Stocks bought by Mutual Funds in October 2023

Posted by : Sheen Hitaishi | Mon Nov 20 2023

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overflow=”visible” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” column_position=”default” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” animation_type=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text css=”.vc_custom_1700460207834{margin-right: 16px !important;margin-left: 16px !important;border-right-width: 10px !important;border-left-width: 10px !important;}”]In October, the Nifty50 index witnessed a sharp fall in the latter half of the month, resulting in a nearly 3% decline by month-end. Many stocks experienced a significant drop, sparking fears of a downtrend as the index traded below key levels. Fund managers across various mutual fund schemes capitalized on lower valuations during this correction, actively purchasing stocks. Buying interest surged notably in sectors such as banking and finance, IT, auto, and pharmaceutical companies.

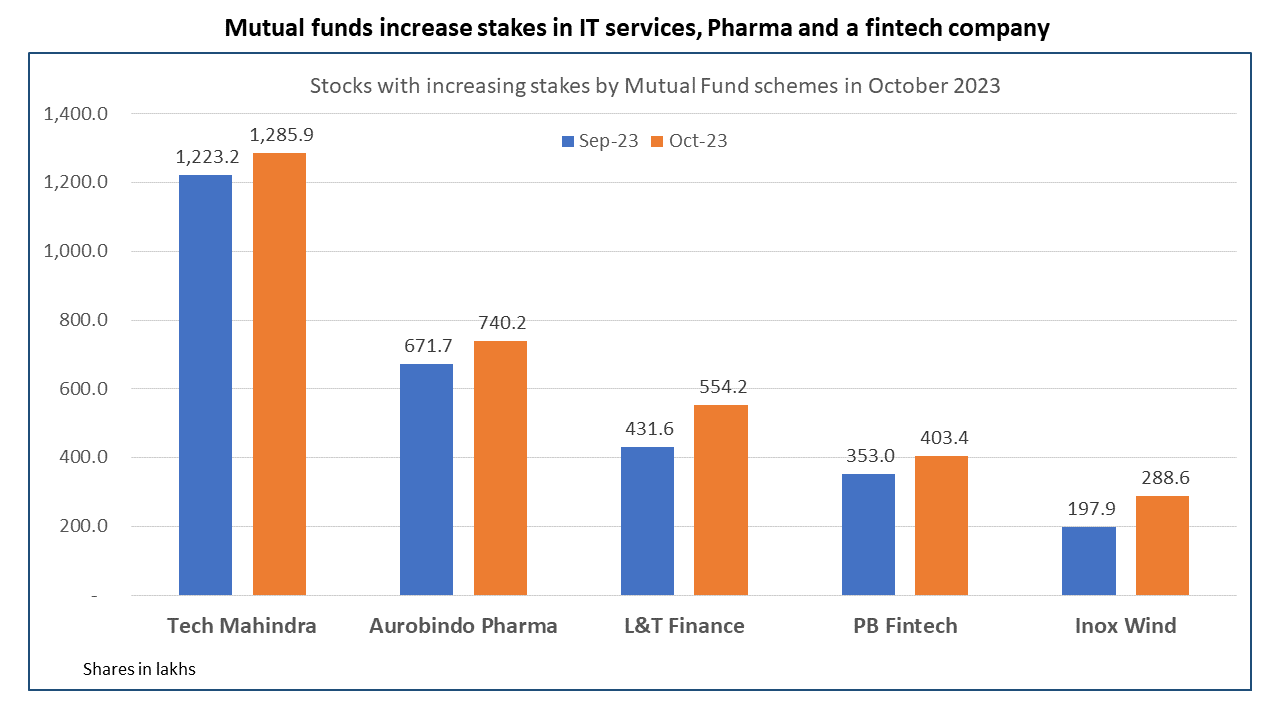

Below are a few stocks from the Nifty 500 universe that observed increased shares in mutual fund schemes. Stocks with the highest buying in index funds have been excluded.

Tech Mahindra

Tech Mahindra is a leading provider of consulting-led integrated portfolio services to customers such as Telecom Equipment Manufacturers, Telecom Service Providers, and IT Infrastructure Service Providers, among others. The company is currently undergoing substantial organizational restructuring. Management expresses optimism that this new structure will enhance efficiency and elevate the customer experience, especially considering the opportunities arising in the communications vertical with the broader rollout of 5G.

Funds that increased holdings in Tech Mahindra:

- ICICI Prudential Multi-Asset Fund Growth

- Kotak Emerging Equity Scheme Growth

- Invesco India Arbitrage Fund Growth

- Kotak Equity Arbitrage Fund Growth

Aurobindo Pharma

Aurobindo Pharma is a leading pharmaceutical company with vertically integrated business units engaged in formulations, custom synthesis, peptides, R&D, and APIs. The company has experienced strong growth momentum in its US and European businesses, driven by robust demand, a diverse product portfolio, new product launches, market share gains, and improved operating leverage. Notably, the stock, which saw a sharp decline from May 2021, has more than doubled from its lows in Jan 2023.

Funds that increased holdings in Aurobindo Pharma:

- HDFC Mid-Cap Opportunities Fund Growth

- ICICI Prudential Value Discovery Fund Growth

- Invesco India Arbitrage Fund Growth

- SBI Arbitrage Opportunities Fund Regular Growth

L&T Finance

L&T Finance Holdings offers financial products and services in the corporate, infrastructure, and retail sectors, including fund products and investment services. The company’s twin strategy of expanding its retail book and significantly reducing the wholesale book while maintaining a healthy asset quality has enabled it to achieve its Lakshya 2026 retail mix goal of over 80.0%, three years ahead of schedule.

Funds that increased holdings in L&T Finance:

- SBI Arbitrage Opportunities Fund Regular Growth

- Axis Arbitrage Regular Growth

- Nippon India Arbitrage Fund Growth

- Franklin India Prima Fund Growth

PB Fintech

PB Fintech is India’s largest online platform for Insurance and Lending products, operating through Policybazaar and Paisabazaar platforms, catering to the large and highly underpenetrated online insurance and lending markets. In Q2 FY24, renewal and trail commissions surged by 48.3% from Rs 294 crore to Rs 436 crore on a YoY basis. It boasts an operating margin of around 85%. PaisaBazaar’s collaboration on co-created products with lending partners is yielding results, contributing 14% to credit business revenue.

Funds that increased holdings in PB Fintech:

- Mirae Asset Emerging Bluechip Fund Growth

- Mirae Asset Tax Saver Fund -Regular Plan-Growth

- Franklin India Focused Equity Fund Growth

- Tata Digital India Fund Regular Growth

Inox Wind

Inox Wind is a fully integrated player in the wind energy market, providing end-to-end turnkey solutions. Inox Wind Energy, the holding company of Inox Wind, and INOX Green Energy Services are India’s leading wind O&M services player with 3.2 GW of assets under management. The company is in the process of amalgamating these two entities into Inox Wind, aiming to create a larger renewable energy company.

Funds that increased holdings in Inox Wind:

- ICICI Prudential ELSS Tax Saver Fund Growth

- Nippon India Small Cap Fund – Growth

- ICICI Prudential Multicap Fund Growth

- ICICI Prudential MidCap Fund Growth

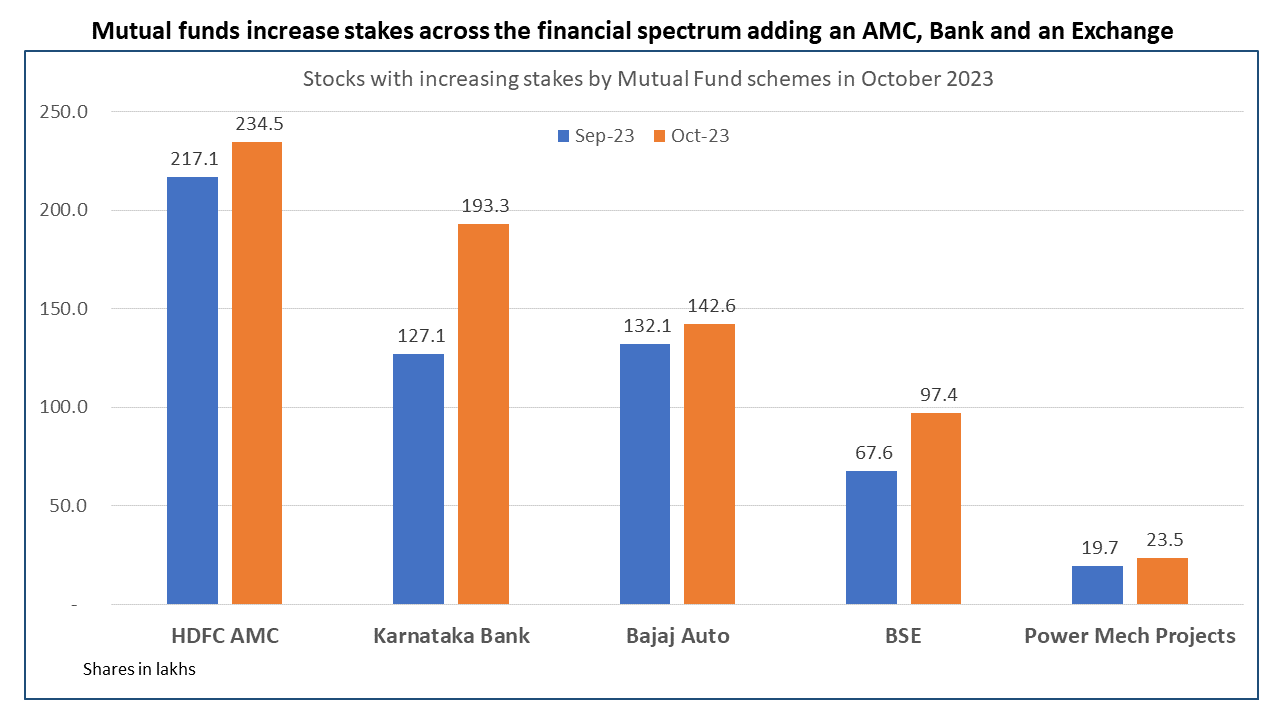

HDFC AMC

HDFC Asset Management Company (HDFC AMC) is a leading asset management company in India, managing assets worth Rs. 5,229 billion as of September 30, 2023. The company reported a successful quarter in Q2FY24, with strong growth in revenue and net profit driven by higher assets under management. Overall performance improved due to robust growth in equity-focused funds, expanding the user base, and increased market share. In this quarter, HDFC AMC launched several new funds, including a non-cyclical consumer fund, a transportation and logistics fund, a pharma and healthcare fund, and a NIFTY 1-day liquid exchange-traded fund.

Funds that increased holdings in HDFC AMC:

- SBI Balanced Advantage Fund Regular Growth

- Mirae Asset Emerging Bluechip Fund Growth

- SBI Arbitrage Opportunities Fund Regular Growth

- Mirae Asset Tax Saver Fund – Regular Plan – Growth

Karnataka Bank

Karnataka Bank is a south India-based private sector bank with a significant presence in the state of Karnataka. Nearly 46% of its branches are located in rural and semi-urban areas, focusing primarily on the retail, MSME, and agricultural segments. The bank has a nationwide presence, operating a total of 901 branches, of which 575 are in Karnataka. Post the Q2FY24 results, the management guided for a 17-18% growth in gross advances in FY24, targeting a total of Rs 72,000 crore. Additionally, the bank is focusing on expanding its Retail segment and has established a team of 600 sales personnel dedicated to generating Retail and Agri loans.

Funds that increased holdings in Karnataka Bank:

- Quant Active Fund Growth

- Quant Small Cap Fund Growth

- Quant Flexi Cap Fund Growth

- Bandhan Emerging Businesses Fund Regular Growth

Bajaj Auto

Bajaj Auto Ltd is the world’s sixth-largest and India’s second-largest manufacturer of motorcycles, also leading in the production of three-wheelers (3W). The Q2FY24 results showcased a 6.36% YoY revenue growth to Rs 11,206.8 crore and a 17.5% increase in net profits to Rs 2,020 crore, the highest in the last eight quarters. The company anticipates future growth through the gradual recovery in exports, expansion of electric 2W and 3W networks, and premiumization in the motorbike portfolio.

Funds that increased holdings in Bajaj Auto:

- Axis Bluechip Fund Growth

- Axis Arbitrage Regular Growth

- ICICI Prudential Bluechip Fund Growth

- Nippon India Arbitrage Fund Growth

BSE

BSE is one of India’s leading securities exchanges, providing a platform for trading in equity, debt instruments, derivatives, and mutual funds, including equities of small-and-medium enterprises (SMEs). In Q2FY24, BSE reported a net profit of Rs 118.41 crore, a more than four-fold increase from Rs 29.39 crore in the year-ago quarter. Its Q2FY24 revenue also reached its highest at Rs 367 crore, a 53% growth compared to Rs 239.8 crore in Q2FY23.

Funds that increased holdings in BSE:

- Invesco India Focused 20 Equity Fund Regular Growth

- Mahindra Manulife Multi Cap Fund Regular Plan Growth

- Motilal Oswal Long Term Equity Fund Regular Plan Growth

- SBI Banking & Financial Services Regular Growth

Power Mech Projects

Power Mech Projects is an engineering and construction company specializing in the erection, testing, and commissioning (ETC) of boilers, turbines, generators, and railway projects. The company is venturing into railway projects, currently executing major projects such as track doubling, electrification, signaling, culverts, and platforms.

Funds that increased holdings in Power Mech Projects:

- Aditya Birla Sun Life Small Cap Fund Growth

- HDFC Defence Fund Regular Growth

- Edelweiss Mid Cap Fund Growth

- Edelweiss Small Cap Fund Regular Growth

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255 )

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: Smart Investing: Cutting out the noise!![/vc_column_text][/vc_column][/vc_row]

Related Posts

Syngene International Gears Up for Q3 Reveal on 17th January; Check Key Expectations Here

Bharat Coking Coal IPO Subscription Day 1: Check Subscription Status

Why is Regaal Resources Share Price Falling?

Bharat Coking Coal IPO GMP: Day 1 IPO Live Updates

Transformers & Rectifiers (India) Q3 Results 2026 Highlights: Net Profit Surged by 34.91% & Revenue Up 31.71% YoY