Reliance Industries Q4FY23 Results Update

Posted by : Sheen Hitaishi | Sun Apr 23 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1682235795968{margin-right: 9px !important;margin-left: 14px !important;}”]

As results season begins, one of the most anticipated is that of Reliance Industries, and with good reason. Reliance Industries is India’s largest conglomerate and has witnessed generations of investors create wealth over the last few decades. In fact, the Reliance stock has the highest weightage in the Nifty 50 index, and any price swings in Reliance Industries stock directly affect the index.

Reliance Industries released its Q4 numbers on Friday, March 21, and here are some of the key highlights:

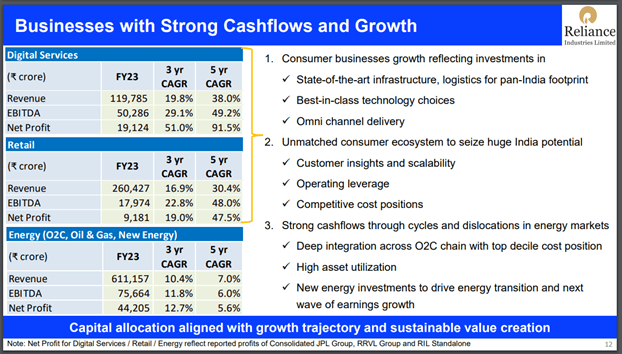

- Consolidated revenue from operations in Q4FY23 came in at Rs 2.13 lakh crore, registering a rise of 2.8% from Rs 2.07 lakh crore in Q4FY22.

- Consolidated net profit stood at Rs 19,299 crore for Q4FY23, up 19% YoY.

- Reliance Retail, the retail arm of Reliance Industries, clocked a 12.9% YoY jump in net profit to Rs 2415 crore in Q4FY23.

- Reliance Retail’s gross revenue stood at Rs 69,267 crore in Q4 FY23, rising 19.4% YoY from Rs 58,017 crore in Q4FY22.

- Reliance Retail’s store footfalls were at 219 million, the highest ever, up from 201 million in Q3FY23.

- The O2C (Oils to Chemicals) vertical saw revenue fall by 11.8% YoY to Rs 1,28,633 crore. Exports dropped 0.4% to Rs 78,851 crore. EBITDA, meanwhile, improved 14.4% to Rs 16,293 crore.

- Oil and gas revenue more than doubled to Rs 4,556 crore as compared to Q4FY22, mainly on account of higher price realisation and a 13% increase in KGD6 gas production.

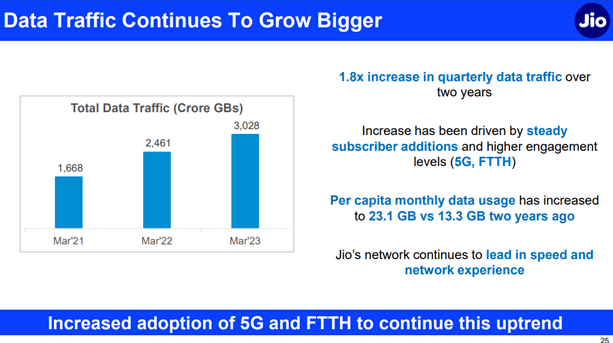

- Jio Platforms (JPL), the holding company of the telecom and digital services businesses of RIL, reported a 23.5% YoY growth in net profit to Rs 19,124 crore for FY23, while revenue from operations stood at Rs 98,099 crore, up 20.2%.

Data Source: Investor Presentation Q4FY23 Results

Management Speak

Reliance Retail Ventures Executive Director Isha Ambani said, “Reliance Retail continues the path of registering industry-leading growth year after year at a scale unmatched in India.” “Our focus on customer-centricity, backed by investments in technology, innovation, and new business segments, has helped us create operational excellence and steer the transformation of India’s retail sector.”

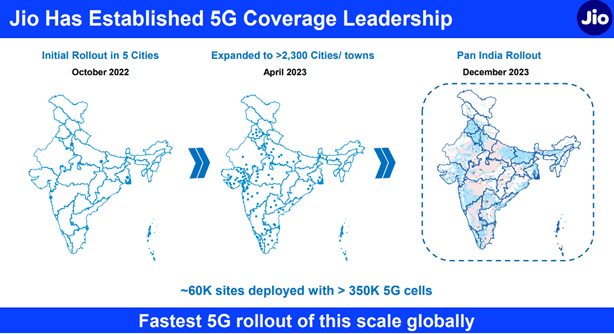

Reliance Jio Infocomm Chairman Akash Ambani said, “5G has led to a significant improvement in customer experience, reflected in the higher engagement levels among Jio users. Jio remains committed to build a robust digital society with tailor-made technology platforms which will drive sustained growth in earnings and value for all stakeholders.”

Data Source: Investor Presentation Q4FY23 Results

RIL Chairman and Managing Director Mukesh Ambani said, “I believe Reliance’s significant investments and strategic partnerships in the renewable energy vertical will help transform the energy landscape of India and the world in the coming years.” He added, This year we have proposed to demerge our financial services arm and list the new entity, Jio Financial Services Ltd. This gives our shareholders an opportunity to participate in an exciting new growth platform from inception.”

Data Source: Investor Presentation Q4FY23 Results

Our Take

Reliance Industries is making enormous strides in the businesses that it has diversified into, be it retail, telecom, or more recently, the Jio platforms. It has garnered the highest ever quarterly profits, driven by the strong operating performance of its mainstay O2C business, optimised feedstock costs, and supportive product margins. The retail and telecom arms also witnessed stable growth.

Reliance Industries is likely to maintain its growth across business verticals in the coming quarters as well. For long-term investors, this stock can be part of their core portfolio. Post-results, the stock is likely to have a positive reaction from investors, as Reliance Industries financial performance has been broadly in line with estimates.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like:

[/vc_column_text][/vc_column][/vc_row]

Related Posts

SEDEMAC Mechatronics IPO Review 2026: GMP Flat, Key Investor Insights

Why is Transrail Lighting Share Price Falling?

Clean Max Enviro Energy Solutions IPO Listing Preview: What to Expect Now?

Shree Ram Twistex IPO Listing Preview: What to Expect Now?

Accord Transformer and Switchgear IPO Listing Preview: What to Expect Now?