Top Telecom Companies Stocks in India 2024

Posted by : Ketan Sonalkar | Fri Feb 09 2024

Top Telecom Stocks in India

Navigating this landscape requires not only understanding the broader trends but also delving into the individual players shaping the future. This comprehensive guide unpacks the top telecom stocks in India, analyzing their performance, prospects, and the critical factors driving the success of Telecom Companies in India.

Major Developments Reshaping the Telecom Landscape:

- 5G Revolution: The much-anticipated 5G rollout is spearheaded by Reliance Jio (RJIL), Bharti Airtel (BRT), and Vodafone Idea (VIL), unleashing unprecedented data speeds and paving the way for game-changing applications across industries. From healthcare breakthroughs to immersive entertainment, 5G promises to unlock a new era of connectivity.

- Spectrum Auctions: Recent auctions secured crucial bandwidth, empowering telecom giants to expand their 5G offerings and cater to the insatiable data appetite of Indian consumers. This access to vital resources fuels not only network capabilities but also drives future revenue streams.

- Consolidation Fever: Potential mergers, like the speculated Bharti Airtel-Vodafone Idea union, could redefine the competitive landscape. By streamlining operations and eliminating redundancies, such consolidations can lead to increased efficiency and market competitiveness, ultimately benefiting both investors and consumers.

- Rural Connectivity Focus: Government initiatives like ‘BharatNet’ bridge the digital divide by bringing broadband access to remote corners of the country. This opens up vast new markets for telecom companies, propelling subscriber growth and revenue diversification.

Why Should You Invest in Indian Telecom Stocks?

- Unleashing High Growth: Driven by rising data consumption, 5G adoption, and government initiatives, the sector anticipates a CAGR exceeding 8%, translating to potential capital appreciation and consistent returns for investors who play their cards right.

- Diversification Lifeline: Diversifying your portfolio with telecom stocks in India like RJIL, BRT, VIL, Bharat Broadband Nigam Limited (BBNL), and MTNL adds stability and mitigates risk, protecting your investments from market fluctuations in other sectors.

- Competitive Arena Breeds Innovation: The presence of established players like Jio and Airtel alongside emerging challengers fosters a dynamic and competitive environment, pushing the boundaries of innovation and creating value for investors through novel service offerings and technological advancements.

- Government Tailwinds: Supportive policies and a strong focus on digital infrastructure development from the Indian government bode well for long-term growth in the telecom sector, providing additional assurance for investors seeking stable returns.

Beyond the Big Picture: A Look at Individual Players:

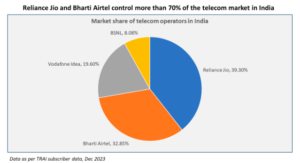

- Reliance Jio (RJIL): The undisputed market leader with a loyal subscriber base and aggressive 5G rollout plans, RJIL offers high growth potential. However, its substantial debt level raises concerns about financial stability and warrants careful consideration.

- Bharti Airtel (BRT): Renowned for its robust network and established brand, BRT is aggressively expanding its 5G footprint and focusing on rural penetration. Its diversified portfolio of offerings, including broadband and digital payments, adds stability and reduces risk for investors.

- Vodafone Idea (VIL): While currently facing financial challenges, VIL’s potential merger with BRT could be a game-changer, presenting a turnaround opportunity for both companies. However, the success of the merger hinges on various factors, and investors should approach with caution.

- Bharat Broadband Nigam Limited (BBNL): A government-backed player with a focus on rural connectivity, BBNL offers long-term value potential due to government support and guaranteed demand. However, its profitability in the near future remains uncertain, and investors should exercise patience.

- Facing financial difficulties, MTNL’s future depends heavily on government support and successful debt restructuring. Investing in MTNL carries higher risk and requires a high tolerance for volatility.

Read more:- Fast Lane to 5G: Telecom Stocks Soar

Decoding the Future of Indian Telecom:

Several key trends, including technological advancements, 5G deployment, increased connectivity demands, and evolving consumer preferences, will shape the future of the telecom sector. Additionally, the performance and growth of the top telecom stocks in India are expected to be influenced by these dynamic market forces.

- 5G-Fueled Innovation: 5G is not just about faster speeds; it will unlock a wave of innovation across industries, from smart cities to autonomous vehicles. This promises a plethora of new revenue streams for telecom companies that can capitalize on these emerging opportunities.

- AI and Automation Revolution: Companies like Jio and Airtel are at the forefront of adopting AI and automation for network management and customer service. This not only improves efficiency and reduces costs but also enhances customer experience, creating a virtuous cycle of growth.

- Bridging the Digital Divide: Continued focus on connecting rural and underserved markets will remain crucial for inclusive growth. Government initiatives like BharatNet will be instrumental in achieving this goal, opening up new avenues for telecom companies and unlocking further potential for investors.

- Cybersecurity Imperative: As data consumption skyrockets, robust cybersecurity measures will become paramount. Securing sensitive data and fostering trust in the digital ecosystem will be crucial for long-term sustainability and consumer confidence, presenting opportunities for companies specializing in cybersecurity solutions.

Conclusion:

The Indian telecom sector presents a compelling investment opportunity in 2024 and beyond, particularly with the inclusion of telecom stocks. With high growth potential, diversification benefits, and a supportive government framework, it offers fertile ground for savvy investors to explore and capitalize on the promising prospects of telecom stocks in India. By understanding the major developments, future trends, and individual player profiles, you can make informed decisions and potentially reap significant rewards from this rapidly evolving sector.

However, careful research, comprehensive analysis, and consulting with a financial advisor are crucial before taking the plunge. Remember, while the rewards can be great, so too are the risks, and meticulous due diligence is key to navigating this dynamic landscape.

You may also look like: Upcoming IPOs in India 2024

Related Posts

Lemon Tree Hotels Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Tata Steel Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Aye Finance IPO Review 2026: GMP Rises 0.28%, Key Investor Insights

MRF Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Whirlpool of India Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here