DMART CASE STUDY– Redefining Hypermarket Retail in India

Posted by : Sheen Hitaishi | Mon Apr 10 2023

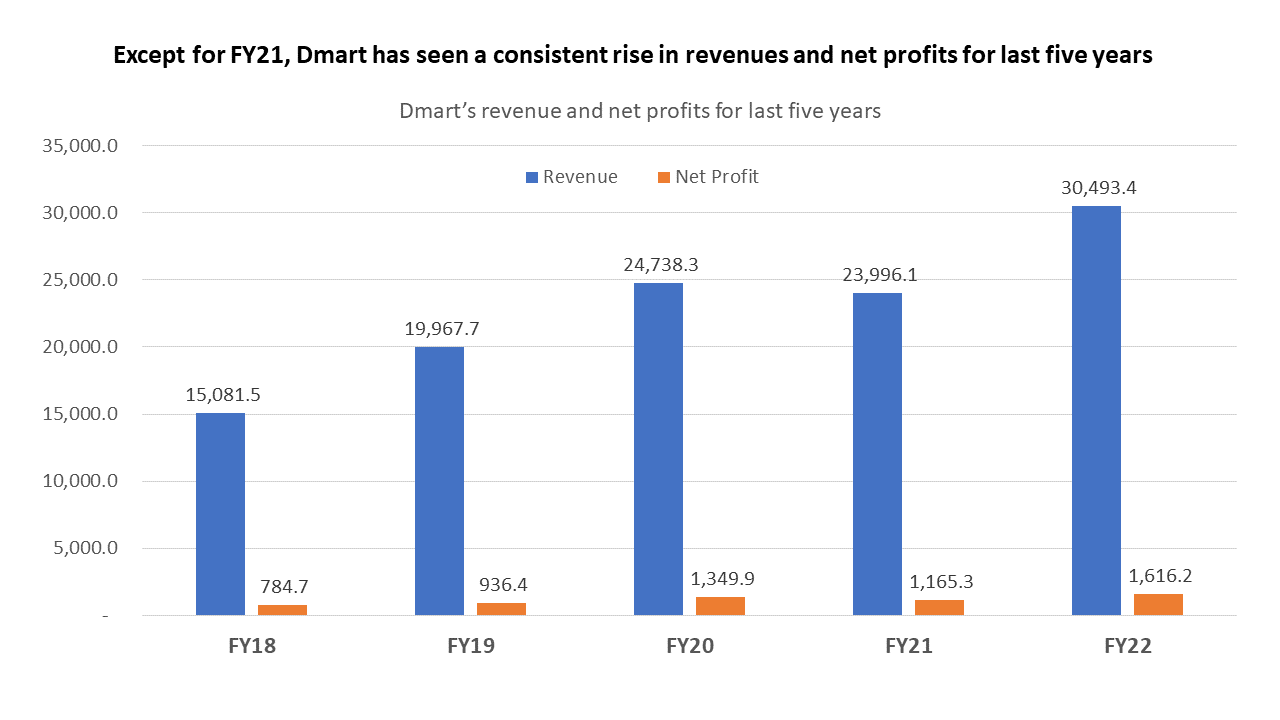

Dmart operates a chain of hypermarkets across the country. Founded in 2002 by Radhakishan Damani, it has become one of the leading retailers in India with 324 stores spread across 14 states. The company’s unique business model offers a wide range of products at affordable prices, with a mission to be the lowest-priced retailer in the regions it operates, while delivering high-quality merchandise and a superior shopping experience. Despite its low prices, Dmart made a profit of Rs. 1500 crore in the past year. One of the key factors behind its success is having a large number of stores, which enables Dmart to negotiate bulk loads at lower rates from vendors and offer products to customers at lower prices.

Table of Contents

ToggleDmart’s Q4 Update Builds Investor Confidence

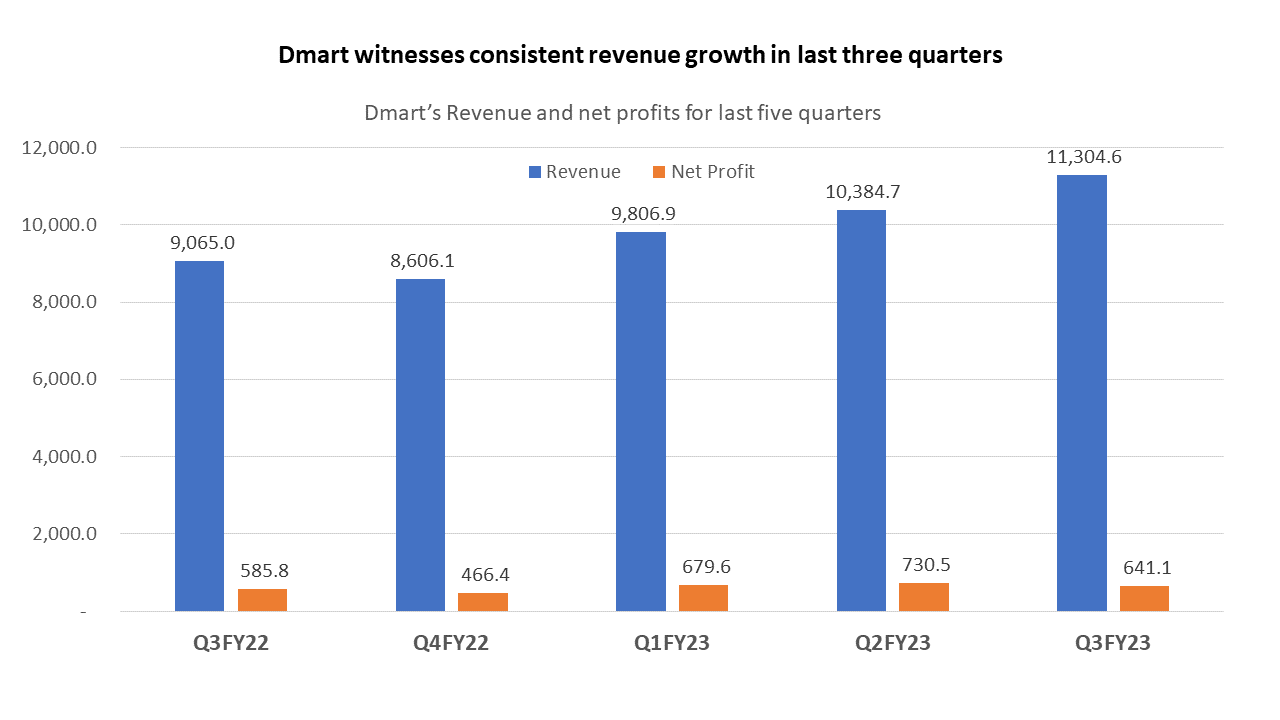

Avenue Supermarts, the company that owns and operates the popular retail chain Dmart, has reported a standalone revenue of Rs10,337 crore for the fourth quarter ending in March’ 23. This represents a substantial growth of 20% compared to the same period last year, during which the company earned Rs 8,606 crores. The company’s total store count also increased, with 18 new stores opening in the March quarter, bringing the total number of stores to 324. This growth in revenue and store count is a testament to the success of Dmart’s unique business model and its continued popularity among consumers in India.

For the third quarter, Avenue Supermarts reported a 7% YoY rise in consolidated net profit at Rs 590 crore. The operating profit, calculated as EBITDA, rose by 11% YoY to Rs 965 crore. However, the operating margin contracted sharply by 106 basis points to 8.34%.

Unique Business Model gives Dmart an edge over competition

Dmart’s low-cost, high-volume business model is based on offering a vast range of products at lower prices. By keeping its costs low and operating on a high volume of sales, Dmart is able to pass on the cost savings to its customers. This has helped the company to build a reputation for offering quality products at affordable prices.

The company’s focus on low-cost products is not limited to just groceries but extends to other product categories as well. For example, Dmart’s clothing section offers trendy and fashionable items at prices that are lower than what is usually found in other retail stores. This has helped the company to gain a loyal customer base and establish itself as a go-to destination for affordable shopping.

Overall, Dmart’s low-cost, high-volume business model has been a key factor in its success. By offering affordable products and focusing on creating a pleasant shopping experience, the company has been able to build a loyal customer base and establish itself as a major player in the Indian retail industry.

Efficient Supply Chain Management System

The supply chain management system of DMART is a critical aspect of its business operations. The company has developed a network of suppliers and distribution centres that helps it manage its inventory efficiently. The system ensures that products are delivered to stores on time and in the right quantities, which allows the company to maintain optimal inventory levels. By doing so, Dmart reduces the risk of stockouts and minimizes wastage, which ultimately translates into cost savings.

The company has also invested in technology to help streamline its supply chain operations. This includes the use of automated inventory management systems and real-time tracking of deliveries. These efforts have helped Dmart build a reputation for reliability and efficiency in its supply chain operations, which has contributed to its success as a retail chain.

Data driven insights improve customer service

DMART’s success is driven by its data-driven approach to customer service. The company collects data on customer preferences, buying habits, and feedback to inform decisions on what products to stock, how to price them, and how to market them. Its loyalty program allows customers to earn points on purchases, providing valuable data on buying habits. Dmart also collects feedback through surveys to enhance the customer experience. By using data to inform decision-making, Dmart has built a loyal customer base that values the quality and affordability of its offerings. All these initiatives have led to Dmart’s excellence in customer service.

In conclusion, Dmart’s success can be attributed to its relentless focus on delivering value to customers through its unique business model, effective supply chain management, and customer-centric approach. By offering a vast range of products at lower prices and providing a seamless shopping experience, Dmart has built a loyal customer base and established itself as a prominent player in the Indian retail market. With its consistent growth and expansion, Dmart is poised to continue its upward trajectory and set new benchmarks for the industry.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Q4 Results Expectations