.

Table of ContentsToggle

Best suggestions provider for commodity trading

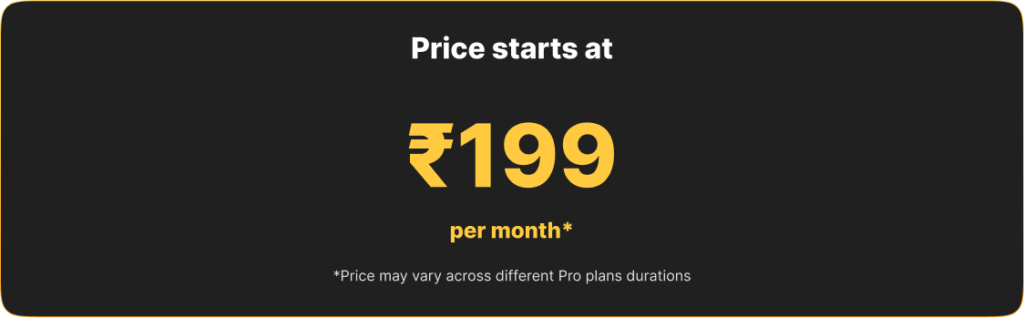

Looking for a commodity trading assistant? Univest is here with its team of 10+ SEBI-registered research analysts who have a collective experience of 75+ years in market research and provide the right suggestions for investing in the commodity market. Univest is one of the best investment advisory and wealth management platforms that helps its users invest in the stock and commodity market through its research-backed commodity trading suggestions. It provides commodity trading suggestions for energy, bullion, and base metals in the MCX market. Investors who are willing to invest in the commodity markets can do so by downloading and signing up for the mobile application of Univest. Once the users are familiar with the app they must purchase a subscription plan to receive commodity trading suggestions. Univest currently offers commodity trading suggestions for non-agricultural commodities, primarily traded on the Multi Commodity Exchange (MCX) of India. MCX is a commodity exchange that facilitates the buying and selling of non-agricultural commodities among investors. Univest users receive commodity trading suggestions for trading through future contracts. These commodity trading suggestions are provided through a subscription plan for three durations: 1-month, 3-month and 12-month. Understanding the risks involved in commodity trading, Univest also provides commodity trading suggestions to assist its users in exiting their bad investments in a timely manner, thus helping them to curtail their potential losses.

- Univest is the best investment advisory platform in India.

- It provides commodity trading suggestions for buying and selling futures contracts of commodities.

- Commodity trading suggestions are provided by SEBI-registered research analysts.

- Users can receive suggestions through subscription plans available for three durations: 1-month, 3-months and 12-months

Best Practices To Follow While Trading In Commodity Markets

- Investors should do thorough research before associating with an investment advisory platform to understand the research methodology and objective of the advisor.

- Investors must seek commodity trading suggestions from SEBI-registered research analysts and investment advisors like Univest.

- Commodity markets are highly volatile; therefore, investors should assess their risk-taking capacity and investing preferences before investing in commodity markets.

- Before seeking share market suggestions, investors must gain knowledge about the workings of the commodity market to understand and apply commodity market suggestions wisely.

- Investors should not blindly trust in commodity market suggestions and should choose the most suitable suggestion that matches with their requirements.

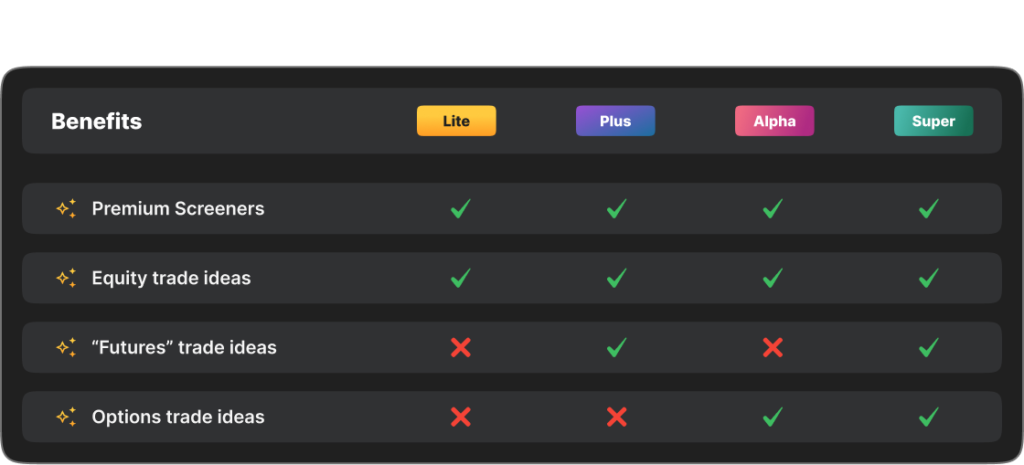

Available Membership

Best Practices To Follow While Trading In Commodity Markets

- Investors should be cautious while acting on stock market ideas that claim guaranteed profits on investments

- Investors should read all the documents related to an investment idea carefully to understand the risk associated with that idea

- Always associate with a SEBI-registered research analyst to seek investment ideas in the stock market.

- Investors should only seek stock market ideas from trustworthy resources to avoid high-risk investments

- Basic knowledge of the stock market is a must before seeking investment ideas to understand and decipher the information given in a particular stock market idea

- Investors should ensure that they are aware of their risk-taking capabilities and investing preferences and are choosing the right stock market idea for investing

Frequently Asked Questions

What is Multi Commodity Exchange (MCX), and how is it different from NSE and BSE?

The Multi Commodity Exchange (MCX) of India is a platform that works as a mediator that assists investors in buying and selling non-agricultural commodities through derivative contracts. MCX started its operation in 2003 and has become the leading commodity exchange for the trading of non-agri commodities. The National Stock Exchange and Bombay Stock Exchange are two active stock exchanges in India. The significant difference between the MCX and the stock exchanges is that on MCX, investors trade commodities, whereas on the NSE and BSE, investors trade stocks of various companies.

What are the trading hours for commodity markets?

The trading hours of commodity markets vary according to the type of commodity being traded. In the agri-commodity segment, timings are 9 AM to 5 PM. Meanwhile, in the non agri-commodity segment, the timings are 9 AM to 11:30 PM; however, during daylight saving, the timing is extended till 11:55 PM.

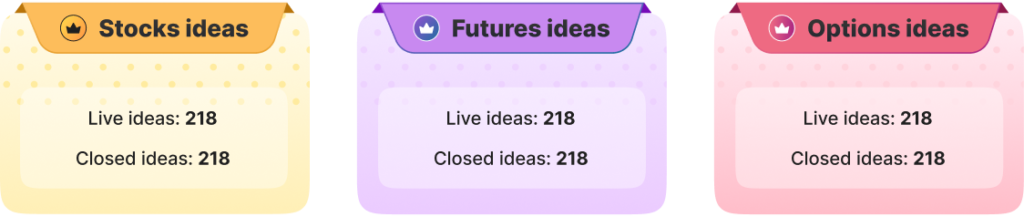

What are the services offered by Univest in the MCX market?

Under the MCX market, Univest provides commodity trading suggestions for three segments:

- Bullion

- Energy

- Base Metals

Can I execute a delivery order in the commodity market?

Yes, commodity markets do have a delivery order feature, but this feature varies from broker to broker and instrument to instrument. Otherwise, a transaction in a commodity market always occurs through derivative contracts only, which expire on their pre-decided expiry date.

What are the major benefits of investing in commodity markets?

The major benefits of commodity markets are:

- Diversification – Commodity markets offer great opportunities to diversify their portfolio because by investing in these markets, investors are exposed to newer sets of investment vehicles that can provide their portfolios an edge in adverse market situations.

- Hedging – Hedging is a way to provide insurance to your investments. By trading in commodities like gold and silver, which can hold their values during inflationary periods in the economy, investors can hedge their risk or get insured from any negative movement in different markets or instruments.

- Speculation – Speculation is an act of buying or selling a security according to the price expectation of that security. In commodity markets, volatility is very high; hence, it also offers ample upside potential. Thus, investors can trade in commodity markets through derivative contracts by holding long and short positions to benefit from price fluctuations.

.