Stock to watch out for next week

Posted by : Sheen Hitaishi | Mon Nov 28 2022

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1669453651562{margin-right: 10px !important;margin-left: 10px !important;}”]

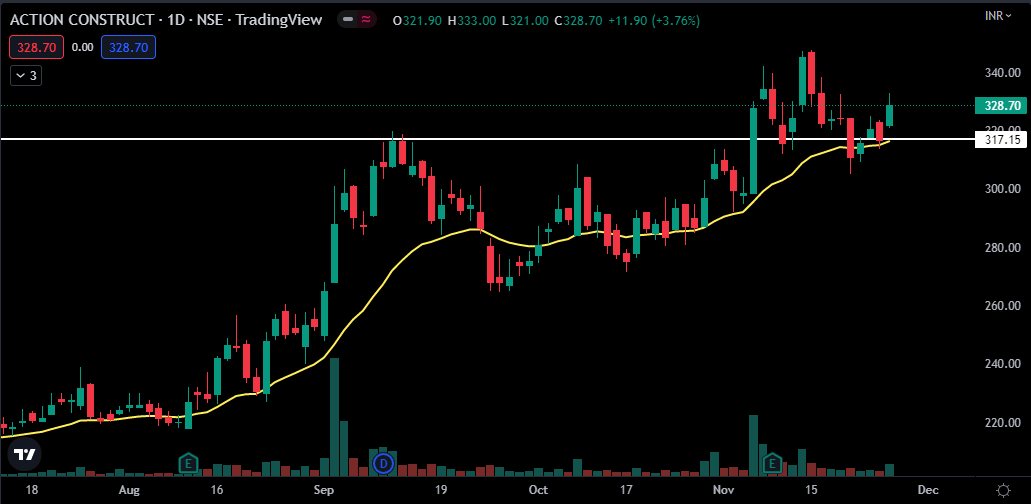

1. ACE

ACE is India’s leading material handling and construction equipment manufacturing company. They are market leaders in Mobile Cranes & Tower Cranes segment. In addition to Mobile Cranes, ACE also offers Mobile/Fixed Tower Cranes, Crawler Cranes, Truck Mounted Cranes, Lorry Loaders, Backhoe Loaders, Vibratory Rollers, Piling Rigs, Forklifts, Warehousing Equipment, Tractors, Harvesters and other Agri Machinery.

Recent Results:

- Net Profit up by 33% YoY

- Revenue up by 37% YoY

Univest Fundamental Score – VERY STRONG

Technical View:

- ACE gave a breakout at 317 levels and now has retested the same level.

- It is taking support from 20 EMA.

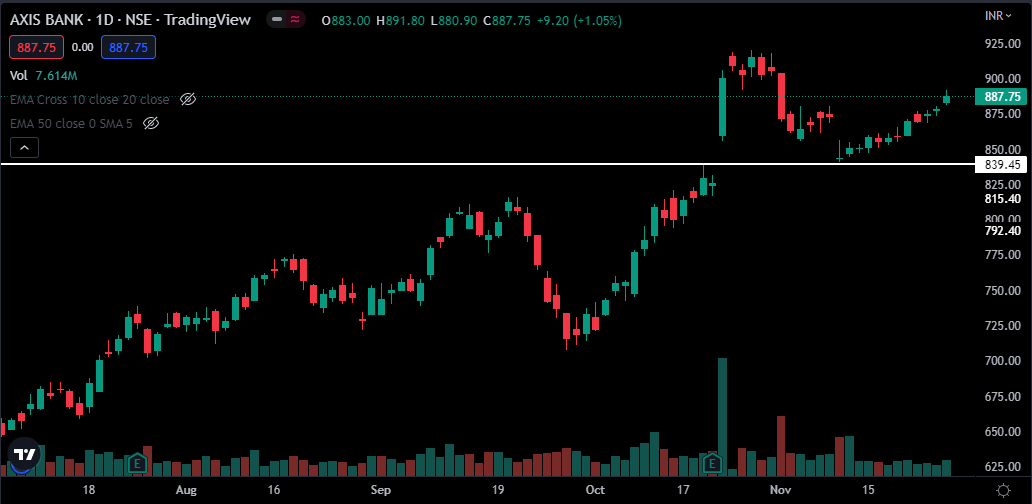

2. AXIS Bank

Axis Bank Limited is an Indian banking and financial services company headquartered in Mumbai, Maharashtra. It sells financial services to large and mid-size companies, SMEs and retail businesses.

Recent Results:

- Net Profit up by 45% YoY

- Revenue up by 21% YoY

Univest Fundamental Score – STRONG

Technical View:

- Axis Bank gave a breakout at 840 levels with a major gap up opening.

- Now it has retested the gap and started moving upside.

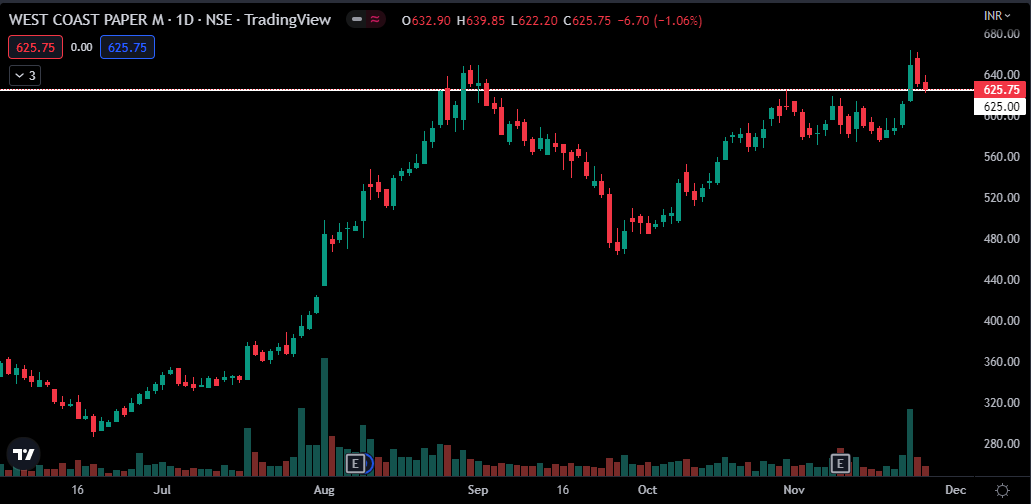

3. West Coast Paper Mills

West Coast Paper Mills Limited (WCPM) is one of the oldest and the largest producers of paper for printing, writing, and packaging in India. Established in 1955, the Mill is located at Dandeli in Uttara Kannada district in Karnataka. The global quality paper produced by the company serves the needs of innumerable industries in printing, writing, publishing, stationary, notebooks and packaging sectors in India, in the process contributing to the development of the nation.

Recent Results:

- Net Profit up by 220% YoY

- Revenue up by 35% YoY

Univest Fundamental Score – VERY STRONG

Technical View:

- West Coast Paper Mills gave a breakout at 625 levels supported by volumes.

- Now it has retested the breakout and there is a high probability that it will turn around from here.

- Investor should wait for a green candle from here to take entry in this stock.

4. ATUL AUTO

Atul Auto Limited is a leading three wheeler (also known as: Auto rickshaw, Tuk-Tuk, E-rickshaw) manufacturing company in Rajkot, Gujarat, India. The company’s origins lie in the 1970s, when Jagjivanbhai Chandra sought to modify motorcycles to make transport meet the needs of rural areas of Saurashtra, and adapted the engines from golf carts scrapped by the Maharaja of Jamnagar, resulting in his first chhakada vehicles.

Recent Results:

- Net Loss decreased from 4.5 Cr to 0.12 Cr

- Revenue up by 50% YoY

Univest Fundamental Score – NEUTRAL

Technical View:

- Atul Auto gave a breakout at 300 levels.

- It has now retested the same level and started moving upwards with volumes.

[/vc_column_text][/vc_column][/vc_row]

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: SBI results

Related Posts

Best Multibagger Midcap Stocks in India 2026

Why is the IRFC Share Price Falling?

Striders Impex IPO Review 2026: GMP Rises 0.00%, Key Investor Insights

Fractal Industries IPO Listing at 6.02% Premium at ₹229 Per Share

PNGS Reva Diamond Jewellery IPO Day 1: Subscription at 0.04x, GMP Rises 2.33% | Live Updates