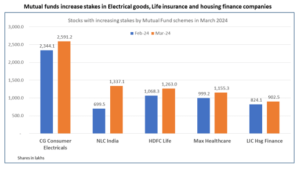

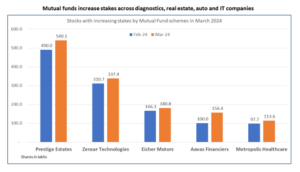

Stocks bought by Mutual Funds in March 2024

Posted by : Ketan Sonalkar | Fri Apr 19 2024

Stocks Bought by Mutual Funds

March saw the Nifty rise 1.57% touching all-time highs of 22500 towards the end of the month. This was the fifth consecutive month that saw the Nifty 50 index close higher than the previous month. Even at these elevated levels, mutual fund managers found opportunities in select sectors and stocks and added them to respective schemes. Sectors in favor were housing finance, auto, diagnostics, and healthcare to name a few.

Listed below are some other stocks from the Nifty 500 universe which saw increasing share in equity mutual fund schemes in January. Stocks with maximum buying in index funds and arbitrage funds have been excluded. Schemes listed have bought more than one lakh shares of the respective stocks during the last month.

1. CG Consumer Electricals

Crompton Greaves Consumer Electricals is amongst India’s leading consumer electrical companies present in the Electrical Consumer Durables (ECD) and Lighting segments. It manufactures and distributes a diverse range of consumer products ranging from fans, lamps, and luminaries to pumps and household appliances such as water heaters, mixer grinders, toasters, irons, and electric lanterns in the ECD segment and a complete range of lighting products. It is a market leader in fans, domestic pumps, and street lighting segments.

Funds that increased holdings in CG Consumer Electricals:

- HDFC Focused 30 Fund Growth

- Mirae Asset ELSS Tax Saver Fund -Regular Plan-Growth

- HDFC Flexi Cap Fund Growth

- Franklin India Opportunities Fund Growth

2. NLC India

NLC India, formerly Neyveli Lignite Corporation Limited (NLC) is a state-owned enterprise. The company is engaged in fossil fuel mining and thermal power generation using lignite as well as Renewable Energy Sources. It has 3 lignite mines with a total capacity of 30.10 million TPA at Neyveli, Tamil Nadu, and 1 open cast lignite mine of capacity 2.1 million TPA at Barsingsar, in Rajasthan.

Funds that increased holdings in NLC India:

- Quant Small Cap Fund Growth

- Nippon India Small Cap Fund – Growth

- Kotak Multicap Fund Regular Growth

- Aditya Birla Sun Life Frontline Equity Fund Growth

3. HDFC Life

HDFC Life is a life insurance company and a group company of HDFC Bank. The Company offers a range of individual and group insurance solutions including participating, non-participating, and unit-linked lines of businesses. The portfolio comprises various insurance and investment products such as Protection, Pension, Savings, Investment, Annuity, and Health.

Funds that increased holdings in HDFC Life:

- ICICI Prudential Value Discovery Fund Growth

- ICICI Prudential Banking and Financial Services Fund Growth

- PGIM India Flexi Cap Fund Regular Growth

- Nippon India Large Cap Fund – Growth

4. Max Healthcare

Max Healthcare is a leading hospital chain in India with a major concentration in North India consisting of a network of 13 network healthcare facilities, which includes BLK Hospital and BNH Hospital. Max Healthcare Institute plans to invest over Rs 5,000 crore to double its bed capacity to over 8,000 beds in the next four to five years, according to its Chairman and MD Abhay Soi. Half of the investment is expected to be made in Uttar Pradesh.

Funds that increased holdings in Max Healthcare:

- SBI Equity Hybrid Fund Regular Payout Inc Dist cum Cap Wdrl

- Motilal Oswal Midcap Regular Growth

- Franklin India Bluechip Fund Growth

- Axis ELSS Tax Saver Fund Growth

5. LIC Housing Finance

LIC Housing Finance is one of the largest housing finance companies in India with the objective of providing long-term finance to individuals for the purchase or construction of houses/flats for residential purposes in India.It is expecting a net profit of ₹5,000 crore in FY24 on the back of robust loan demand and expansion in non-core business. In the last quarter, the affordable housing segment remained strong in tier-2 and tier-3 markets, and this forms the company’s major customer base.

Funds that increased holdings in LIC Housing Finance:

- Kotak Emerging Equity Scheme Growth

- Mirae Asset ELSS Tax Saver Fund -Regular Plan-Growth

- Canara Robeco Emerging Equities Growth

- Bandhan Financial Services Fund Regular Growth

6. Prestige Estate

Prestige Estates Projects is one of the leading real estate development companies with projects in the residential, office, retail, and hospitality segments. Its operations are spread across South India, Pune, Goa and Ahmedabad. It has entered into a deal with Abu Dhabi Investment Authority and Kotak AIF to invest ₹2,001 crore in residential projects with a gross revenue potential of ₹18,000 crore across four major cities in the country.

Funds that increased holdings in Prestige Estates:

- Mirae Asset Large & Midcap Fund Growth

- Motilal Oswal Flexicap Fund Regular Plan-Growth

- HDFC Multi Cap Fund Regular Growth

- Mirae Asset Midcap Fund Regular Growth

7. Zensar Technologies

Zensar Technologies is a midcap IT services company, with industry expertise across Manufacturing, Retail, Media, Banking, Insurance, Healthcare, and Utilities.In the last quarter, the management reiterated its aspiration to keep the margin guidance band of 14-16%. Anything over and above this would be re-invested to drive future growth. The company was working around a few large deals, which had an impact on margins in Q3FY24.

Funds that increased holdings in Zensar Technologies:

- HDFC Small Cap Fund Growth

- HSBC Multi Asset Allocation Fund Regular Growth

- Franklin India Opportunities Fund Growth

- HSBC Value Growth

8. Eicher Motors

Eicher Motors is an Indian, multinational automotive company that has diversified interests in manufacturing motorcycles and commercial vehicles. It manufactures the iconic ‘Royal Enfield’ brand of motorcycles, which leads the premium motorcycle segment in India. It has a joint venture with Sweden’s AB Volvo – VE Commercial Vehicles (VECV) for the manufacture of commercial vehicles.In March, it incorporated a wholly-owned subsidiary in the Netherlands to enhance the availability of various articles like spares, apparel, and motorcycle accessories in Europe.

Funds that increased holdings in Eicher Motors:

- Mirae Asset Large & Midcap Fund Growth

- HSBC Midcap Fund Growth

- Mirae Asset ELSS Tax Saver Fund -Regular Plan-Growth

- ICICI Prudential Multi-Asset Fund Growth

9. Aavas Financiers

Aavas Financiers is registered as a Housing Finance Company, engaged in long-term financing activity in the domestic markets to provide housing finance. It chose to serve the growing needs of housing finance customers in the low and middle-income group of sub-urban and rural India, to serve the customers in the metro cities and urban regions of the country.

Funds that increased holdings in Aavas Financiers:

- SBI Small Cap Fund Regular Plan-Growth

- SBI Flexicap Fund Regular Growth

- Kotak Multicap Fund Regular Growth

- HDFC Capital Builder Value Fund Growth

10. Metropolis Healthcare

Metropolis Healthcare is one of the leading diagnostics companies in India. It has a widespread presence across 220 cities in India with leadership positions in West and South India. The company has grown in scale due to the numerous acquisitions done during the last two decades. In March 2024 the company experienced a 10% annual increase in overall revenue, with significant year-on-year growth in revenue for its core business, maintaining a consistent rise in sales volumes across various segments. The company repaid its debt in Q4, resulting in a debt-free status as of March 31, 2024.

Funds that increased holdings in Metropolis Healthcare:

- HDFC Flexi Cap Fund Growth

- HDFC ELSS TaxSaver Growth

- HDFC Focused 30 Fund Growth

- Franklin India Opportunities Fund Growth

Disclaimer: This is for general information and education purposes only. The Securities quoted (if any) are for illustration only and are not recommendatory. Past performance does not guarantee any future returns. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. For more details/disclosures, visit at www.univest.in/univest mobile application.

Related Posts