Weekly Update

Posted by : Sheen Hitaishi | Sat Feb 17 2024

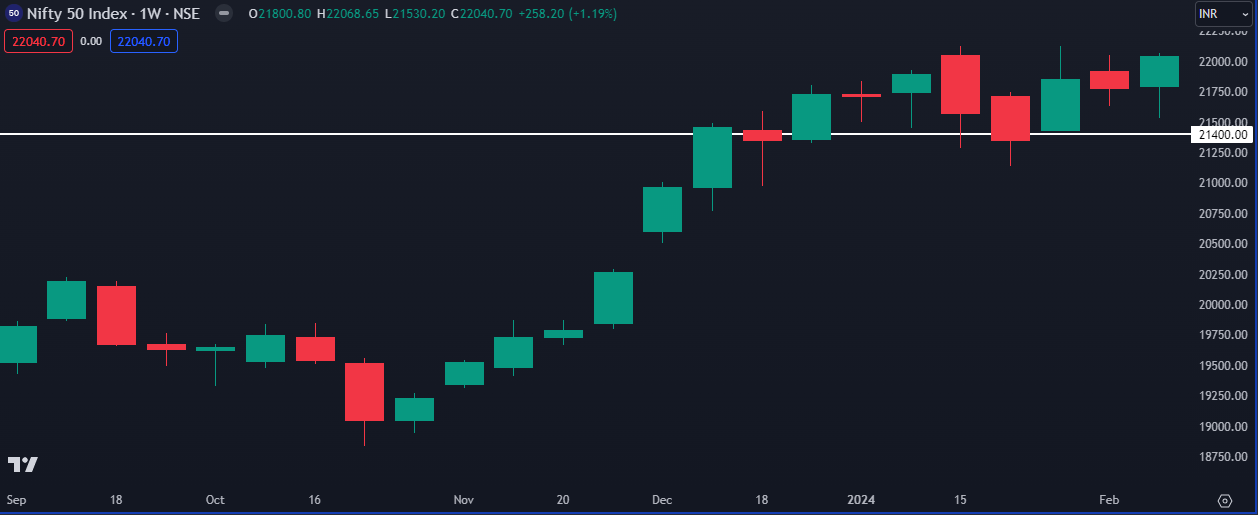

NIFTY

The Nifty started the week slowly but bounced back midweek, closing strongly above the 22,000 mark. Even during recent dips, the index stayed above its 10-week moving average (EMA), which suggests a generally positive trend.

Looking ahead, options data suggests the indices could continue to climb next week. Notably, the Nifty closed above 22,000 and is expected to gain further momentum beyond 22,130. The next hurdle is seen at 22,500, with potential support at 21,400.

Both the Midcap and Smallcap indices also rebounded from near their 10-week moving averages on the weekly chart after some initial profit-taking, showing a strong recovery in the last four trading days. This overall market movement suggests positive sentiment and the potential for continued upward momentum.

Nifty50 Weekly Chart

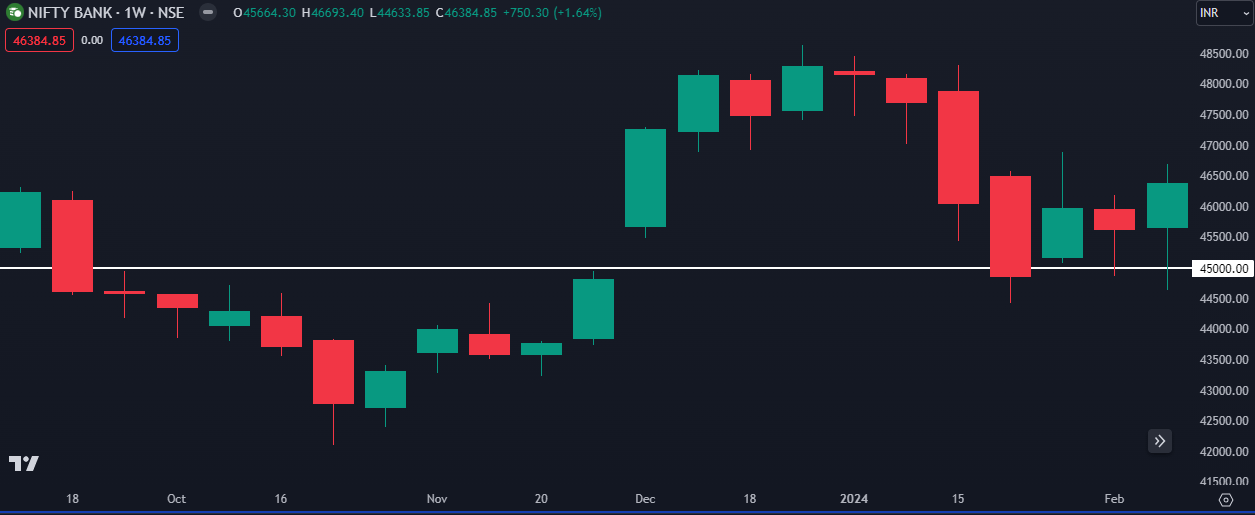

BANK NIFTY:

Following an initial profit booking on the first day, the index bounced back from its lows and sustained a rally, ultimately closing above both the 10 and 20 EMA on the weekly chart.

Looking ahead, the immediate resistance is at 47,000, with the next major hurdle at 48,000. Support is at 45,000. These support and resistance levels are key indicators for market participants, influencing their decisions and potentially impacting market dynamics in the near term. Investors and traders are advised to closely monitor developments around these resistance points as they navigate the evolving market landscape.

This revised version is shorter, clearer, and uses simpler language while still conveying the same information. It also avoids potential repetition by replacing “subsequent significant hurdle” with “next major hurdle.

Bank Nifty Weekly Chart

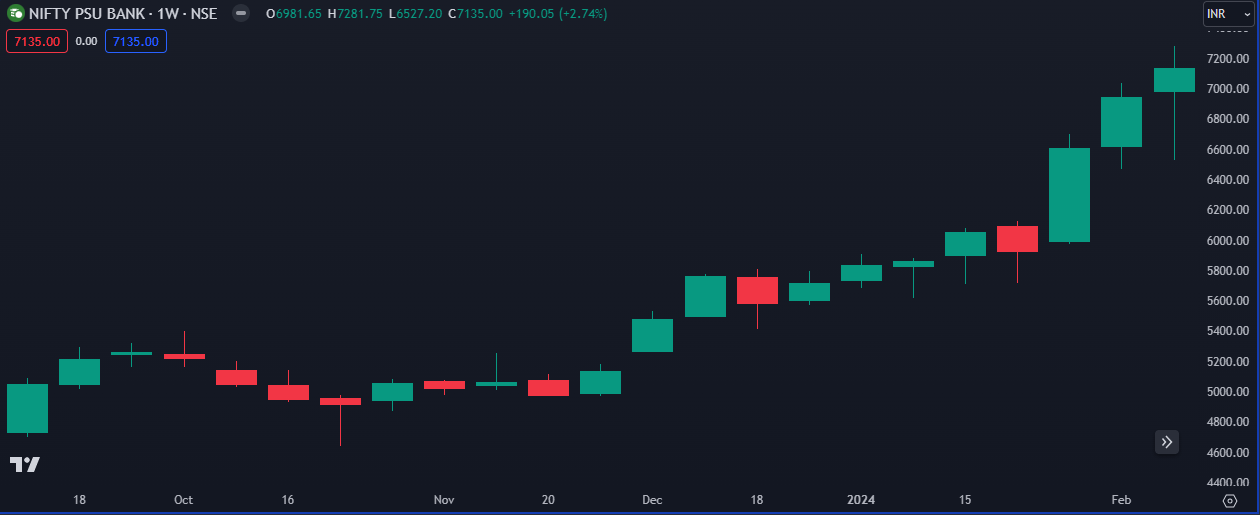

Top Performing Sector of the Week

Nifty PSU Bank (3.7% Up)

– Bank of Baroda (8.9%)

– State Bank of India (7.9%)

– Punjab National Bank (4.7%)

Nifty PSU Bank Weekly chart

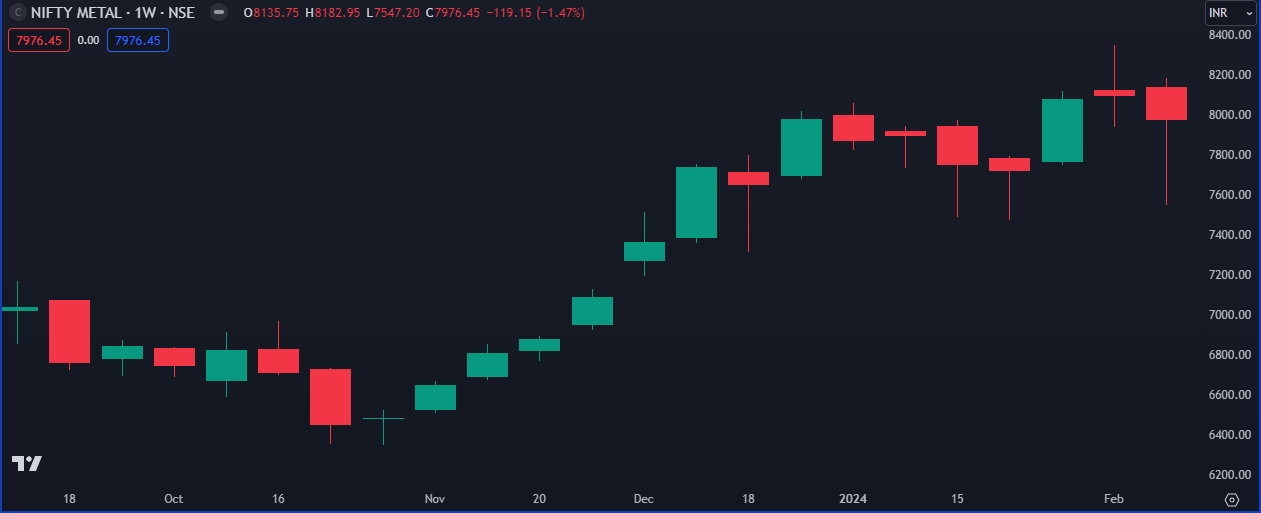

Worst Performing Sector of the Week

Nifty Metal (-3%)

- Hindalco (-14.2%)

- Hindustan Copper (-10.8%)

- Ratnamani Metals & Tubes (-10.2%)

Nifty Metal Weekly chart

Key News

- Paytm QR, Soundbox, Card machine will continue to work as always even beyond March 15, confirms RBI. The company has shifted its nodal account to Axis Bank (by opening an Escrow Account) to continue seamless merchant settlements as before.

- Fineotex Chemical has acquired an additional factory land premises of 7 acres at Additional Ambernath, MIDC, Thane, Maharashtra for a total investment of Rs 35 crores.

- Karur Vysya Bank: CRISIL has reaffirmed the rating of Certificate of Deposits Programme (Rs 3000 crore) at CRISIL A1+.

- CCL Products: India Ratings has revised the Company’s outlook to Negative from Stable while affirming its Long-Term Issuer Rating at ‘IND AA-’.

Related Posts