Stock bought by Mutual Funds in April 2023

Posted by : Kashish Aggarwal | Thu Feb 26 2026

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1684232167036{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]In April 2023, the benchmark Nifty 50 surged by 4% showing strength across many sectors. The mood of the market changed to optimism during this period as the results for many companies were above expectations.

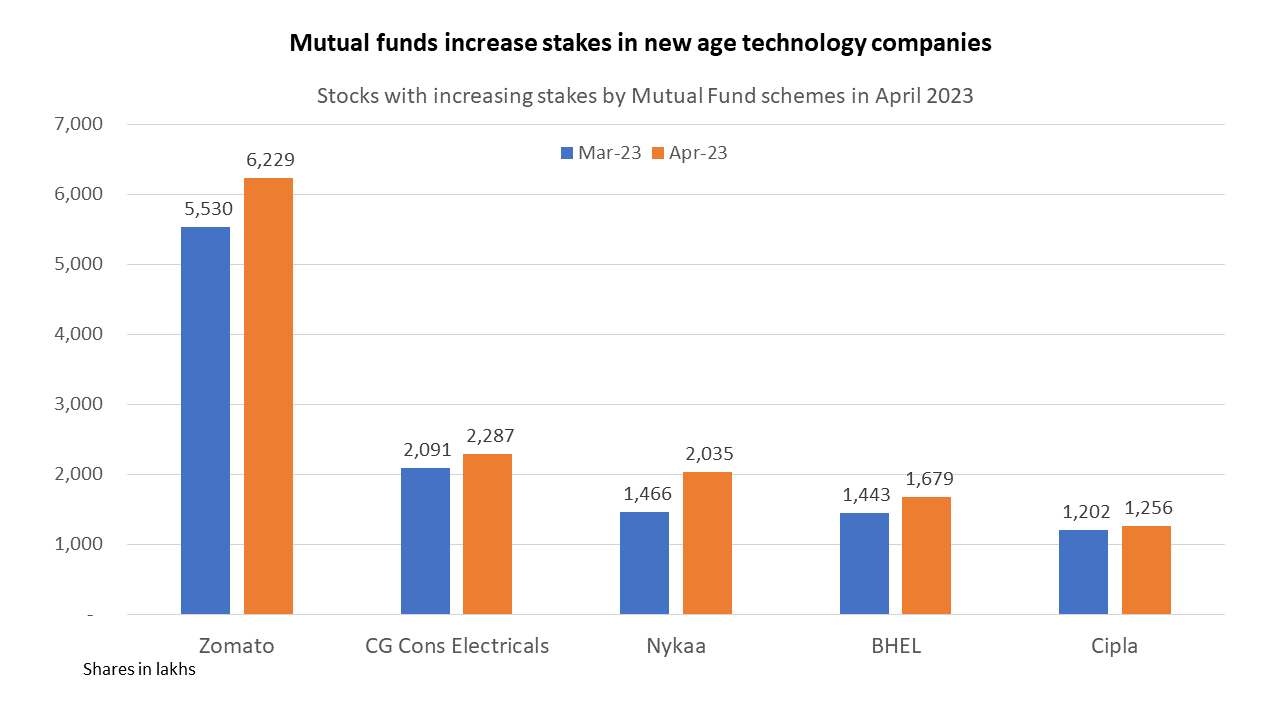

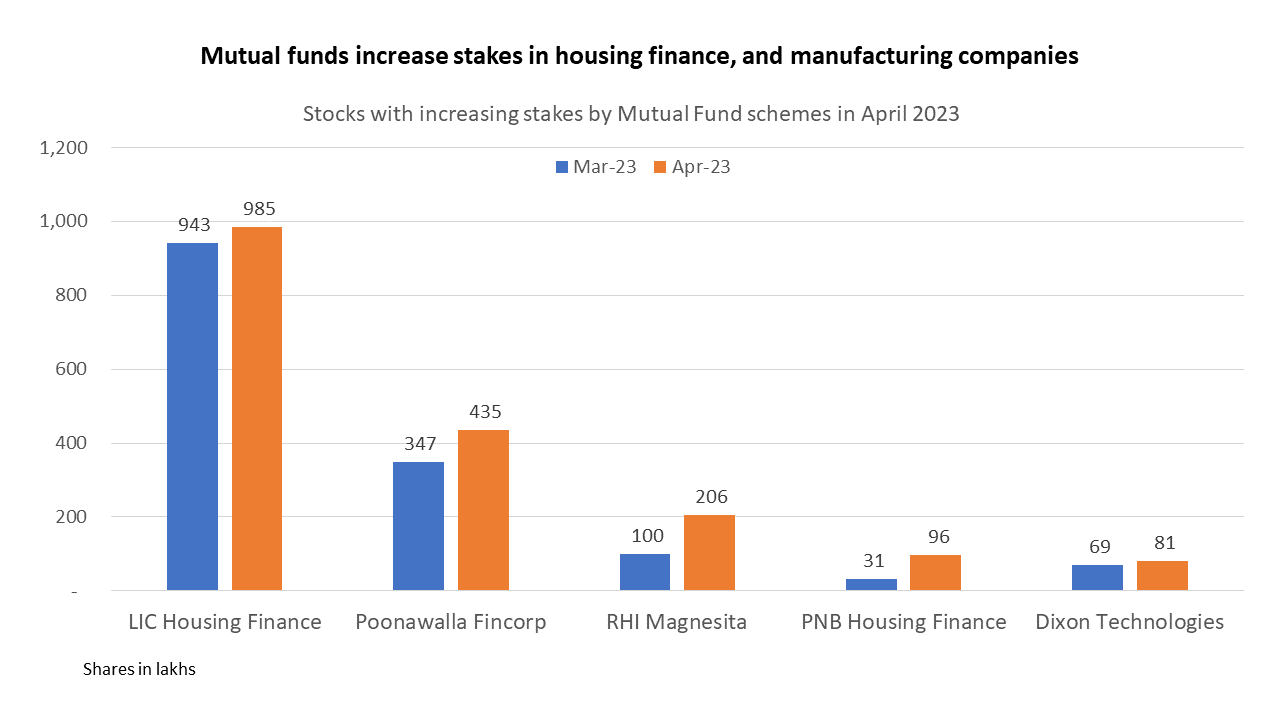

Fund managers of mutual funds bought stocks across sectors in companies where they saw the potential for investors’ returns. The buying interest ranges from new-age technology companies, a leading PSU and some housing finance companies.

Listed below are stocks from the Nifty 500 universe which saw increasing shares in mutual fund schemes. Each stock saw net purchases of more than one lakh shares by at least four mutual schemes each in April.

Zomato

Zomato is a leading food delivery aggregator in India and has presence in more than 23 other countries. The company has a presence in more than 1,000 towns and cities.

With the exit of Amazon, the food delivery market is now a duopoly with Zomato commanding 55% market share and Swiggy at 45%. Its food delivery continues to reduce losses every quarter and is expected to turn profitable in the next few quarters. The Zomato “Gold” membership is also a significant contributor to its revenues since the last two quarters.

Funds who increased holdings in Zomato:

- Motilal Oswal Flexicap Fund Regular Plan Growth

- Motilal Oswal Midcap 30 Regular Growth

- Kotak Multicap Fund Regular Growth

- Kotak Equity Savings Fund Regular Growth

CG Consumer Electricals

Crompton Greaves Consumer Electricals is among India’s leading fast moving electrical goods FMCG companies. It is a leader in lighting which contributes 16% of revenues and is a market leader in the domestic fan industry with value market share of 27%.

The company recently acquired Butterfly, a kitchen appliances manufacturer and thereby made an entry into the kitchen appliances category and has a ready network for expansion in South India, where Butterfly has a strong base.

Funds who increased holdings in CG Consumer Electricals:

- Kotak Equity Arbitrage Fund Growth

- Mirae Asset Tax Saver Fund -Regular Plan-Growth

- Mirae Asset Emerging Bluechip Fund Growth

- HDFC Large and Mid Cap Fund Growth

Nykaa (FSN E-Commerce Ventures)

Nykaa (FSN E-Commerce Ventures) is engaged in the business of manufacturing, selling & distribution of beauty, wellness products on the online platforms as well as through physical stores.

As compared to many other e-commerce startups, Nykaa has been profitable for the last eight quarters. Fund managers’ confidence in the stock seems to stem from the fact that Nykaa has consistently been improving metrics like GMV, Average order value and growth in unique transacting customers.

Funds who increased holdings in Nykaa (FSN E-Commerce Ventures):

- Mirae Asset Tax Saver Fund -Regular Plan-Growth

- Mirae Asset Emerging Bluechip Fund Growth

- SBI Large & Midcap Fund Regular Payout Inc Dist cum Cap Wdrl

- ICICI Prudential Large & Mid Cap Fund Growth

BHEL (Bharat Heavy Electricals Ltd)

BHEL, a PSU company is an integrated power plant equipment manufacturer and is engaged in design, engineering, manufacture, construction, testing, commissioning, and servicing of a wide range of products and services for the core sectors of the economy, viz, Power, Transmission, Industry, Transportation, Renewable Energy, Water, Oil & Gas and Defence & Aerospace.

Recent key order wins include supply of rotor and E&M spares for hydro power plants and upgradation of HMI for thermal power plant for power segment. Supply of transformers for locomotives to the Indian Railways, supply of propulsion equipment, substations, gas compressors, among others.

Funds who increased holdings in BHEL:

- Nippon India Small Cap Fund – Growth

- Nippon India Vision Fund – Growth

- SBI Arbitrage Opportunities Fund Regular Growth

- Edelweiss Arbitrage Fund Regular Growth

Cipla

Cipla is a pharmaceutical company manufacturing, developing, and marketing a wide range of branded and generic formulations and Active Pharmaceutical Ingredients (APIs) with over 1,500+ products in 65 therapeutic categories, with over 50 dosage forms.

The next few quarters are likely to witness significant momentum in the US on the back of possible approvals/launches of gAdvair, gAbraxane and other complex generics launches including peptides. In Q4FY23, its India business grew 16% YoY.

Funds who increased holdings in Cipla:

- HDFC Flexi Cap Fund Growth

- DSP Tax Saver Fund Regular Plan Growth

- Parag Parikh Flexi Cap Regular Growth

- DSP Equity Opportunities Fund Growth

LIC Housing Finance

LIC Housing Finance (LICHF) is one of the largest housing finance companies in India. It provides long-term finance to individuals, professionals, and builders of residential flats and houses. The company has a wide distribution network of 282 marketing offices.

Strong demand for residential properties, widening footprint, digital transformation, and improving asset quality augur well for its future performance.

Funds who increased holdings in LIC Housing Finance:

- SBI Contra Fund Regular Payout Inc Dist cum Cap Wdrl

- Nippon India Arbitrage Fund Growth

- HDFC Large and Mid Cap Fund Growth

- Nippon India Value Fund – Growth

Poonawalla Fincorp

Poonawalla Fincorp is a Non-Banking Finance Company (‘NBFC’) engaged in providing finance through its pan India branch network.

Considering the consistently improving disbursement momentum and diversified product suite, management expects the portfolio to grow by more than 35% annually on a sustainable basis over the medium term. Focused product segments include small business loans, consumer loans, pre-owned cars, small personal loans and Loans Against Property (LAP). Also, the company is increasing contributions from distribution pillars of direct, digital and partnerships.

Funds who increased holdings in Poonawalla Fincorp:

- Aditya Birla Sun Life Equity Advantage Fund Growth

- Aditya Birla Sun Life Focused Equity Fund Growth

- PGIM India Midcap Opportunities Fund Regular Growth

- Bandhan Core Equity Fund – Growth

RHI Magnesita

RHI Magnesita India is engaged in the business of manufacturing and trading of refractories, monolithics, bricks and ceramic paper.

RHI Magnesita acquired the Indian refractory business of Dalmia Bharat Refractories Limited via a Share Swap Agreement executed on January 5, 2023. It also acquired Hi-tech Chemicals on October 19, 2022 byway of slump sale and the process of acquisition has been completed on January 31, 2023. Both these acquisitions put together takes the company’s local production capacity to beyond 5 lac tons per annum.

Funds who increased holdings in RHI Magnesita:

- ICICI Prudential Balanced Advantage Fund Growth

- Nippon India Small Cap Fund – Growth

- HDFC Childrens Gift Fund

- HDFC Balanced Advantage Fund Growth

PNB Housing Finance

PNB Housing Finance is an NBFC providing loans to individuals and corporate bodies for purchase, construction, repair, and up-gradation of houses.

The company is expanding its affordable housing loan offering as well as the premium housing. It has built a separate vertical with dedicated sales, collections and credit underwriting team for affordable housing business and presence has been expanded to 82 branches and outreaches as on 31st Dec 2022.

Funds who increased holdings in PNB Housing Finance:

- Nippon India Small Cap Fund – Growth

- Tata Equity P/E Fund Regular Growth

- Tata Flexi Cap Fund Regular Growth

- Baroda BNP Paribas Flexi Cap Fund Regular Growth

Dixon Technologies

Dixon Technologies transformed from being a manufacturer of electronic goods to leading multi-product corporation with widespread activities. The Company is primarily engaged in the manufacturing of electronics as its core business activity. It is also a beneficiary of the Government PLI scheme for electronics manufacturing.

Funds who increased holdings in Dixon Technologies:

- PGIM India Midcap Opportunities Fund Regular Growth

- PGIM India Flexi Cap Fund Regular Growth

- HDFC Mid-Cap Opportunities Fund Growth

- Kotak Emerging Equity Scheme Growth

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Weekly Update[/vc_column_text][/vc_column][/vc_row]