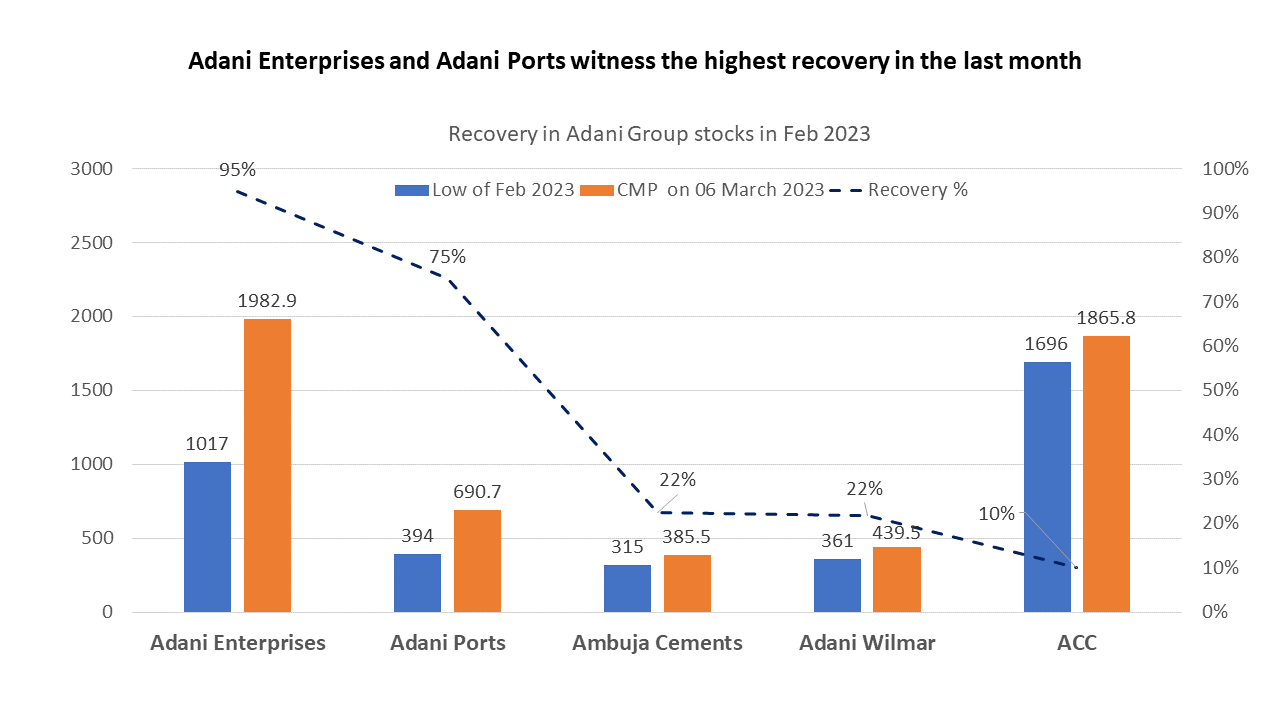

The chart below shows the stocks that gained significantly from their lows nearly a month ago.

The highest recovery was seen in the flagship company Adani Enterprises. This company released its Q3FY24 numbers in the first week of February, just after the fall of its stock price. The results were a redemption of their strong fundamentals with revenue growth of 42.1% on a YoY basis supported by strong net profit growth. In fact, the company has posted positive net profits for the last four quarters with net profits in Q3FY23 at Rs 820.1 crore. The operating margins have also improved this quarter to 6.12%, the highest in past five quarters.

Similarly, Adani Ports saw a YoY revenue growth of 14.2%, while net profits dropped marginally YoY to Rs 1,315.5 crore in Q3FY23. Adani Ports is expected to close FY23 with revenues higher than Rs 20,000 crore, which would be the highest for the company in a given financial year. Considering the passenger traffic at Indian airports and the government’s plans for modernisation as well as the construction of airports, this company has a long runway for growth from here.

Adani Wilmar, ACC, and Ambuja Cements are also profitable companies and these have been acquired by Adani Group over the last year. While the group incurred debt for the purchase of the cement companies, ACC and Ambuja Cements, these are running the business with strong revenue generation potential and the group also intends to expand cement production capacity over the next few years.

Another interesting development last week was the investment of a global equity investment firm in the share of Adani Group companies. GQG Partners, a leading US-based global equity investment boutique has invested $1.87 billion (Rs 15,446 crore) in three Adani Group companies through a block deal while Goldman Sachs bought 8.2 million shares from the company.

GQG Partners has invested in the Adani Portfolio – Adani Ports and Special Economic Zone Limited, Adani Green Energy Limited, Adani Transmission Limited, and Adani Enterprises Limited.

The investment in Adani Ports and Adani Enterprises makes for more than two-thirds of the investment of GQG Partners, the reason is not difficult to gauge. These are the fundamentally strongest companies in the group and have delivered a good set of numbers in the last quarter.

Investments in Adani Green and Adani Transmission are probably based on a long-term outlook on these companies. Adani Green has posted losses in four of the last five quarters. However, with heavy investments in alternative energy sources, the returns would accrue only after a few years.

Adani Transmission is in the business of electric power generation and distribution. Here too many projects are under construction and will be able to contribute to the company’s profitability only after a few years.

The stocks of both Adani Green as well as Adani Transmission have not recovered from the lows they hit in Feb 2023, but have instead headed lower over the past few days.

To summarise, the Adani Group companies with sound fundamentals have started recovering from their lowest point last month and are poised to grow further from here. These have also seen buying interest from foreign institutional investors. On the other hand, the companies that are currently not strong fundamentally have not yet seen a bounce and have got a fraction of investments as compared to the fundamentally strong ones.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: APL Apollo Tubes – A differentiated metal industry player[/vc_column_text][/vc_column][/vc_row]