Stock bought by MFs in February 2023

Posted by : Sheen Hitaishi | Thu Mar 16 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1678962068527{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]In February 2023, the benchmark Nifty 50 index lost nearly 2%, continuing its downtrend that began in December 2022. The month of February was also marred by irrational reactions to the Hindenburg report, which not only dragged down Adani group stocks but also created a negative sentiment in the market. However, towards the end of the month, investors realized that there wasn’t much substance in the report, and Adani group took some image-saving measures. Consequently, the markets did not go down as drastically as expected. During this month, fund managers of mutual funds bought stocks across sectors in companies that have delivered quarterly results above expectations or those that are likely to see growth in the future.

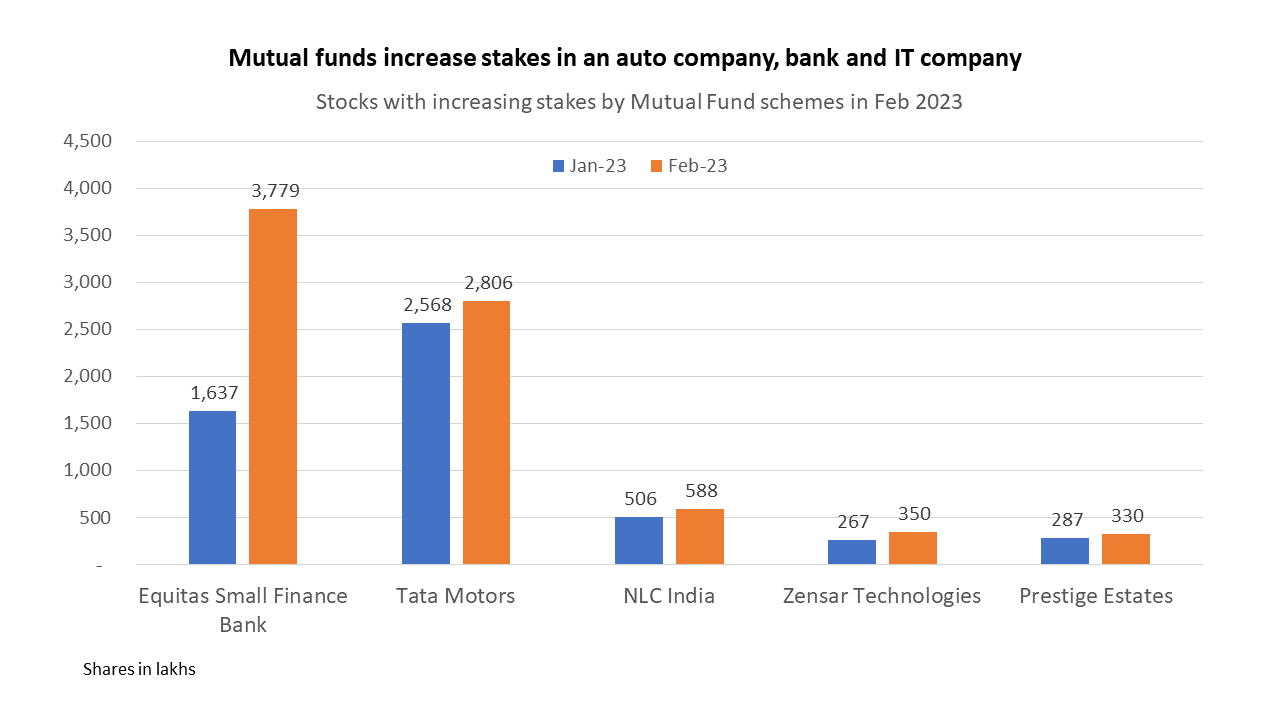

Equitas Small Finance Bank

Equitas Small Finance Bank is engaged in the retail banking business, with a focus on micro-finance, commercial vehicle finance, home finance, and providing financing solutions for individuals and micro and small enterprises (MSEs) that are underserved by formal financing channels. The bank posted a stellar set of numbers for Q3FY23, with YoY revenue growth of 17.5% and YoY net profit growth of 57.3%. Funds that increased holdings in Equitas Small Finance Bank were Franklin India Smaller Companies Fund Growth, Franklin India Prima Fund Growth, DSP Small Cap Fund Regular Plan Growth, and Canara Robeco Small Cap Fund Regular Growth.

Tata Motors

Tata Motors is India’s leading commercial vehicle manufacturer and has the third-highest market share of passenger vehicles in India. It has taken the lead in EV in the car segment with the Nexon EV. In Q3FY23, it posted net profits after several quarters of losses. Funds that increased holdings in Tata Motors were Kotak Equity Arbitrage Fund Growth, HDFC Top 100 Fund Growth, Invesco India Arbitrage Fund Growth, and Aditya Birla Sun Life Frontline Equity Fund Growth.

NLC India

NLC India is engaged in the business of mining of Lignite, Coal, and generation of power by using lignite as well as Renewable Energy Sources. The company is adding a 3200MW coal-based thermal plant (3x800MW phase-I and 1x800MW phase-II) in Talabira, Odisha. Management expects the plant to be commissioned by 2027-28. From the current coal production of 6MT in FY22 (20MT capacity), NLC plans to ramp up output to 13MT in FY23 and close to 20MT in FY24. The company has tied up ~8MT with NTPC, and the balance will be sold in the open market. Funds that increased holdings in NLC India include Nippon India Small Cap Fund – Growth, Baroda BNP Paribas Balanced Advantage Fund Regular Growth, Baroda BNP Paribas Large and Mid-Cap Fund Regular Growth, and Mahindra Manulife Small Cap Fund Regular Growth.

Zensar Technologies

Zensar Technologies is an IT services company that has industry expertise spanning across Manufacturing, Retail, Media, Banking, Insurance, Healthcare, and Utilities. The company appointed Manish Tandon as CEO & MD of the company for five years from January 2023. He has over 27 years of industry experience and last served as CEO of CSS Corp and is likely to bring in new initiatives to drive growth, which has been a challenge for the last few quarters.

Funds that increased holdings in Zensar Technologies were Nippon India Small Cap Fund – Growth, Quant Small Cap Fund Growth, Franklin India Smaller Companies Fund Growth, and Quant Quantamental Fund Regular Growth.

Prestige Estates

Prestige Estate is a real estate company operating mainly in Bangalore and Chennai and has recently spread to other locations like Mumbai, Noida, and Hyderabad. With a project pipeline of 73msf and a focus on business development across markets, Prestige Estate intends to maintain new launches at 30msf+ over the next three years.

Funds who increased holdings in Prestige Estates include HDFC Flexi Cap Fund Growth, Mirae Asset Emerging Bluechip Fund Growth, Franklin India Prima Fund Growth, and Mirae Asset Tax Saver Fund – Regular Plan – Growth.

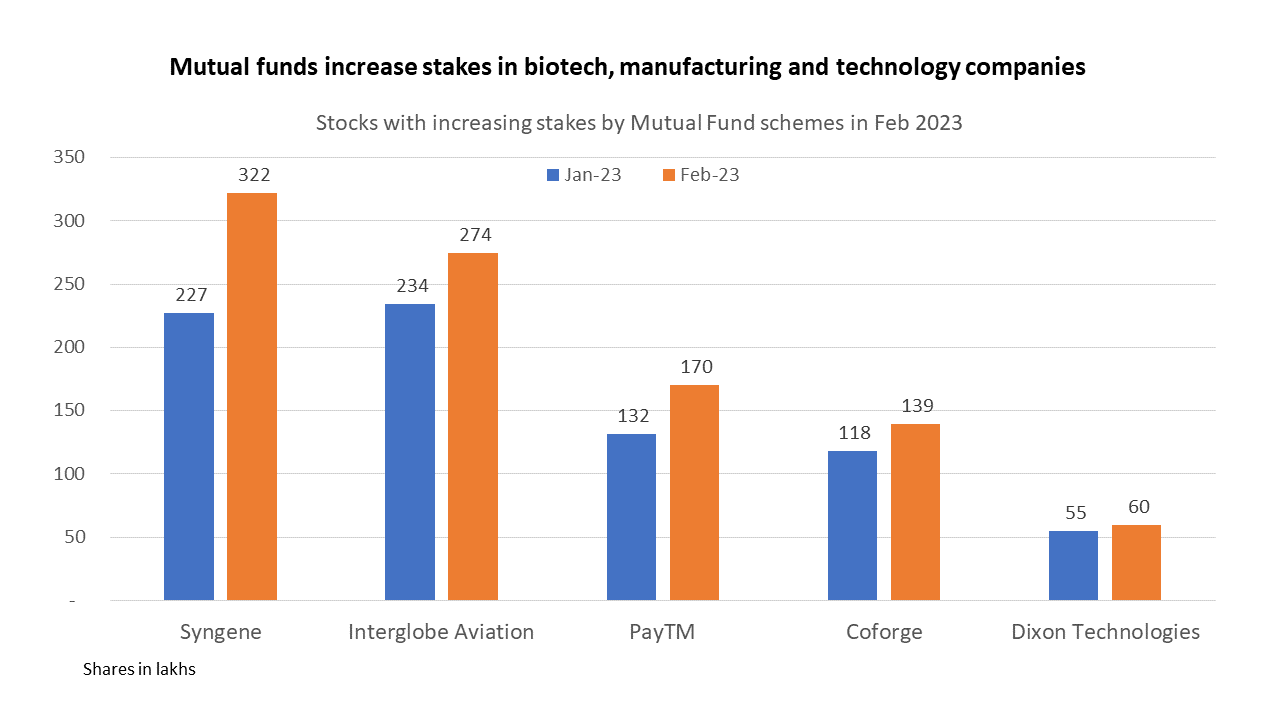

Syngene

Syngene is a contract research, development, and manufacturing organization catering mainly to global innovator pharma/chemical companies. It offers integrated scientific services from early discovery to commercial supply. Management expects growth from expanding its biopharma manufacturing business by commissioning its microbial facility and expanding the mammalian cell manufacturing facility.

Funds that increased holdings in Syngene were ICICI Prudential Focused Equity Fund Growth, Invesco India Contra Fund Growth, ICICI Prudential MidCap Fund Growth, and Nippon India Pharma Fund – Growth.

Interglobe Aviation

Interglobe Aviation, more commonly known as Indigo, is one of India’s most profitable low-cost airlines. With travel back on people’s agenda after two years of the pandemic, airlines are flying full on almost all routes.

Funds that increased holdings in Interglobe Aviation include Nippon India Pharma Fund – Growth, ICICI Prudential Value Discovery Fund Growth, ICICI Prudential Equity & Debt Fund Growth, and ICICI Prudential Multi-Asset Fund Growth.

PayTM

PayTM or One 97 Communications is a new-age tech fintech company that facilitates payment and financial services. It primarily includes payment facilitator services, facilitation of consumer and merchant lending to consumers and merchants, wealth management, etc. In Q3FY23, the average monthly transacting users (MTUs) increased 32.0% YoY to 85mn. The total loan value disbursed by the company grew 357% YoY to Rs. 9,958cr, as 8.1mn borrowers drew down the loan, and 1.4mn borrowers were added.

Funds that increased holdings in PayTM were Mirae Asset Large Cap Fund Regular Growth, Mirae Asset Focused Fund Regular Growth, Franklin India Prima Fund Growth, and Motilal Oswal Equity Hybrid Fund Regular Growth.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Stocks in Rakesh Jhunjhunwala portfolio with increased stake in Q3FY23

[/vc_column_text][/vc_column][/vc_row]

Related Posts

Omnitech Engineering IPO Listing Preview: What to Expect Now?

PNGS Reva Diamond Jewellery IPO Listing Preview: What to Expect Now?

Yaap Digital IPO Listing Preview: What to Expect Now?

Striders Impex IPO Allotment Status: 0.96x Subscribed, GMP Flat — Check Online

Acetech E-commerce IPO Day 2: Subscription at 0.26x, GMP Flat | Live Updates