Dharmaj & Pritika IPOs oversubscribed several times even before closing day

Posted by : Sheen Hitaishi | Thu Dec 01 2022

In contrast to the previous year, when much-awaited IPOs including Paytm, Zomato, and many others witnessed tremendous bloodshed as their share prices went on to plummet below 70% by their anniversaries this year, a lot of IPOs have recently had good listing gains in 2022. The ones that made the highest investor gains and the ones that made the lowest or negative investor gains have already been covered in an article on the Univest website.

Once more, the enthusiasm around IPOs has been sparked as the recently announced IPOs for Dharmaj Crop Guard and Pritika Engineering Components have already received several oversubscriptions before their subscription end date of November 30. In contrast to Pritika Engineering, an SME IPO whose subscription started on November 25 and was oversubscribed by 28 times till November 29, Dharmaj Crop was fully subscribed on Day 1 itself, or November 28, and was almost 5.29 times subscribed by Day 2. Both IPOs have been gaining investors’ traction and are expected to post decent listing gains. Therefore, let’s analyse the prospects of both companies and decide whether it is worth subscribing to or not.

IPO prospect’s

Dharmaj Crop Guard IPO opened on Nov 28, 2022, and closes on Nov 30, 2022. The IPO has a fresh issue of up to Rs 216 crore and an offer for the sale of 14,83,000 equity shares. The price range for the offer is Rs 216-237 a share. Further, it has a lot size of 60 shares with each share of a face value of Rs 10. The allotment of shares will be concluded on 5th December 22, whereas shares will be listed on 8th December.

Pritika Engineering Components IPO opened on Nov 25, 2022, and closes on Nov 30, 2022. The Pritika Engineering Components IPO lot size is 4000 shares, with each share a face value of Rs 10. Further, each share is offered to investors at a pre-determined price of Rs 29. The allotment of shares will be concluded on 5th December’22, whereas shares will be listed on 8th December at NSE SME. A point to be noted here is that the company was previously listed on Calcutta Stock Exchange and the same was directly listed on the Bombay stock exchange dated October 01, 2015.

Purpose of IPO

Dharmaj Crop has the following objects of the Fresh Issue as proposed to be utilised in the prospects:

● Funding capital expenditure towards setting up a manufacturing facility at Saykha, Bharuch, Gujarat.

● Funding incremental working capital requirements of the Company.

● Repayment and/or pre-payment, in full and/or part, of certain borrowings of the Company.

● General corporate purposes.

Whereas Pritika engineering has the following objectives for the utilization of its IPO proceeds:

● Investment concerning the new unit set up by the wholly owned subsidiary, Meeta Castings Limited (MCL)

● General Corporate purposes

You may also like: LIC reported stellar Q2FY23 numbers

Company’s product portfolio and business overview

Dharmaj Crop Guard Limited is an agrochemical business that was established in 2015. Insecticides, fungicides, herbicides, plant growth regulators, micro fertilisers, and antibiotics are just a few of the many agrochemical formulations that the company manufactures, distributes, and markets to both B2C and B2B clients. It had more than 196 institutional products as of November 30, 2021, which are sold to more than 600 customers situated in India and other countries. By November 30, 2021, the business had sold its goods to more than 60 clients in 20 different nations.

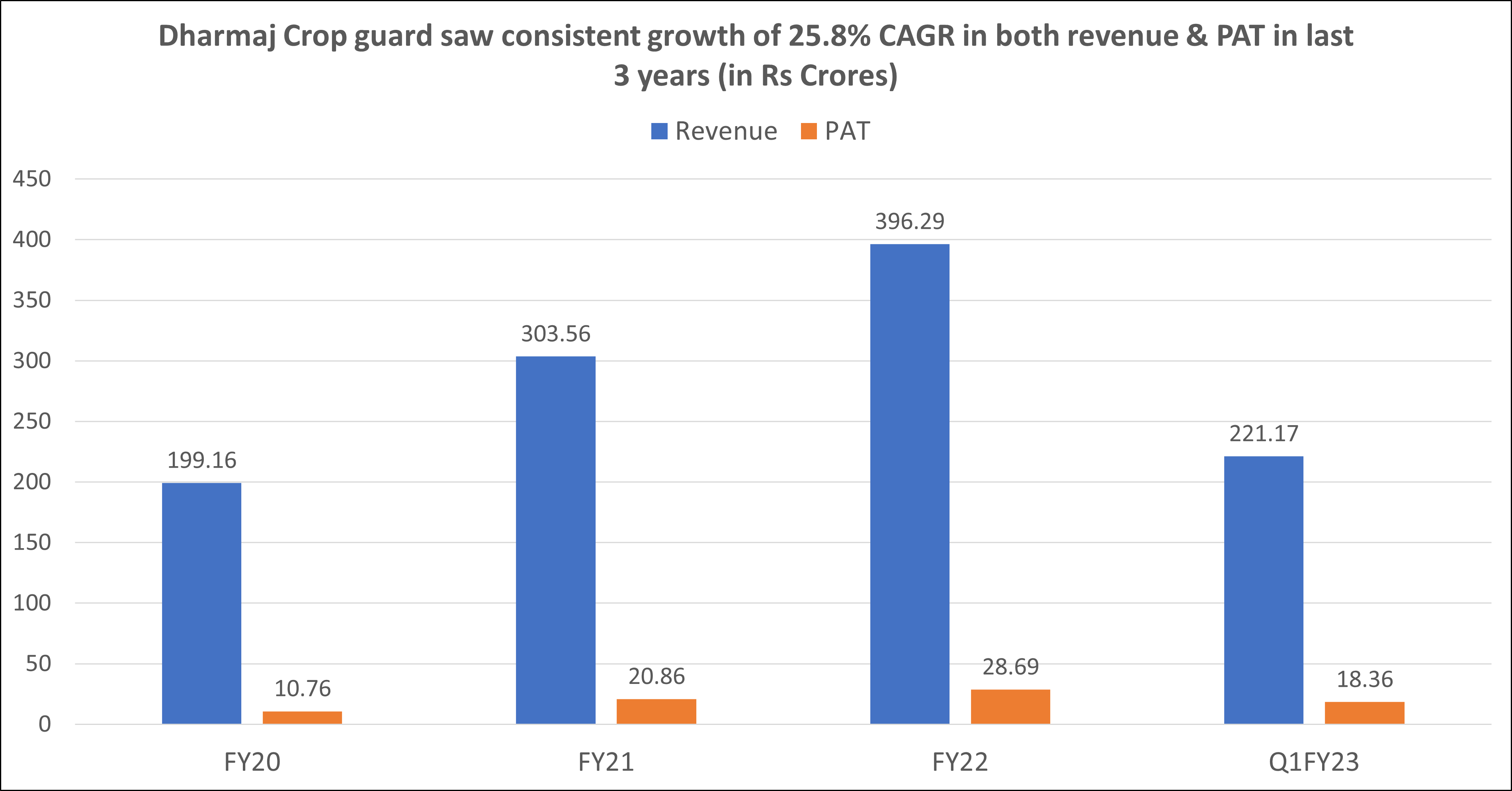

Over FY20-22, Dharmaj’s revenue/ EBITDA/PAT grew at a CAGR of 25.8%/ 34.7%/ 38.0% to Rs 398 crores/ Rs 44 crores/29 crores respectively, while, EBITDA and PAT margins improved by 220bps (to 11.2%) and 180bps (to 7.2%), respectively.

While coming onto Pritika Engineering Components Limited, manufactures precision machined parts principally for the automotive industry, in particular for tractors, lorries, and other commercial vehicles, etc. The company produces a variety of tractor and automobile parts, including brake housing, front engine supports, differential cases, flywheel housing, rear axle casings, and covers for hydraulic lifts.

SWOT Analysis of Dharmaj Crop Guard

Strengths

Among the specialised agrochemical products offered by Dharmaj are insecticides, fungicides, herbicides, plant growth regulators, micro fertilizers, and antibiotics. Its commercial operations are risk-insulated thanks to this diversification.

Additionally, Dharmaj had approximately 4,362 dealers as of September 30, 2022, with access to 16 stock depots in 17 states. During the same time period, it also exported goods to about 25 other nations. Lastly, it is net debt-to-equity ratio is at 0.4, which is again an indicator of sound fundamentals.

Weakness

The agrochemical industry is weather-dependent. Additionally, the costs of its operations may be and have been considerably impacted by strict regulatory requirements resulting from worries about climate change.

Opportunities

Dharmaj increased its market share in India for agrochemical products in recent years by increasing its product portfolio organically and the company intends to continue to evaluate opportunities to capitalize on industry consolidation and acquire other products and brands to grow its portfolio. The company intends to continue to utilize its R&D capabilities and manufacturing expertise and focus its investment on product enhancement.

Threats

The ability of farmers to spend on crop protection products may be impacted by changes in government policies, such as cuts to government support for agriculture, adjustments to the incentives and subsidies given to farmers, restrictions on the export of certain crops, or adjustments to minimum support prices.

SWOT Analysis of Pritika Engineering Components

Strengths

The business is committed to producing high-quality goods and enhancing industrial procedures at every stage of the production process. Additionally, the company’s operations are managed by skilled and experienced management staff, giving it a competitive advantage and allowing it to run smoothly.

Last but not least, the group companies have a highly skilled R&D staff that designs a variety of new and complex products as requested by the customers in a competitive timetable to meet the customised needs of the OEMs.

Weakness

Since the business lends large credit terms to its clients and is therefore exposed to counterparty credit risk, any worsening in the standing of those clients’ finances, their capacity to pay, or their incapacity to issue credit in accordance with accepted market standards could have a negative effect on the business’s profitability.

Threats

There are some ongoing legal cases concerning the corporation, and any unsuccessful defence of these cases could have a negative impact on the company’s finances, business, reputation, and the outcome of ongoing operations.

Univest View:

The Dharmaj Crop Guard IPO has been subscribed 5.97 times on Nov 29, 2022 The public issue was subscribed 7.75 times in the retail category, 0.76 times in the QIB category, and 8.74 times in the NII category. The company is a young player in this segment and does have its own set of strengths and weaknesses. Moreover, the P/E of the company is around 14 which is much lower than the industry median of 21. This makes the valuation of the company much better and thereby keeps place for investor gains on listing day. The current GMP is around 10-15% of the issue price. Therefore, investors can subscribe to this IPO for decent listing gains and if it performs well in the next quarter then consider holding it for the long term.

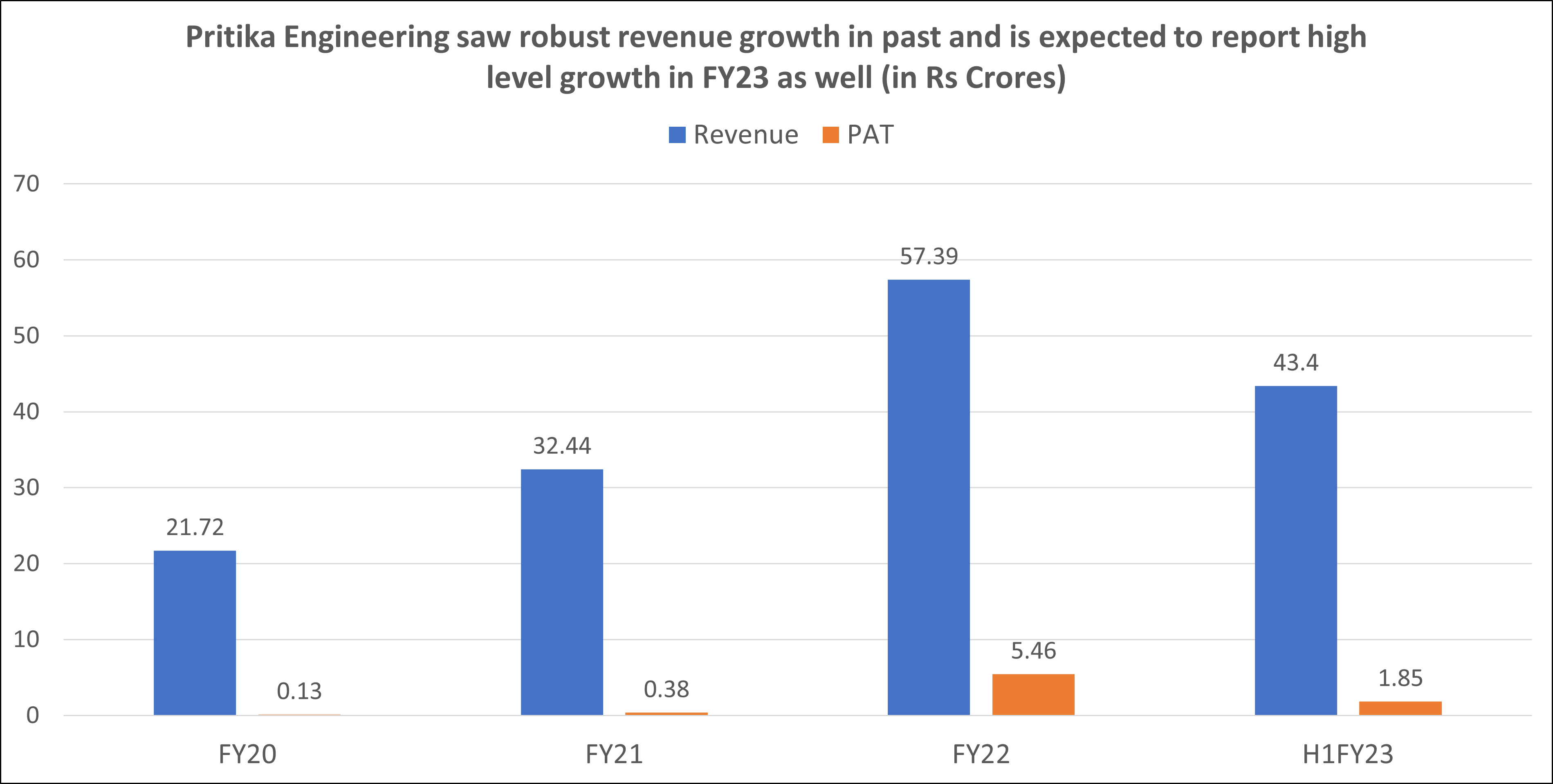

The Pritika Engineering Components IPO was subscribed 28.97 times on Nov 29, 2022. The public issue subscribed 49.83 times in the retail category, times in the QIB category, and 8.11 times in the NII category. Pritika Engineering is in a highly competitive segment that is fragmented and has many big players around. It has fared on average except for FY22 with super profits. Based on its FY23 earnings, the issue is lucratively priced, but the sustainability of such margins going forward raises concerns. Well-informed, cash surplus risk seekers may consider an investment with a long-term perspective.

ABOUT THE AUTHOR

Ketan Sonalkar (SEBI Rgn No INA000011255

Ketan Sonalkar is a certified SEBI registered investment advisor and head of research at Univest. He is one of the finest financial trainers, with a track record of having trained more than 2000 people in offline and online models. He serves as a consultant advisor to leading fintech and financial data firms. He has over 15 years of working experience in the finance field. He runs Advisory Services for Direct Equities and Personal Finance Transformation.

Note – This channel is for educational and training purpose only & any stock mentioned here should not be taken as a tip/recommendation/advice

You may also like: 2W Industry for the next quarter

Related Posts

EPW India IPO GMP & Review: Apply or Avoid?

MARC Technocrats IPO Allotment Status Check Online: GMP, Subscription, Price, and More

Global Ocean Logistics India IPO Allotment Status Check Online: GMP, Subscription, Price, and More

Neptune Logitek IPO Listing Preview: What to Expect Now?

Nephrocare Health Services IPO Listing at 7% Premium at ₹460 Per Share