Best Chemical Stocks in India

Posted by : Ketan Sonalkar | Sat Dec 23 2023

- Best Chemical Stocks in India

- What are Chemical Stocks?

- Top chemical stocks in India:

- Navigating the Investment Maze:

- Reaping the Rewards of Chemical Stocks

- Challenges faced by the industry

- FAQs: Your Chemical Stock Conundrums Solved

- Why are some of the chemical stocks rising in India?

- Which is the best chemical stock in India?

- Why are chemical stocks significant?

- How do I invest in chemical stocks?

Best Chemical Stocks in India

India’s chemical industry, once a slumbering giant, is now awakening with the roar of progress. Fuelled by surging domestic demand, strategic government initiatives, and a favourable geographical position, the Indian chemical sector paints a vibrant canvas for investors seeking lucrative opportunities. This article delves into the world of Indian chemical stocks, equipping you with the knowledge and insights to navigate this dynamic market with confidence, including a focus on the Best Chemical Stocks in India.

What are Chemical Stocks?

Chemical stocks represent companies engaged in the manufacture, distribution, and sale of diverse chemicals. These companies cater to various industries, including pharmaceuticals, textiles, agriculture, and personal care products. By investing in chemical stocks, you gain exposure to this critical sector, with the potential for long-term capital appreciation and dividend income.

Riding the Wave of Growth:

The future of the Indian chemical industry shines bright, illuminated by several key factors:

- Domestic Demand Surge: India’s burgeoning middle class, with its rising disposable income, is driving an insatiable demand for chemicals across various sectors. This demand is projected to rise further, offering fertile ground for chemical companies to flourish. Investors looking to capitalize on this opportunity may consider exploring the best Chemical Stocks in India for potential investment.

- Government Backing: The Indian government has rolled out a red carpet for the chemical industry, implementing supportive policies like dedicated chemical parks, tax incentives, and infrastructure development. These efforts aim to unlock the sector’s immense potential and propel its growth.

- Strategic Advantage: India’s proximity to the Middle East, a treasure trove of petrochemical feedstock, grants it a significant geographical edge. This proximity translates to cost-effective sourcing, giving Indian chemical companies a competitive advantage in the global market.

- Innovation Engine: Indian chemical companies are increasingly investing in research and development, churning out innovative and high-value chemicals. This focus on innovation opens doors to new markets and fosters sustainable growth for the industry.

Top chemical stocks in India:

To explore the depths of this promising market, let’s meet some of the top chemical companies in India:

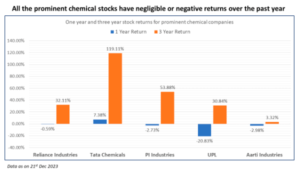

- Reliance Industries Ltd (RIL): This petrochemicals behemoth boasts a diversified portfolio that spans petrochemicals, refineries, and oil and gas exploration. Its sheer size and financial muscle make it a titan in the Indian chemical landscape.

- Tata Chemicals Ltd: A well-established player with a legacy of excellence, Tata Chemicals offers a diverse range of products catering to food, textiles, agriculture, and industrial applications. It’s global presence and strong brand reputation make it a reliable investment choice.

- UPL Ltd: An agrochemical giant with a global footprint, UPL Ltd serves over 130 countries with its crop protection products, seeds, and post-harvest solutions. Its aggressive expansion plans and commitment to sustainability make it a compelling bet for long-term investors.

- PI Industries Ltd: A leader in the agrochemicals and specialty chemicals space, PI Industries is renowned for its innovative solutions and global reach. Its consistent financial performance and commitment to research and development make it a stable investment option.

- Aarti Industries Ltd: A prominent manufacturer of specialty chemicals and pharmaceutical intermediates, Aarti Industries serves clients in over 60 countries. Its focus on high-value chemicals and strong financials make it an attractive investment prospect.

These are just a few examples, and the Indian chemical landscape boasts a plethora of other noteworthy companies. It’s crucial to conduct thorough research and evaluate various options before making investment decisions.

Navigating the Investment Maze:

Before venturing into the Indian chemical stock market, consider these vital factors:

- Industry Trends: Stay ahead of the curve by staying informed about global and national trends impacting the chemical industry. Factors like new regulations, shifting consumer preferences, and technological advancements can influence the performance of chemical companies.

Reaping the Rewards of Chemical Stocks

Investing in Indian chemical stocks offers several potential benefits:

- High Growth Potential: The Indian chemical industry is projected to grow at a healthy rate of over 10% in the coming years, translating to potential capital appreciation for investors who make astute choices.

- Income Potential: Many chemical companies offer regular dividends, providing investors with a steady stream of income to supplement their capital gains.

The Booming Indian Chemical Landscape: A Guide for Savvy Investors (Continued)

- Portfolio Diversification: Chemical stocks belong to a different sector than traditional asset classes like real estate or equities, adding diversification and potentially reducing overall portfolio risk. This diversification reduces vulnerability to market fluctuations in other sectors, protecting your investments.

- Exposure to Key Industries: By investing in chemical stocks, you gain indirect exposure to various growth sectors like agriculture, pharmaceuticals, and textiles, benefiting from their upward trajectories. This diversified exposure opens doors to broader economic growth across multiple industries.

- Investing beyond Borders: Many Indian chemical companies have a global presence, exporting their products across international markets. By investing in these companies, you gain exposure to the international chemical market, diversifying your portfolio geographically and potentially mitigating risks specific to the Indian market.

Challenges faced by the industry

The chemical industry is facing a tough challenge due to cheaper raw material supply from China. According to sources, some finished products are being supplied at par with raw material prices by China while many have very little price difference.

Despite challenges in the global chemical market, Indian chemical companies are expecting to see signs of recovery in margins from H2 FY24. This recovery, the company officials say, is driven by increased interest from global companies in sourcing from India, a rising share of specialty chemicals, and robust capital expenditures by Indian chemical firms. Investors looking to capitalize on potential opportunities in this sector may consider exploring the Best Chemical Stocks in India for strategic investment decisions.

The chemical industry, the report said, is finding ways through volatile commodity prices attributed to heightened competition, geopolitical tensions, supply cuts by the Organization of the Petroleum Exporting Countries (OPEC) affecting crude oil supplies, and uncertainties in demand.

FAQs: Your Chemical Stock Conundrums Solved

Now, let’s address some frequently asked questions to dispel any lingering doubts and pave the way for confident investment decisions:

Why are some of the chemical stocks falling in India?

Several factors can contribute to the decline of chemical stocks in India, including:

- Global economic slowdown: A slowdown in global economic growth can dampen demand for chemicals, impacting Indian companies’ export potential and profitability.

- Fluctuations in raw material prices: Volatile crude oil and other raw material prices can squeeze margins for chemical companies, leading to stock price declines.

- Changes in government policies: Regulatory changes or policy uncertainties can affect investor sentiment and lead to short-term stock price corrections.

- Company-specific issues: Internal factors like operational challenges, management concerns, or financial performance issues can also trigger stock price drops for individual companies.

Why are some of the chemical stocks rising in India?

Positive trends can also lead to an upsurge in chemical stock prices, such as:

- Strong domestic demand: Increasing demand for chemicals from various sectors within India can boost company revenues and profitability, driving stock prices upward.

- Favorable government initiatives: Government support through tax breaks, infrastructure development, or policy reforms can positively impact the industry and benefit chemical companies.

- New product launches: Successful introductions of innovative or high-value chemicals can create excitement in the market and drive up stock prices for the respective companies.

- Positive financial performance: Strong earnings reports, dividend announcements, or debt reduction can instill investor confidence and lead to stock price appreciation.

Which is the best chemical stock in India?

Identifying the best chemical stocks depends on several factors and individual investment goals. However, some consistently well-performing companies with long-term growth potential include Reliance Industries Ltd, Tata Chemicals Ltd, UPL Ltd, PI Industries Ltd, and Aarti Industries Ltd. Thorough research, considering financial stability, industry trends, and risk tolerance, is crucial before making investment decisions, especially when exploring the Best Chemical Stocks in India.

Why are chemical stocks significant?

Chemical stocks play a crucial role in the Indian economy:

- Supporting Diverse Industries: They provide vital raw materials and inputs for various downstream industries, driving their growth and innovation.

- Employment Generation: The chemical industry employs millions of people, directly and indirectly, contributing to economic development and job creation.

- Export Potential: Indian chemical companies have the potential to become major exporters in the global market, boosting foreign exchange earnings and national competitiveness.

- Technological Advancements: The industry fosters research and development in new technologies and material science, contributing to overall technological progress.

How do I invest in chemical stocks?

Several options exist for investing in chemical stocks in India, including:

- Direct Stock Purchase: Open a Demat account with a broker and purchase shares of individual companies in the chemical stock market.

- Mutual Funds: Invest in mutual funds with a focus on the chemical sector, benefiting from professional portfolio management and diversification. Explore stocks bought by Mutual Funds within this sector to gain insights into the investment strategies adopted by seasoned fund managers.

Read More: Stocks bought by Mutual Funds

- Exchange Traded Funds (ETFs): Track an index of chemical stocks in India through ETFs, gaining exposure to the entire sector’s performance.

Remember, thorough research, careful analysis, and a solid investment strategy are key to navigating the dynamic world of Indian chemical stocks and making informed decisions that align with your financial goals. This article provides a comprehensive overview of the Indian chemical stock market, highlighting its potential, key companies, and important factors to consider. Always conduct your own research, consult with financial advisors, and invest responsibly to benefit from the exciting opportunities this sector offers, including the exploration of top Chemical Stocks in India.

With its robust growth prospects, government support, and diversified potential, the Indian chemical landscape presents a fertile ground for investors seeking rewarding opportunities. By delving deeper into this dynamic sector and making informed decisions, you can capitalize on its exciting journey and reap the rewards of its chemical alchemy, including exploration of the Best Chemical Stocks in India for strategic investment considerations Explore the niche market of Specialty Chemicals: Is the growth story over or a revival on the horizon, as part of your strategic investment considerations.

Disclaimer: This is for general information and education purposes only. The Securities quoted (if any) are for illustration only and are not recommendatory. Past performance does not guarantee any future returns. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. For more details/disclosures, visit univest/univest mobile application.

Related Posts