Market falls this week – What should investors do?

Posted by : Sheen Hitaishi | Mon Dec 26 2022

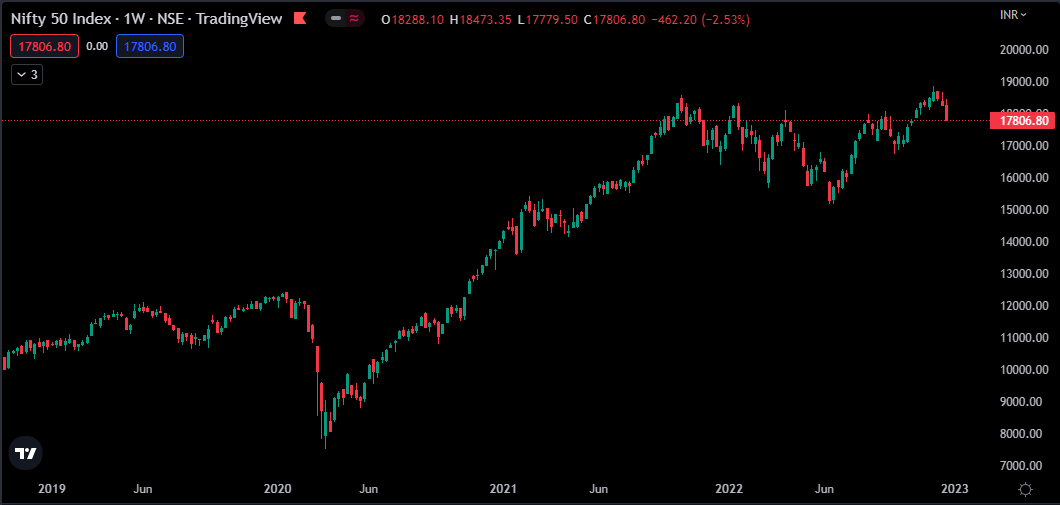

The Nifty began this week with a slight positive bias after falling for more than 1.5% last week. However, as this week progressed, the last three trading days beginning from Wednesday 21st December 2022 saw the Nifty fall sharply each day ending the week 2.53% lower than the previous week. The fall was not restricted to the large-cap stocks, but the weakness was seen across the board with many mid and small-cap stocks losing more than 10% this week.

What should an investor do now?

The fear factors

Many analysts feel that the immediate short-term reason for Indian stocks’ fall is the Japanese government’s decision to change their bond return range which has strengthened Yen in the forex market. Apart from this, FIIs’ tendency of redeeming at the end of their finances ahead of Christmas is another reason for negative sentiments in the market.

Other factors include the fear of recession in the US as the US Fed’s hawkish commentary is still oscillating in the minds of market investors. Also, with Covid cases rising in China, there are fears that there might be another spread of the virus across the world in the coming months. Add to that the IMF projecting that 1/3rd of the world economy is likely to contract over the next year.

An investor should remember that at any given time, there will be different factors attributed to a rise or a fall and these will keep changing every few weeks, either with a positive or negative bias.

While all these factors are at play, one should also have a look at the history of the Nifty50 index over the last three years to understand the periods of rise and fall.

The Technical charts angle

After a sharp fall in March 2020, the Nifty rallied straight from a low of around 8000 to a new high of 18400 in October 2021. This meant that the index more than doubled in the span of one and a half years. This was followed by a correction beginning from October 2021 to June 2022, with a correction of around 16% the Nifty reached a level of 15300. From here the Nifty rallied to make a new high in November 2022 at 18850. The recent fall is only a fall of 5.6% from its peak level last week. We believe that unless the markets correct more than 10% from their peak, there is no cause for undue panic as rises and falls are functions of the market. In fact, after reaching a new high, a correction was due on a technical basis in order to ready the market for the next move ahead.

What happened this year?

We are witnessing this correction at the end of this calendar year. Evaluating the year gone by there are a few sectors that have outperformed and a few that have underperformed.

Notable sector-based index outperformers include

Nifty PSU Bank – up by 55.1%

Nifty FMCG –up by 21.4%

Nifty Bank – up by 19%

Notable sector-based index underperformers include

Nifty IT – down by 23.6%

Nifty Media – down by 16.2%

Nifty Realty – down by 13.4%

For the next year, investors need to track whether the sectors that delivered better returns this year are able to continue the same next year as well and keep a check on any turnaround in the sectors that have delivered negative returns.

What should an investor do with his portfolio?

Long-term investors need not worry at this stage as there are no drastic events that have occurred. The correction in technical terms will only help these investors to gain higher returns over the next few years. Though they still need to track and not “forget” about investments.

Short-term investors need to review and check whether their stocks have breached levels beyond their risk appetite and exit those stocks. The Univest app helps identify strength in the long term as well as short term and should be used to identify trades that need to remain invested and those that need to be exited.

Is there a double whammy of Covid and recession coming?

While China is battling rising Covid cases, the rest of the world is cautious, and with most of the Indian population vaccinated, the possibility of an alarming situation is low. Today many of the developed countries are staring at a recession due to the excess money printing and loosening of liquidity during Covid times which is now getting back at them along with rising inflation. India followed fiscal prudence during the pandemic and as a result, remains one of the best-performing markets in the world this year. Many initiatives by the Govt have ensured that there will be a thriving economy over the next few years. These include the PLI schemes for different industries, and rising exports in sectors like defense, pharma, etc. To sum up, the next few years could lead the indices to new highs.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: 2W results

Related Posts

Best Multibagger Midcap Stocks in India 2026

Why is the IRFC Share Price Falling?

Striders Impex IPO Review 2026: GMP Rises 0.00%, Key Investor Insights

Fractal Industries IPO Listing at 6.02% Premium at ₹229 Per Share

PNGS Reva Diamond Jewellery IPO Day 1: Subscription at 0.04x, GMP Rises 2.33% | Live Updates