Reliance Industries Q3FY23 Results: Strong growth in Retail and Jio

Posted by : Sheen Hitaishi | Tue Jan 24 2023

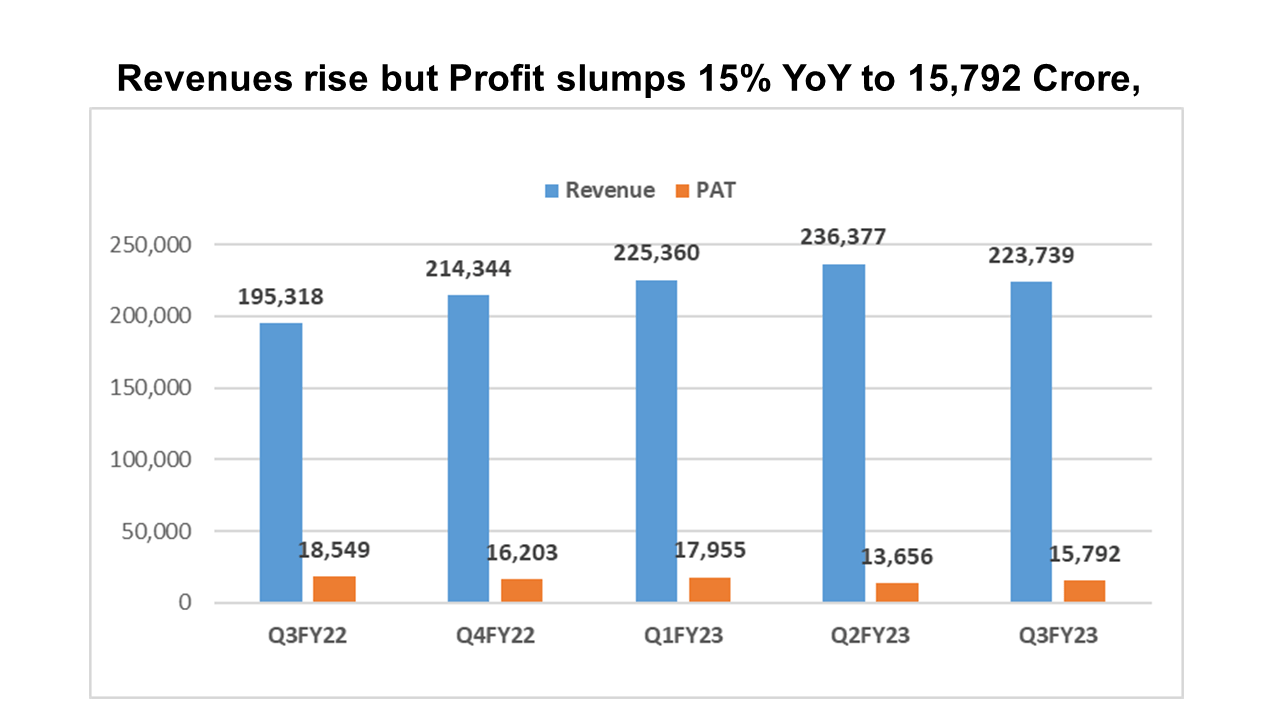

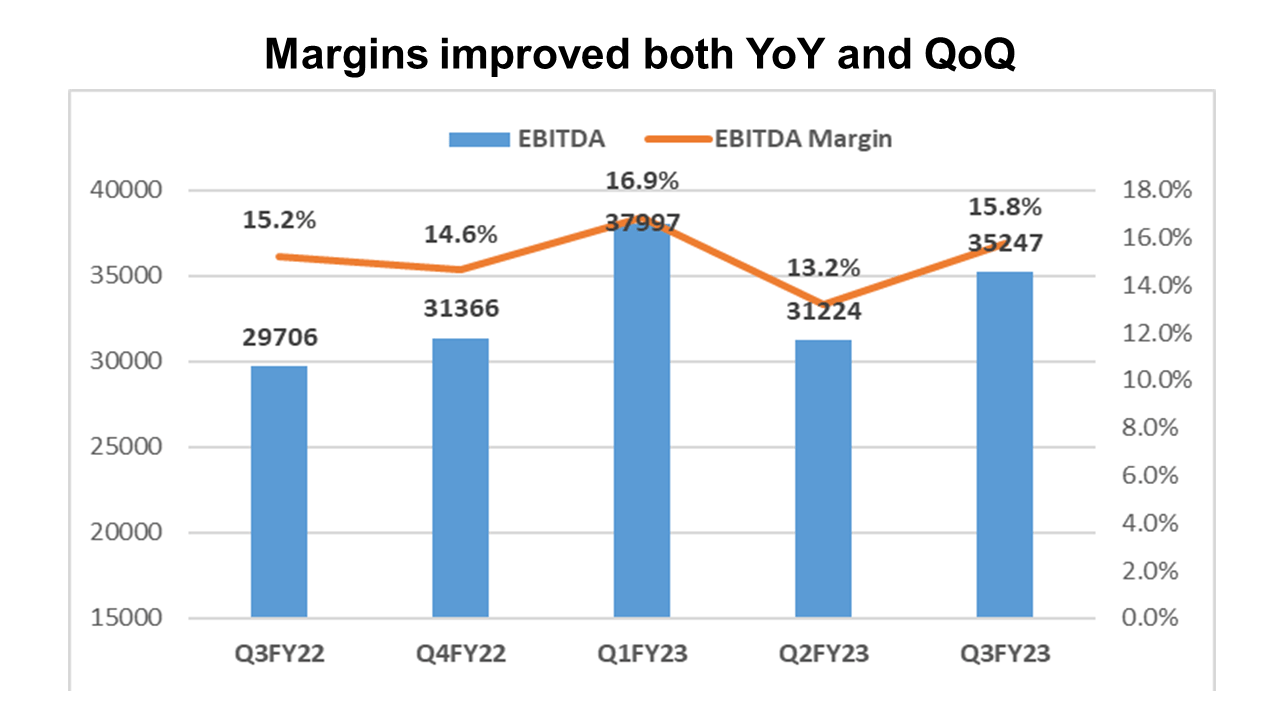

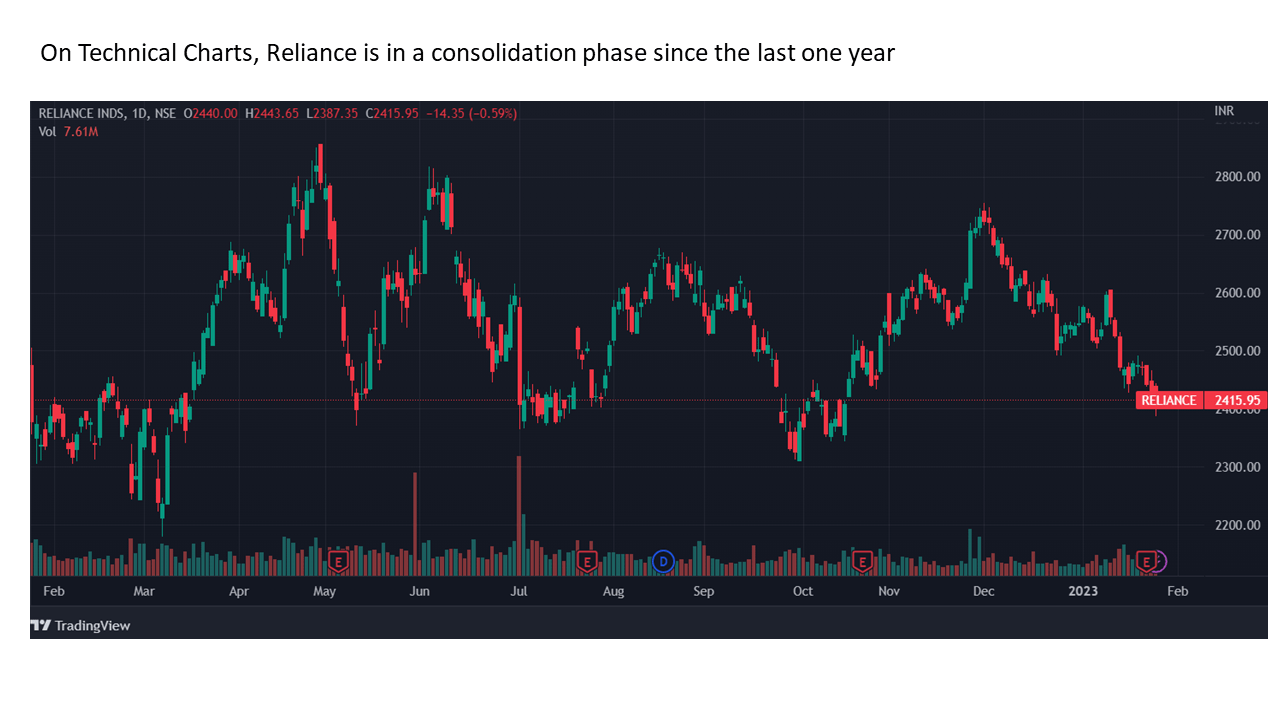

Reliance Industries is one of India’s biggest conglomerates with a presence in oil refining & marketing and petrochemicals, oil & gas exploration, retail, digital services, media, etc. Even on the technical charts, Reliance stock can be seen moving mainly in a sideways trend for a year now and has slightly moved down post-announcement of Q3FY23 results. The company on 20th January 2023 announced its Q3FY23 numbers, where they reported a 13.5% YoY growth in EBITDA led by consumer businesses. So, let’s now have a broader look over the company’s financials by analysing their Q3FY23 numbers & try to project their future direction.

The net debt in the Q2FY23 was 93,253 Cr, it has increased 15.4% to 1,10,248. The increasing debt trend has resulted in higher financing costs primarily due to interest rate hikes by Central Banks and higher loan balances.

Reliance Industries stated that its board has approved Rs 20,000 crore fundraising via non-convertible debentures (NCDs) through a private placement basis.

RIL’s consolidated operating profit, calculated as earnings before interest, taxes, depreciation, and amortization (EBITDA), rose 13.5% on the year to Rs 38,460 crore. Consolidated revenue of the mainstay oil-to-chemicals (O2C) business rose 10% on the year to Rs 1.44 lakh crore. This business made up more than 65% of RIL’s consolidated topline in the quarter.

Jio Platforms Key Financial; Strong growth in Revenue and EBITDA PAT up 28.6% YoY

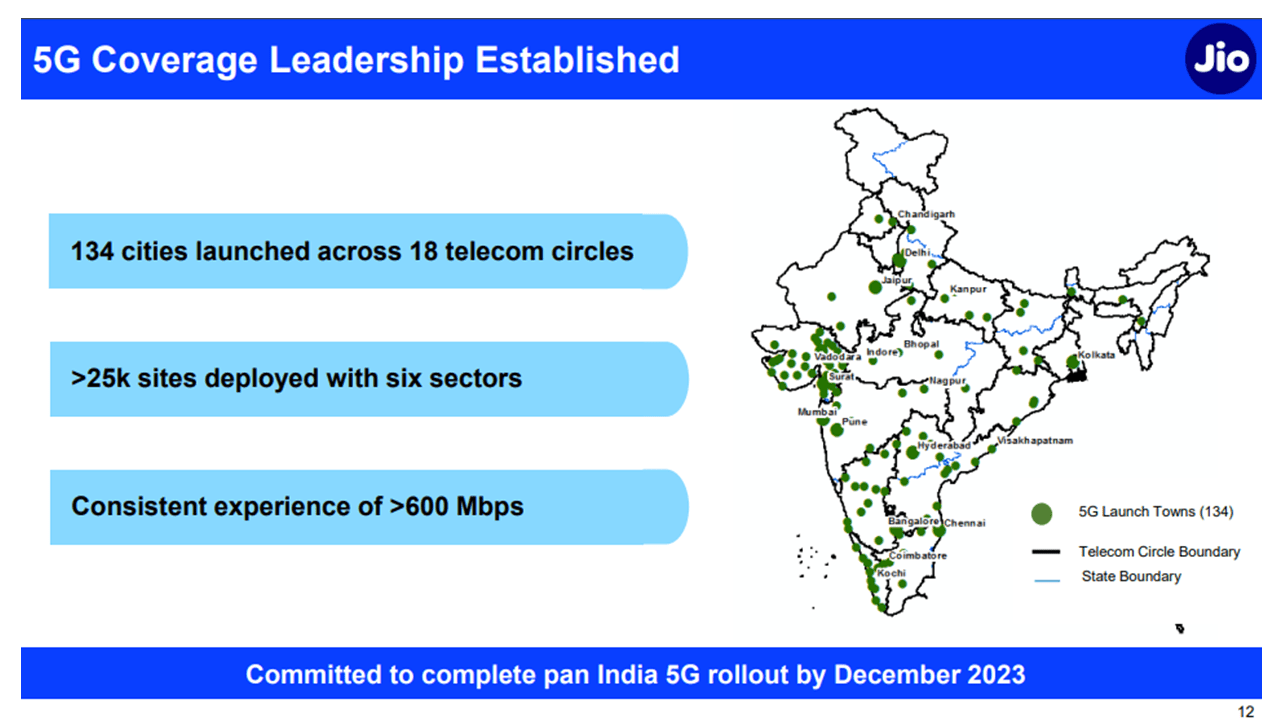

JPL’s consolidated net profit rose to Rs 4,881 crore from Rs 4,729 crore in the July-September period and Rs 3,795 crore in the third quarter of last fiscal year, and revenue increased by 21% to Rs 24,892 crore. The Operating revenue grow at 20.9% YoY driven by consistent subscriber additions and ARPU increase to 178.3 Rs.

“Jio delivered record revenues and EBITDA driven by strong momentum in customer growth and data consumption. This quarter we launched True 5G services. It is now available in 134 cities and towns in India, enhancing the customer experience while enabling next-generation services,” said RIL chairman and managing director Mukesh Ambani.

Data Source : Q3FY23 Investor Presentation

Jio plans to connect over 100 million premises with JioFiber and JioAirFiber offering unparalleled digital experiences, also plans to empower small merchants and businesses with cutting-edge, plug-and-play solutions delivered from the cloud.

The total wireless data consumption rose to 29 billion GB in Q3FY23 as compared to 28.2 billion GB in the previous three months. Quarterly ARPU, a key performance parameter, improved to Rs 178.2 from Rs 177.20 in the second quarter, due to a better subscriber mix. It marginally fell short of the street estimate of Rs 179.

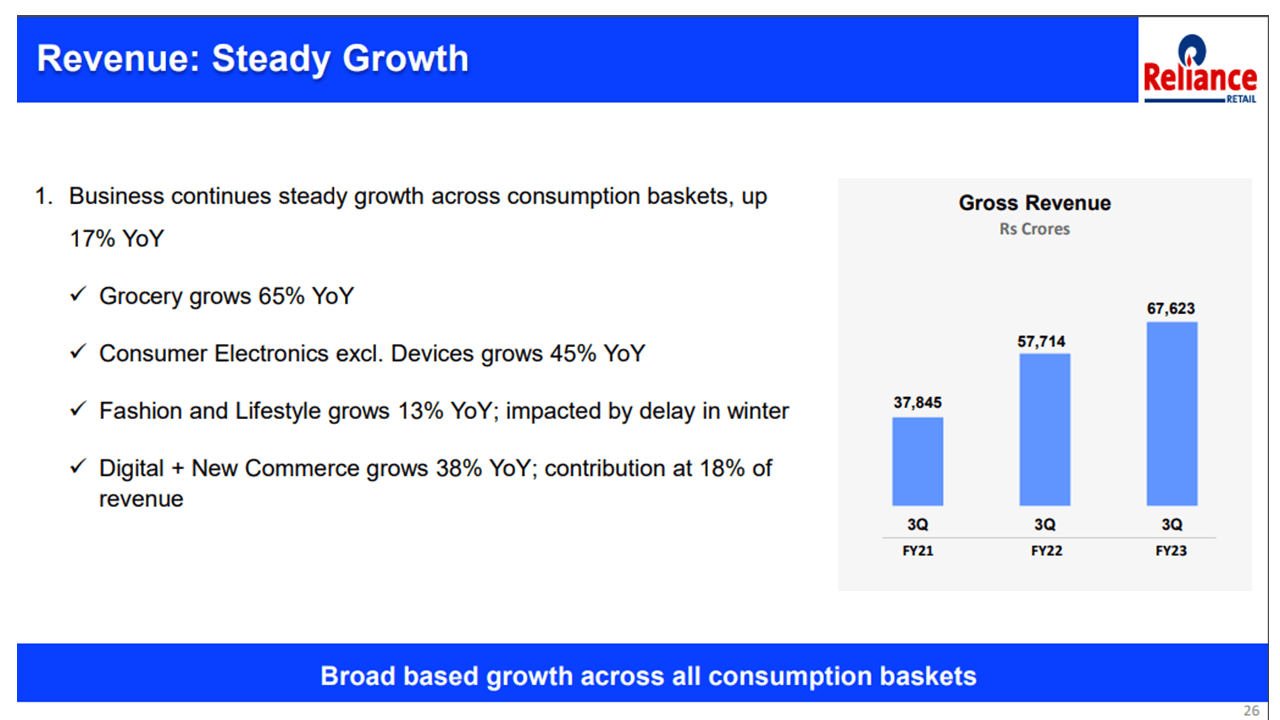

Reliance retail; 789 new stores, Highest ever footfall of 201 million

This was a record quarterly revenue reported by the retail major. Operating profit rose 25% on year to Rs 4,773 crore, and was also the highest-ever for the company. Reliance Retail business recorded the highest-ever quarterly revenue and EBITDA for the quarter with the highest ever footfall at 201 million across formats and geographies for Q3FY23, against 160 million footfall in Q3FY22 and 180 million in Q2FY23.

Data Source : Q3FY23 Investor Presentation

Net profit for the quarter rose 6.2% YoY to Rs 2,400 crore, from Rs 2,259 crore in Q3FY22. The physical store network expanded with 789 new openings, taking the total store count at the end of the quarter to 17,225 stores with an area of 60.2 million square feet, the company said in its press release.

AJIO achieves highest quarterly revenue driven by festive sales, expanding total customer base by 33% YoY. The consumer brands under the firm grew twice. The offline and digital commerce captured a strong customer engagement through bestival festive sale; sets new high with revenue up 74% YoY.

In the same quarter launder energy drink brand ‘Runner’ in 6 flavours and ‘Independence’ in staples category directly competing with ITC. Inorder to bolster further the brand portfolio they have acquired Sosyo and Lotus Chocolate. As mentioned in Univest’s Q2 result analysis ‘JioMart on Whatsapp’ expands active customer base 37% MoM and orders grew 9 times since launch.

Univest View along with Technical Analysis

On the technical charts, it is clearly visible that currently, Reliance stock is trading at the same price as one year back. The 50 EMA is above 100 & 200 EMA, all three lines are very close to the current market price. The current marketplace is trading at 100 EMA, which has a probability to take support and bounce back. While on the long-term horizon, the reliance stock is taking support at 2315 while 3856 is acting as resistance.

Even after the announcement of Q3FY23 results, the share saw a bearish reaction from investors. The Relative Strength Index shows a negative sign in the daily and weekly timeframe, but in the monthly timeframe, the RSI is 50 which acts as a support. Several brokerage houses have maintained a buy rating on the Reliance Industries stock price.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Asian Paints Q3FY23 Results

Related Posts

Why is JP Power Share Price Falling?

Why is the MRF Share Price Falling?

Best SIP Plans for 3 Years in 2026: Build Wealth with Stability

Acetech E-commerce IPO Review 2026: GMP Flat, Key Investor Insights

PNGS Reva Diamond Jewellery IPO Day 3: Subscription at 0.99x, GMP Rises 0.26% | Live Updates