Mutual Fund Buys in October 2022

Posted by : Sheen Hitaishi | Tue Nov 22 2022

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1668852946085{margin-left: 10px !important;}”]

Mutual Fund Buys in October 2022

Every month data from AMFI (Association of Mutual Funds of India) puts out the data of the buying and selling of every mutual fund scheme in the market. This data gives insights into what sectors are on the fund managers radar as well as action by mutual fund houses based on results or any significant event in any company.

The month of October also mutual funds add many stocks across large, mid and Nifty500 companies. What we have covered here is the top four stocks across each category and the mutual funds that have purchased at least more than one lakh shares of each stock through the month of October 2022.

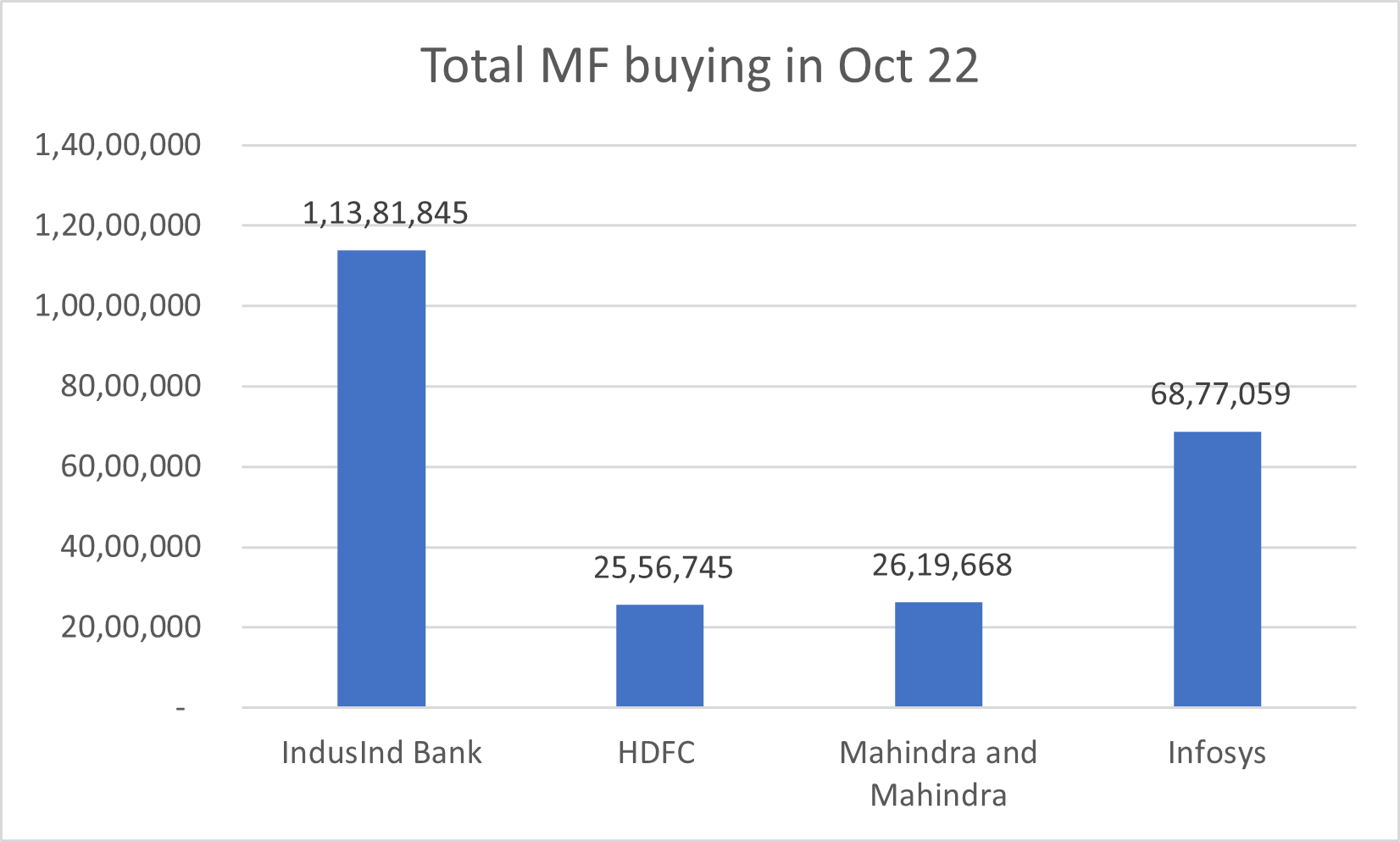

Starting with the large cap (Nifty50) stocks that saw buying of a total of few crore shares in each of these companies.

IndusInd Bank – One of India’s leading private sector banks. The bank posted a good set of results in Q2FY23. In the last one year it has delivered better returns than leading private sector banks like HDFC Bank and Kotak Mahindra Bank.

Mutual fund schemes that bought more than one lakh shares in October

|

IndusInd Bank |

Shares in numbers |

|

Kotak Equity Arbitrage Fund Growth |

19,53,450 |

|

HDFC Top 100 Fund Growth |

13,75,000 |

|

HDFC Balanced Advantage Fund Growth |

10,62,000 |

|

Aditya Birla Sun Life Tax Relief 96 Pyt of Inc Dis cum Cap Wdrl |

7,71,538 |

HDFC (Housing Development Finance Corporation) – One the largest NBFCs engaged in providing finance to individuals, corporates and developers for the purchase, construction, development and repair of houses, apartments and commercial properties in India. With approval for the merger with its own bank, HDFC Bank, getting closer to regulatory approval rising buying interest is seen in this stock.

Mutual fund schemes that bought more than one lakh shares in October

|

HDFC |

Shares in numbers |

|

Aditya Birla Sun Life Focused Equity Fund Growth |

13,35,323 |

|

ICICI Prudential Value Discovery Fund Growth |

4,60,827 |

|

Franklin India Bluechip Fund Growth |

4,15,000 |

|

HDFC Balanced Advantage Fund Growth |

3,73,500 |

Mahindra and Mahindra – One of the leading auto manufacturers known for its iconic brand “Scorpio”. The company has been having a good run with its new launches receiving a huge response from customers. The Q2FY23 results were also the best quarterly results in the history of the company.

Mutual fund schemes that bought more than one lakh shares in October

|

Mahindra and Mahindra |

Shares in numbers |

|

HDFC Flexi Cap Fund Growth |

11,86,288 |

|

ICICI Prudential Tranporstation and Logistics Fund Regular Growth |

4,18,779 |

|

Kotak Business Cycle Fund Regular Growth |

3,25,000 |

|

Axis Bluechip Fund Growth |

2,82,425 |

Infosys – It is India’s second largest IT services company. It surprised analysts in with Q2FY23 results when it reported a strong TCV of USD2.7b (the highest in the last seven quarters), of which 54% were net new. The deal pipeline remains healthy and larger than preceding quarters. The management also updated its revenue growth guidance for FY23 to 15-16% YoY in CC terms.

Mutual fund schemes that bought more than one lakh shares in October

|

Infosys |

Shares in numbers |

|

SBI Contra Fund Regular Payout Inc Dist cum Cap Wdrl |

9,00,000 |

|

Aditya Birla Sun Life Frontline Equity Fund Growth |

7,95,576 |

|

Kotak Equity Arbitrage Fund Growth |

6,51,600 |

|

ICICI Prudential Technology Fund Growth |

5,56,800 |

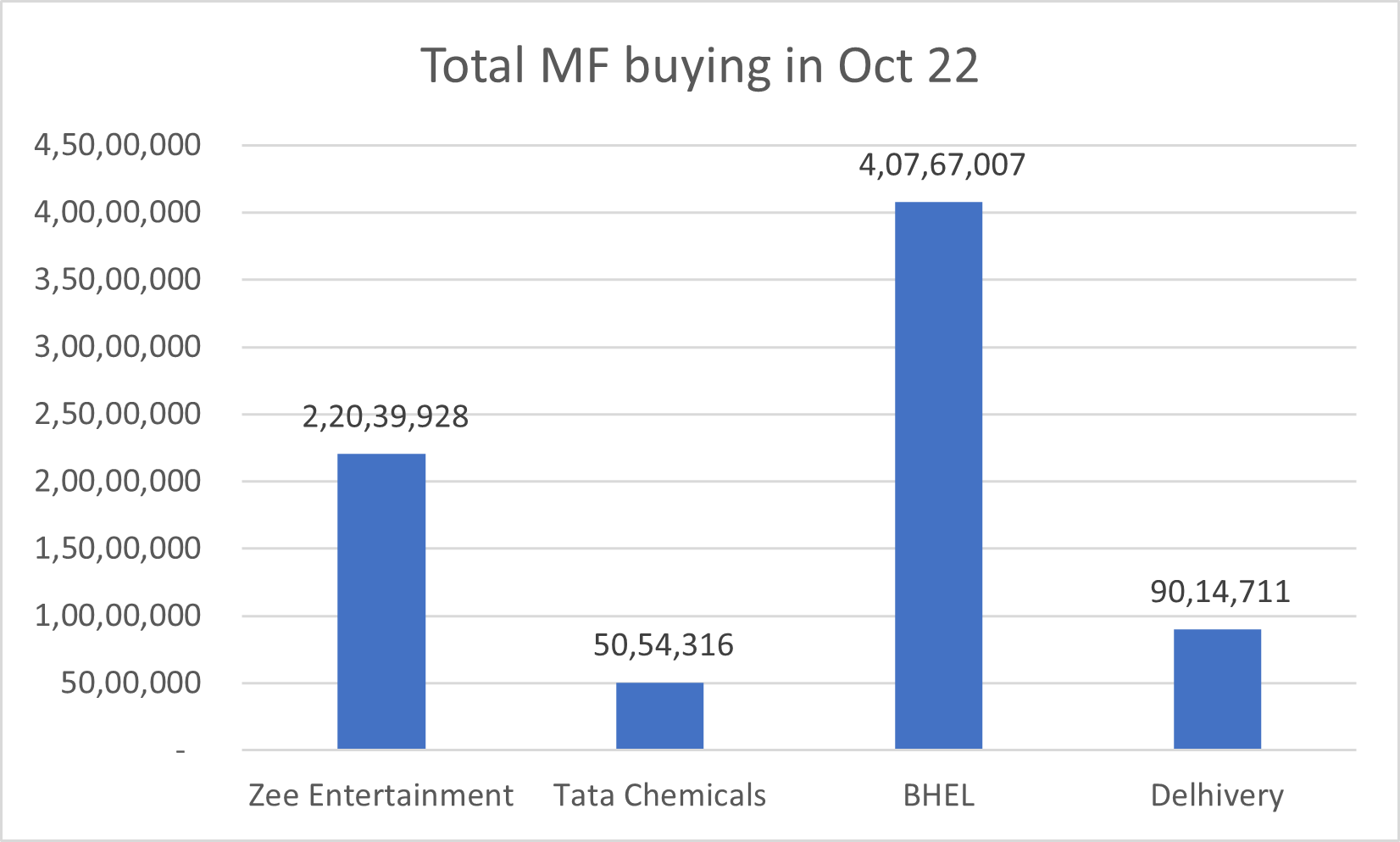

Midcap companies that that saw buying of a total of few crore shares this month by mutual funds.

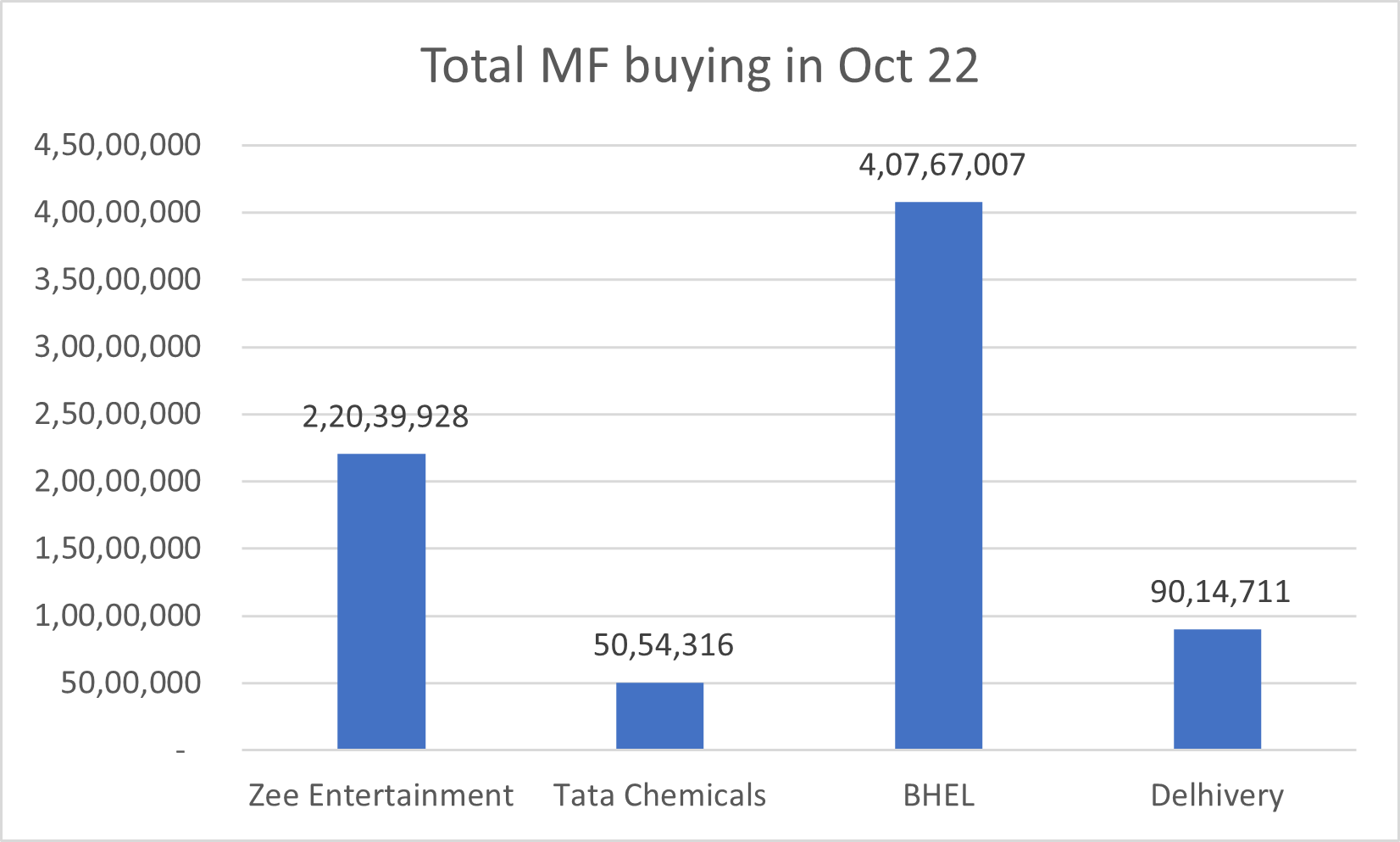

Zee Entertainment – It is is engaged in Broadcasting of Satellite Television Channels and digital media and also owner of the OTT platform Zee5. It has seen growing market share in its regional channels this quarter. Another trigger that has initiated buying interest is the merger with Sony, which is expected to be complete in the next two quarters.

Mutual fund schemes that bought more than one lakh shares in October

|

Zee Entertainment |

Shares in numbers |

|

ICICI Prudential Value Discovery Fund Growth |

55,03,758 |

|

Aditya Birla Sun Life Frontline Equity Fund Growth |

25,55,228 |

|

ICICI Prudential Focused Equity Fund Growth |

18,64,566 |

|

Mirae Asset Emerging Bluechip Fund Growth |

17,50,000 |

Tata Chemicals – Tata Chemicals is one of the top five players in the global soda ash market. Under basic chemical, it offers soda ash, sodium bicarbonate, cement, salt, marine chemicals and crushed refined soda. Speciality chemical consists of agro chemical through Rallis and other specialty solutions such as nutritional products. It also posted a stellar Q2FY23 result with highest revenue and profits in the last ten quarters.

Mutual fund schemes that bought more than one lakh shares in October

|

Tata Chemicals |

Shares in numbers |

|

Kotak Flexicap Fund Growth |

26,50,000 |

|

Kotak Equity Opportunities Fund Growth |

12,00,000 |

|

Kotak Business Cycle Fund Regular Growth |

3,80,000 |

|

Nippon India Growth Fund – Growth |

2,90,000 |

BHEL (Bharat Heavy Electricals Limited) – This PSU is India’s largest engineering company and dominates the supply of equipment for power plants in the country. Its products include gas turbines, generators, thermal sets, diesel shunters, turbo sets, hydro sets, power transformers, switch gears, circuit breakers and boilers. In Q2FY23, it booked new orders worth Rs 14,511 crore. With a strong order pipeline across its verticals, interest in the stock is rising.

Mutual fund schemes that bought more than one lakh shares in October

|

BHEL |

Shares in numbers |

|

Nippon India Focused Equity Fund – Growth |

1,04,07,404 |

|

HDFC Arbitrage Fund Wholesale Plan Growth |

45,04,500 |

|

DSP Dynamic Asset Allocation Fund Regular Growth |

33,39,000 |

|

L&T Arbitrage Opportunities Fund Regular Growth |

30,87,000 |

Delivery – It is an integrated logistics company with a pan India presence having a network that includes 122 gateways, 21 automated sort centres and 93 fulfilment centres. In Q2FY23, the company was able to substantially increase its revenues on a YoY basis as well as pare down its losses. Though not profitable yet, probably of a profitable quarter in the near future have increased.

Mutual fund schemes that bought more than one lakh shares in October

|

Delhivery |

Shares in numbers |

|

SBI Flexicap Fund Regular Growth |

40,00,000 |

|

HDFC Flexi Cap Fund Growth |

30,45,655 |

|

HDFC Focused 30 Fund Growth |

7,22,827 |

|

ICICI Prudential Tranporstation and Logistics Fund Regular Growth |

5,46,838 |

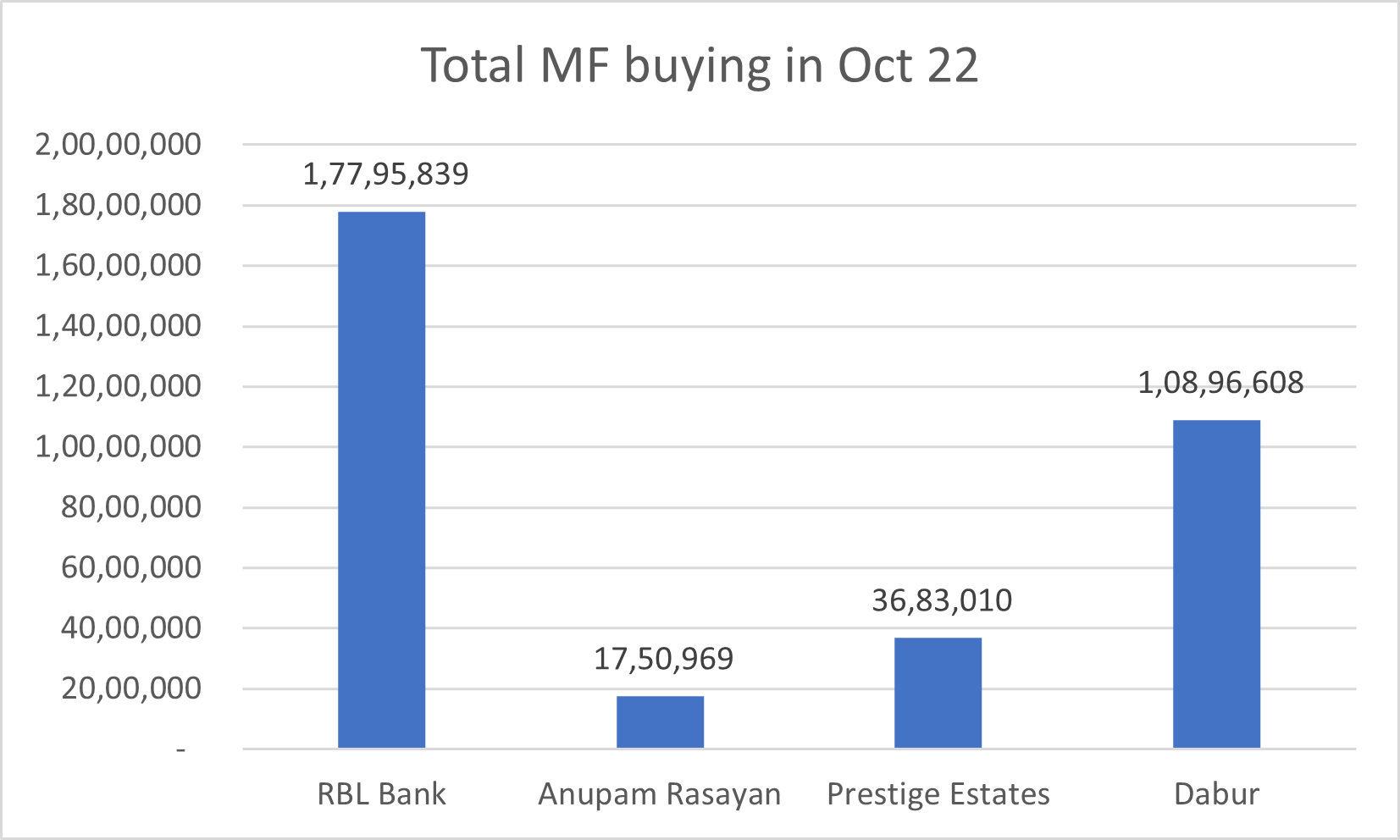

Other companies part of the Nifty 500 that that saw buying of a total of few crore shares this month by mutual funds.

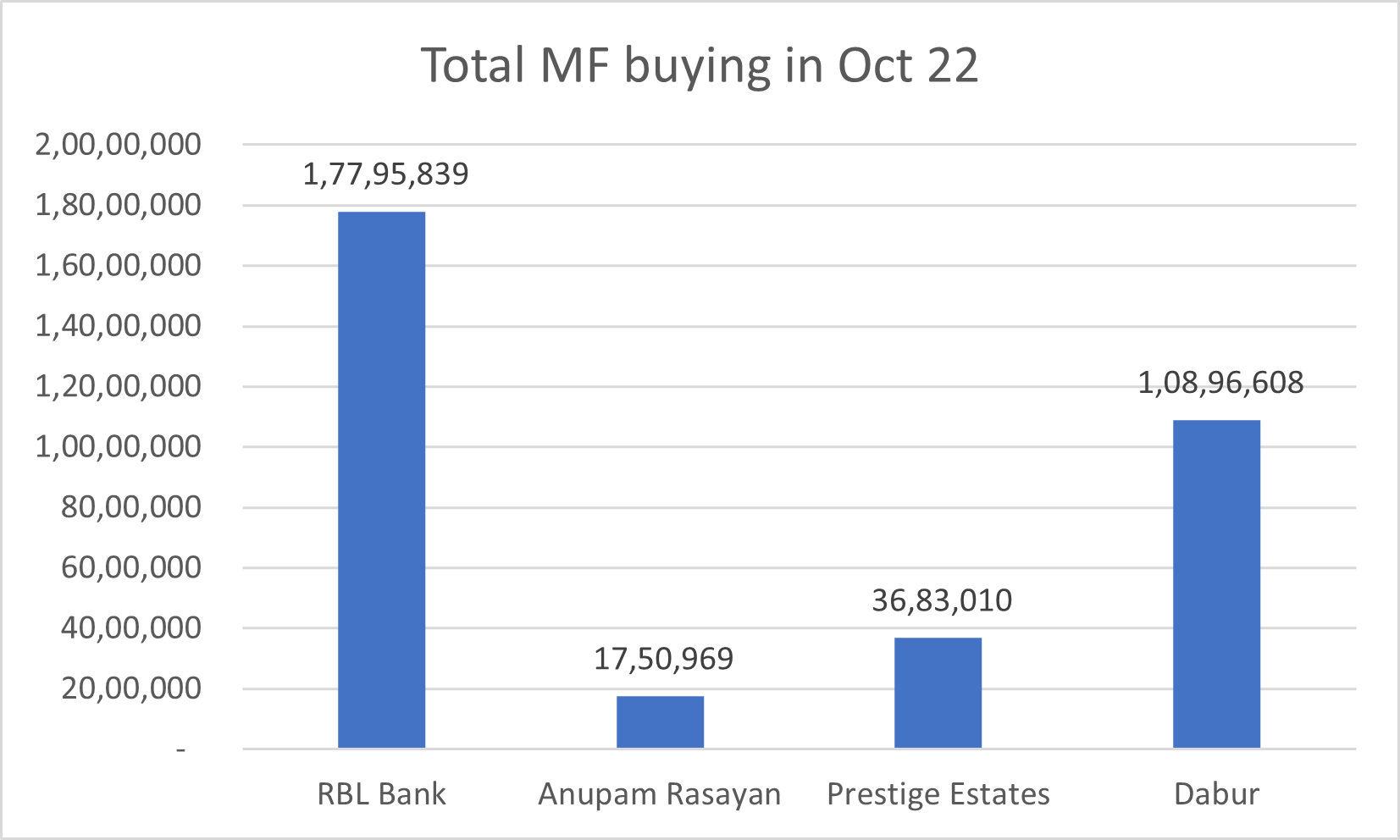

RBL Bank – It is a private sector bank with a wide range of banking and financial services including wholesale banking, retail banking, treasury operations and other banking related activities. The bank reported a 5.5X YoY jump in net profit to Rs 2 billion in Q2FY23. It also plans to launch its 2W, Used Cars, and Gold loans in 3QFY23.

Mutual fund schemes that bought more than one lakh shares in October

|

RBL Bank |

Shares in numbers |

|

Nippon India Small Cap Fund – Growth |

50,00,000 |

|

Nippon India Arbitrage Fund Growth |

16,60,000 |

|

Tata Flexi Cap Fund Regular Growth |

16,50,000 |

|

Quant Small Cap Fund Growth |

13,50,000 |

Anupam Rasayan – It is a specialty chemical player. The Q2FY23 results saw the revenues rise by 50%. The company has expansion plans in place to building multipurpose plants in our existing units at Sachin and Jhagadia. It also raised around Rs 500 crore through Qualified Institutional Placement (QIP) for growth capex in Q2FY23.

Mutual fund schemes that bought more than one lakh shares in October

|

Anupam Rasayan |

Shares in numbers |

|

Quant Active Fund Growth |

4,96,551 |

|

Aditya Birla Sun Life Multi-Cap Fund Regular Growth |

4,13,793 |

|

Aditya Birla Sun Life Equity Advantage Fund Growth |

3,44,827 |

|

Franklin India Smaller Companies Fund Growth |

3,44,526 |

Prestige Estates – It is one India’s largest developer in terms of booking value for FY22. Majority of its growth has been from projects in Bengaluru and Hyderabad. The company has made a foray into new territories with projects in Mumbai and NCR region. It reported Q2FY23 gross sales bookings of Rs 35.1bn in Q2FY23 as against Rs3 0.1bn in Q1FY23 with five new launches spread across 7.4msf in Bengaluru and Mumbai.

Mutual fund schemes that bought more than one lakh shares in October

|

Prestige Estates |

Shares in numbers |

|

Mirae Asset Emerging Bluechip Fund Growth |

11,27,520 |

|

Mirae Asset Midcap Fund Regular Growth |

11,09,712 |

|

Mirae Asset Tax Saver Fund -Regular Plan-Growth |

6,53,067 |

|

HDFC TaxSaver Growth |

3,97,315 |

Dabur – It is one of the leading fast moving consumer goods (FMCG) players dealing in consumer care, ayurvedic and food products with a portfolio of over 250 products. On 26 October 2022, Dabur announced the acquisition of 51% shareholding of Badshah Masala for Rs. 588 crore. Badshah manufactures, sells, and exports blended spices, ground spices, and seasonings. It also reported a good set of Q2FY23 with highest revenues in the last ten quarters.

Mutual fund schemes that bought more than one lakh shares in October

|

Dabur |

Shares in numbers |

|

Kotak Equity Arbitrage Fund Growth |

26,57,500 |

|

Mirae Asset Large Cap Fund Regular Growth |

18,41,689 |

|

ICICI Prudential Focused Equity Fund Growth |

11,50,550 |

|

Nippon India Arbitrage Fund Growth |

7,25,000 |

[/vc_column_text][vc_column_text css=”.vc_custom_1668852946085{margin-left: 10px !important;}”]

Mutual Fund Buys in October 2022

Every month data from AMFI (Association of Mutual Funds of India) puts out the data of the buying and selling of every mutual fund scheme in the market. This data gives insights into what sectors are on the fund managers radar as well as action by mutual fund houses based on results or any significant event in any company.

The month of October also mutual funds add many stocks across large, mid and Nifty500 companies. What we have covered here is the top four stocks across each category and the mutual funds that have purchased at least more than one lakh shares of each stock through the month of October 2022.

Starting with the large cap (Nifty50) stocks that saw buying of a total of few crore shares in each of these companies.

IndusInd Bank – One of India’s leading private sector banks. The bank posted a good set of results in Q2FY23. In the last one year it has delivered better returns than leading private sector banks like HDFC Bank and Kotak Mahindra Bank.

Mutual fund schemes that bought more than one lakh shares in October

|

IndusInd Bank |

Shares in numbers |

|

Kotak Equity Arbitrage Fund Growth |

19,53,450 |

|

HDFC Top 100 Fund Growth |

13,75,000 |

|

HDFC Balanced Advantage Fund Growth |

10,62,000 |

|

Aditya Birla Sun Life Tax Relief 96 Pyt of Inc Dis cum Cap Wdrl |

7,71,538 |

HDFC (Housing Development Finance Corporation) – One the largest NBFCs engaged in providing finance to individuals, corporates and developers for the purchase, construction, development and repair of houses, apartments and commercial properties in India. With approval for the merger with its own bank, HDFC Bank, getting closer to regulatory approval rising buying interest is seen in this stock.

Mutual fund schemes that bought more than one lakh shares in October

|

HDFC |

Shares in numbers |

|

Aditya Birla Sun Life Focused Equity Fund Growth |

13,35,323 |

|

ICICI Prudential Value Discovery Fund Growth |

4,60,827 |

|

Franklin India Bluechip Fund Growth |

4,15,000 |

|

HDFC Balanced Advantage Fund Growth |

3,73,500 |

Mahindra and Mahindra – One of the leading auto manufacturers known for its iconic brand “Scorpio”. The company has been having a good run with its new launches receiving a huge response from customers. The Q2FY23 results were also the best quarterly results in the history of the company.

Mutual fund schemes that bought more than one lakh shares in October

|

Mahindra and Mahindra |

Shares in numbers |

|

HDFC Flexi Cap Fund Growth |

11,86,288 |

|

ICICI Prudential Tranporstation and Logistics Fund Regular Growth |

4,18,779 |

|

Kotak Business Cycle Fund Regular Growth |

3,25,000 |

|

Axis Bluechip Fund Growth |

2,82,425 |

Infosys – It is India’s second largest IT services company. It surprised analysts in with Q2FY23 results when it reported a strong TCV of USD2.7b (the highest in the last seven quarters), of which 54% were net new. The deal pipeline remains healthy and larger than preceding quarters. The management also updated its revenue growth guidance for FY23 to 15-16% YoY in CC terms.

Mutual fund schemes that bought more than one lakh shares in October

|

Infosys |

Shares in numbers |

|

SBI Contra Fund Regular Payout Inc Dist cum Cap Wdrl |

9,00,000 |

|

Aditya Birla Sun Life Frontline Equity Fund Growth |

7,95,576 |

|

Kotak Equity Arbitrage Fund Growth |

6,51,600 |

|

ICICI Prudential Technology Fund Growth |

5,56,800 |

Midcap companies that that saw buying of a total of few crore shares this month by mutual funds.

Zee Entertainment – It is is engaged in Broadcasting of Satellite Television Channels and digital media and also owner of the OTT platform Zee5. It has seen growing market share in its regional channels this quarter. Another trigger that has initiated buying interest is the merger with Sony, which is expected to be complete in the next two quarters.

Mutual fund schemes that bought more than one lakh shares in October

|

Zee Entertainment |

Shares in numbers |

|

ICICI Prudential Value Discovery Fund Growth |

55,03,758 |

|

Aditya Birla Sun Life Frontline Equity Fund Growth |

25,55,228 |

|

ICICI Prudential Focused Equity Fund Growth |

18,64,566 |

|

Mirae Asset Emerging Bluechip Fund Growth |

17,50,000 |

Tata Chemicals – Tata Chemicals is one of the top five players in the global soda ash market. Under basic chemical, it offers soda ash, sodium bicarbonate, cement, salt, marine chemicals and crushed refined soda. Speciality chemical consists of agro chemical through Rallis and other specialty solutions such as nutritional products. It also posted a stellar Q2FY23 result with highest revenue and profits in the last ten quarters.

Mutual fund schemes that bought more than one lakh shares in October

|

Tata Chemicals |

Shares in numbers |

|

Kotak Flexicap Fund Growth |

26,50,000 |

|

Kotak Equity Opportunities Fund Growth |

12,00,000 |

|

Kotak Business Cycle Fund Regular Growth |

3,80,000 |

|

Nippon India Growth Fund – Growth |

2,90,000 |

BHEL (Bharat Heavy Electricals Limited) – This PSU is India’s largest engineering company and dominates the supply of equipment for power plants in the country. Its products include gas turbines, generators, thermal sets, diesel shunters, turbo sets, hydro sets, power transformers, switch gears, circuit breakers and boilers. In Q2FY23, it booked new orders worth Rs 14,511 crore. With a strong order pipeline across its verticals, interest in the stock is rising.

Mutual fund schemes that bought more than one lakh shares in October

|

BHEL |

Shares in numbers |

|

Nippon India Focused Equity Fund – Growth |

1,04,07,404 |

|

HDFC Arbitrage Fund Wholesale Plan Growth |

45,04,500 |

|

DSP Dynamic Asset Allocation Fund Regular Growth |

33,39,000 |

|

L&T Arbitrage Opportunities Fund Regular Growth |

30,87,000 |

Delivery – It is an integrated logistics company with a pan India presence having a network that includes 122 gateways, 21 automated sort centres and 93 fulfilment centres. In Q2FY23, the company was able to substantially increase its revenues on a YoY basis as well as pare down its losses. Though not profitable yet, probably of a profitable quarter in the near future have increased.

Mutual fund schemes that bought more than one lakh shares in October

|

Delhivery |

Shares in numbers |

|

SBI Flexicap Fund Regular Growth |

40,00,000 |

|

HDFC Flexi Cap Fund Growth |

30,45,655 |

|

HDFC Focused 30 Fund Growth |

7,22,827 |

|

ICICI Prudential Tranporstation and Logistics Fund Regular Growth |

5,46,838 |

Other companies part of the Nifty 500 that that saw buying of a total of few crore shares this month by mutual funds.

RBL Bank – It is a private sector bank with a wide range of banking and financial services including wholesale banking, retail banking, treasury operations and other banking related activities. The bank reported a 5.5X YoY jump in net profit to Rs 2 billion in Q2FY23. It also plans to launch its 2W, Used Cars, and Gold loans in 3QFY23.

Mutual fund schemes that bought more than one lakh shares in October

|

RBL Bank |

Shares in numbers |

|

Nippon India Small Cap Fund – Growth |

50,00,000 |

|

Nippon India Arbitrage Fund Growth |

16,60,000 |

|

Tata Flexi Cap Fund Regular Growth |

16,50,000 |

|

Quant Small Cap Fund Growth |

13,50,000 |

Anupam Rasayan – It is a specialty chemical player. The Q2FY23 results saw the revenues rise by 50%. The company has expansion plans in place to building multipurpose plants in our existing units at Sachin and Jhagadia. It also raised around Rs 500 crore through Qualified Institutional Placement (QIP) for growth capex in Q2FY23.

Mutual fund schemes that bought more than one lakh shares in October

|

Anupam Rasayan |

Shares in numbers |

|

Quant Active Fund Growth |

4,96,551 |

|

Aditya Birla Sun Life Multi-Cap Fund Regular Growth |

4,13,793 |

|

Aditya Birla Sun Life Equity Advantage Fund Growth |

3,44,827 |

|

Franklin India Smaller Companies Fund Growth |

3,44,526 |

Prestige Estates – It is one India’s largest developer in terms of booking value for FY22. Majority of its growth has been from projects in Bengaluru and Hyderabad. The company has made a foray into new territories with projects in Mumbai and NCR region. It reported Q2FY23 gross sales bookings of Rs 35.1bn in Q2FY23 as against Rs3 0.1bn in Q1FY23 with five new launches spread across 7.4msf in Bengaluru and Mumbai.

Mutual fund schemes that bought more than one lakh shares in October

|

Prestige Estates |

Shares in numbers |

|

Mirae Asset Emerging Bluechip Fund Growth |

11,27,520 |

|

Mirae Asset Midcap Fund Regular Growth |

11,09,712 |

|

Mirae Asset Tax Saver Fund -Regular Plan-Growth |

6,53,067 |

|

HDFC TaxSaver Growth |

3,97,315 |

Dabur – It is one of the leading fast moving consumer goods (FMCG) players dealing in consumer care, ayurvedic and food products with a portfolio of over 250 products. On 26 October 2022, Dabur announced the acquisition of 51% shareholding of Badshah Masala for Rs. 588 crore. Badshah manufactures, sells, and exports blended spices, ground spices, and seasonings. It also reported a good set of Q2FY23 with highest revenues in the last ten quarters.

Mutual fund schemes that bought more than one lakh shares in October

|

Dabur |

Shares in numbers |

|

Kotak Equity Arbitrage Fund Growth |

26,57,500 |

|

Mirae Asset Large Cap Fund Regular Growth |

18,41,689 |

|

ICICI Prudential Focused Equity Fund Growth |

11,50,550 |

|

Nippon India Arbitrage Fund Growth |

7,25,000 |

[/vc_column_text][/vc_column][/vc_row]

Related Posts

Marushika Technology IPO Review 2026: GMP Rises Flat, Key Investor Insights

Highway Infrastructure Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

Euro Pratik Sales Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

Vikas Lifecare Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here

Rajnish Wellness Gears Up for Q3 Reveal on 7th February; Check Key Expectations Here