Upcoming IPOs in India 2024

Posted by : Ketan Sonalkar | Thu Jun 05 2025

Upcoming IPOs in India

The Indian IPO market in 2024 gleams like a treasure chest overflowing with possibilities. With over 65 companies including upcoming IPOs in India lining up for their grand debut, a potent mix of established players and innovative ventures paints a vibrant picture for investors. This comprehensive guide is your passport to navigate this dynamic terrain, equipping you with the knowledge and tools to unlock the potential gems that can enrich your portfolio.

Overview:

Imagine witnessing the limitless opportunity for a company, the moment it enters the grand ballroom of the stock market, a vast and dynamic stage, offers the chance for companies including Upcoming IPOs in India, to showcase their potential, attract investments, and join the rhythm of economic expansion. It’s a captivating spectacle, where each move made on this financial dance floor holds the promise of prosperity and success. That’s the essence of an IPO – a pivotal event where a private company raises capital from the public by selling its shares on the exchange. For investors, it’s a captivating opportunity to be among the first to jump onto the bandwagon, potentially reaping significant returns if the company’s journey becomes a success story.

What are Upcoming IPOs?

These initial offerings unlock a diverse tapestry of sectors, each holding the promise of groundbreaking ventures and established leaders.

From the digital wave spearheaded by Swiggy and FirstCry to the electric revolution championed by Ola Electric, the year promises plenty of excitement.

But the landscape extends beyond these familiar names:

- Healthcare Heroes: Portea Medical strides into the future of home healthcare, offering comfort and convenience not only to patients but also potential returns for investors. In a similar vein, Max Healthcare, a prominent player in the healthcare sector, stands out for its commitment to delivering top-notch medical services, providing holistic care and creating a positive impact on the well-being of individuals.

- Renewable Reimagined: Australian Premium Solar shines bright, inviting participation in building a sustainable future powered by sunlight. Australian Premium Solar shines bright, inviting participation in building a sustainable future powered by sunlight. Similarly, Indian renewable energy, characterized by solar, wind, and other eco-friendly sources, aims to meet energy needs while minimizing environmental impact.

- Fintech Fortunes: Paytm Payments Bank and Pine Labs join the fray, aiming to revolutionize digital transactions and financial inclusion, potentially enriching both users and investors.

- Gaming Gigabytes: Nazara Technologies enters the arena of esports, a burgeoning sector poised to capitalize on the ever-growing gamer population.

- Retail Renaissance: Don’t underestimate the power of brick-and-mortar. Maxposure Limited, a leading luxury real estate developer, could offer a unique investment angle.

List of Upcoming IPOs in India 2024:

This list offers a glimpse into the diverse landscape, but remember, new gems emerge constantly:

- Technology: Swiggy, FirstCry, Oyo, Myntra, Nykaa

- Electric Vehicles: Ola Electric, Ather Energy, BluSmart Mobility

- Healthcare: Portea Medical, Aster DM Healthcare, Mankind Pharma

- Renewables: Australian Premium Solar, Sterling and Wilson Renewable Energy

- Financial Services: Paytm Payments Bank, Pine Labs, ICICI Securities

- Gaming: Nazara Technologies

- Retail: Maxposure Limited, Shoppers Stop

- Others: Chennai Super Kings Cricket Ltd, Byju’s

Read: IPO Review: Honasa Consumer

What to Check Before Investing in an IPO?

Remember, while IPOs hold alluring potential, they also come with inherent risks. Before stepping into this realm, be a mindful investor and perform your due diligence:

- Financial Forensics: Don’t be fooled by shiny facades. Scrutinize the company’s financials – its business model, revenue streams, profitability, and debt levels. This is your X-ray, revealing the company’s inner workings.

- Management Matters: The captain steers the ship. Assess the management team’s experience, track record, and vision for the company’s future.

Are they seasoned navigators or first-time sailors?

- Valuation Voyage: Don’t pay an exorbitant price for a treasure chest filled with pebbles. Compare the IPO price with similar companies in the sector.

Is it a fair deal or an overpriced adventure?

- Market Monsoons: Remember, the stock market is like the weather – ever-changing. Factor in the overall market sentiment and potential economic headwinds. Invest in sunshine, not in impending storms.

Where can I get comprehensive information about an upcoming IPO?

All details about the company can be obtained from the DRHP that needs to be mandatorily filed by the company that wants to do an IPO with the regulator. A Draft Red Herring Prospectus (DRHP) is a document that is prepared to introduce a new business or product to a potential investor. Now, turning our attention to the Epack Durable IPO, the critical question arises: Should Investors Bid or Skip?

Whether to bid or skip in an IPO depends on your investment goals, risk tolerance, and the company’s prospects. Evaluate the company’s financial health, growth potential, and industry trends. Consider consulting with a financial advisor for personalized advice. Always conduct thorough research before making any investment decisions.

The DRHP provides detailed information about the company, its financials, operations, management, and the proposed offering. It serves as a disclosure document for potential investors, allowing them to evaluate the company and make informed investment decisions. The term “Draft” indicates that certain details in the document may be subject to change or omission before the final prospectus is issued.

Important Sections to Read in a DRHP

Being an important document that a company needs to file while releasing its IPO, the DRHP contains several details regarding the company. As an investor, it is necessary to read the prospectus. Some of the important sections in a DRHP that you cannot miss are as follows.

About the company:

This section provides an overview of the company’s business model, operations, industry analysis, competitive landscape, and growth prospects. It helps in understanding the company’s core activities, market position, and future plans.

- IPO Objective

This section explains how the company plans to utilise the funds raised through the offering. It should provide a clear breakdown of how the company plans to allocate the funds and the expected impact on its business.

- Financial details

The financial statements, including the balance sheet, income statement, and cash flow statement, provide insights into the company’s financial performance, profitability, liquidity, and solvency. It is important to assess the financial health and stability of the company in a DRHP.

- Risk factors

The risk factors section in a DRHP outlines the potential risks and uncertainties associated with investing in the company. It provides insights into the market risks, legal or regulatory risks, challenges, and any other factors that may affect the company’s business prospects.

Let us look at the record of IPOs from last year

The year 2023 saw a total of 57 IPOs offered by companies in a range of sectors from, finance to pharma to cables to condoms. The number of IPOs for 2023 is the second highest in the past decade, second only to 2021, which notched 63 IPOs.

Among mainboard IPOs listed on BSE and NSE in 2023, only three out of 48 listed public issues are currently trading below their respective issue prices. Those three mainboard IPOs are Yatra Online, IRM Energy and Radiant Cash Management Services.

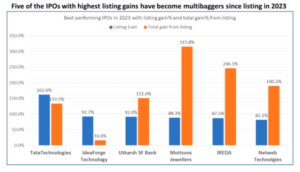

Among the IPOs that delivered highest returns, shares of Tata Technologies, IdeaForge and Utkarsh Small Finance Bank more than doubled or nearly doubled on the listing day itself.

What is the Process of Investing in an IPO Online?

The good news is, you don’t need a dusty map and a manual compass to invest in IPOs anymore. Most major brokerage platforms like Zerodha and Angel One offer convenient online participation facilities, including upcoming IPOs in India.

Here’s your digital treasure hunt guide:

- Demat Digits: Ensure you have a Demat account linked to your trading account. It’s your virtual treasure chest, ready to hold your IPO shares And for those interested in potential new investments, Upcoming IPOs in India are opportunities from companies about to release their stocks to the public

- Bid Brilliance: Choose your IPO, specify the number of shares you desire, and set your price – your bid to become a shareholder. Remember, a well-placed bid is key to striking gold. For those seeking fresh opportunities, Upcoming IPOs in India are new companies preparing to enter the stock market.

- Fund Fortification: Allocate sufficient funds in your trading account to cover your bid amount. Don’t get caught empty-handed when opportunity knocks.

- Allocation Alchemy: If your bid is accepted, the shares will be magically deposited into your Demat account on the settlement date. Your treasure hunt comes to fruition!

You may also look like: Investing in Logistics Stocks in India

Related Posts

Lemon Tree Hotels Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Tata Steel Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Aye Finance IPO Review 2026: GMP Rises 0.28%, Key Investor Insights

MRF Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here

Whirlpool of India Gears Up for Q3 Reveal on 6th February; Check Key Expectations Here