Stocks to watch out for next 3-6 months

Posted by : Sheen Hitaishi | Tue Feb 21 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1676978570914{margin-right: 16px !important;margin-left: 16px !important;}”]

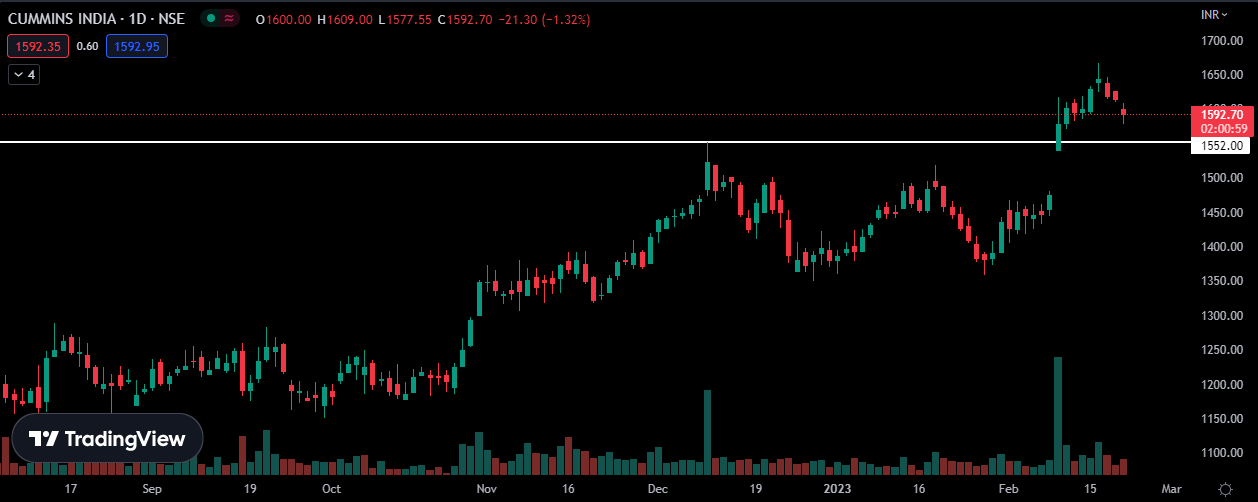

Cummins India

Cummins Inc. is an American multinational corporation that designs, manufactures, and distributes engines, filtration, and power generation products. Cummins also services engines and related equipment, including fuel systems, controls, air handling, filtration, emission control, electrical power generation systems, and trucks.

Univest Fundamental Score – STRONG

Our view:

⦁ Cummins has given a breakout of “Flat Base pattern” at the 1552 levels

⦁ Q3 Results Update (YoY) – Net profit up 57% and Revenue up 26%.

⦁ Return on Equity is 17.2%.

⦁ Stock is trading at a PE of 40 and the sector PE is 41.

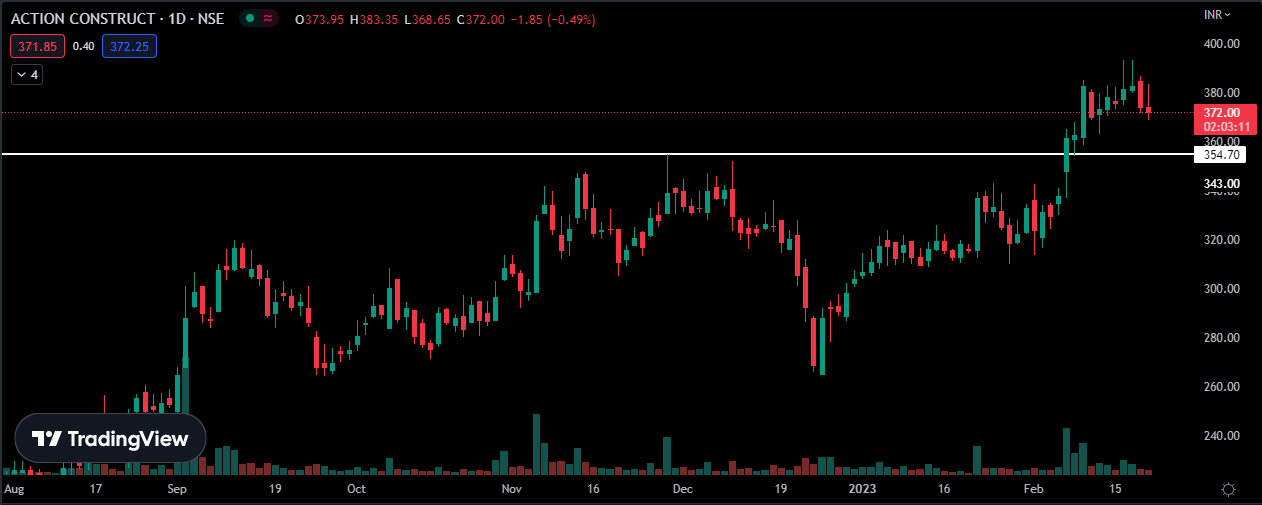

Action Construction Equipment

ACE has eight manufacturing sites in Faridabad, Haryana, with research and development in the Faridabad district, and has a manufacturing capacity of 12000 construction equipment and 9000 tractors annually. Their product portfolio is divided into four main categories: agricultural equipment, construction equipment, road construction equipment, and earth-moving machinery, mainly catering to Asia-Pacific, Africa , and Latin America regions.

Univest Fundamental Score – STRONG

Our view:

- ACE has given a breakout on “Consolidation pattern” at 354.7 level.

- Q3 results update (YoY) – Net profit up 71% and Revenue up 27%

- Return on equity is 16.4%.

- Stock is trading at a PE of 28 and the sector PE is 71

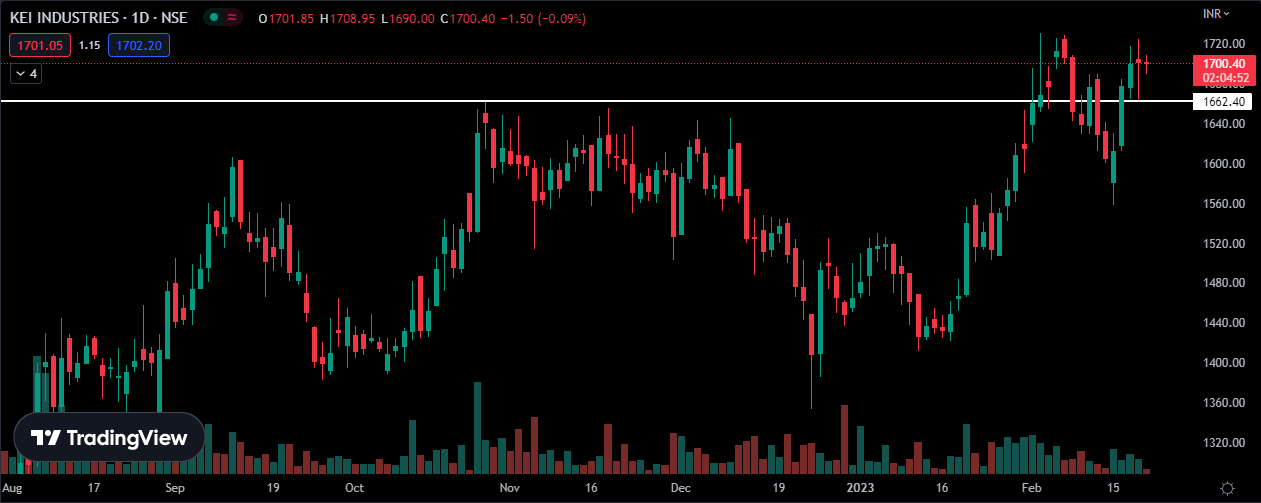

KEI Industries

KEI was established in 1968 as a partnership firm under the name Krishna Electrical Industries, with the prime business activity of manufacturing house-wiring rubber cables. Today, it has grown into an empire with a global presence, offering holistic wire & cable solutions. Their products serve customers globally in over 45 countries, through a rich network of 5000+ channel partners

Univest Fundamental Score – STRONG

Our view:

- KEI Industries has given a breakout of “Consolidation pattern” at 1661.95 level.

- Q3 results update (YoY) – Net profit up 27% and Revenue up 14%

- Return on equity is 19,33% and is consistently above 15% for the last 5 years.

- Stock is trading at a PE of 32.4 and the sector PE is 48.4

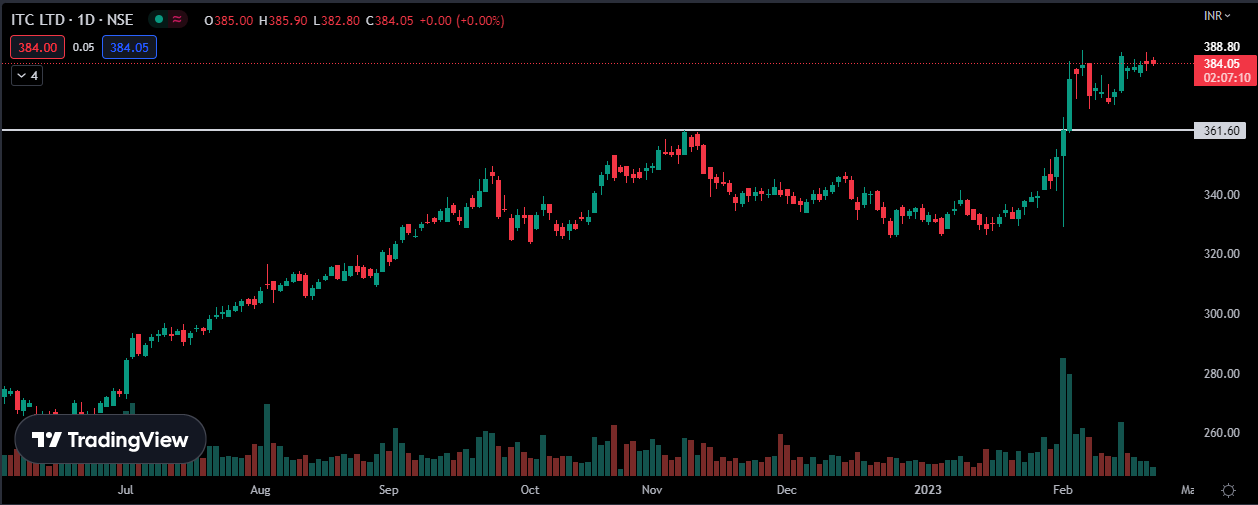

ITC

ITC Limited is an Indian conglomerate company headquartered in Kolkata. ITC has a diversified presence across industries such as FMCG, hotels, software, packaging, paperboards, specialty papers, and agribusiness. The company has 13 businesses in 5 segments. It exports its products to 90 countries. Its products are available in 6 million retail outlets.

Univest Fundamental Score – NEUTRAL

Our view:

⦁ ITC has given a breakout of a long-term Consolidation pattern at 361.6

⦁ Q3 results update (YoY) – Net profit up 23% and Revenue up 4%

⦁ Return on equity is 25.89% and is consistently above 20% for the last 5 years.

⦁ Stock is trading at a PE of 25.5 and the sector PE is 70.4

About the Author

Sagar Wadhwa

Sagar Wadhwa is a Senior Equity Research Analyst who is a key member of the research team at Univest. He has extensive knowledge and expertise in the stock market, financial analysis, and investing and uses this expertise to provide valuable insights to the research team.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly update [/vc_column_text][/vc_column][/vc_row]

Related Posts

Shyam Dhani Industries IPO GMP & Review: Apply or Avoid?

Dachepalli Publishers IPO GMP & Review: Apply or Avoid?

Phytochem Remedies IPO Allotment Status Check Online: GMP, Subscription, Price, and More

KSH International IPO Listing Preview: What to Expect Now?

HRS Aluglaze IPO Listing at 31% Premium at ₹126 Per Share