.

Table of ContentsToggle

Best Share Market Suggestions Site In India

Trend Lines, financial indicators, company analysis, and many more – there is so much to learn just to buy a share of a company. Be it a seasoned investor or a beginner, investing money in the stock market without paying attention to these concepts may result in investors facing huge losses. However, the real question is whether every investor can learn and apply these concepts in the stock market. To put this in perspective, according to a report of SEBI, every 9 out of 10 retail traders in India lose money in the stock market. This report clearly shows that every investor is not equipped with the proper knowledge and skills to invest in the stock market. This calls for a solution to bridge this gap between the retail investors and the suitable share market suggestions for profitable investing.

- Share market suggestion – A service that provides advice or recommendations to investors for investing in the stock market. These share market suggestions include essential information about an investment opportunity, i.e., entry price, target price, holding duration, suggested entry range, and more.

- Stock market suggestions entail the service of providing advice to investors on stock market investing.

- It also assists investors in investing strategically in the stock market.

Share Market Suggestions by Univest For Investing in The Stock Market

Univest is a platform that understands the importance of financial literacy; therefore, to make Indian investors more informed and profitable, it started its operation to provide the best share market suggestions based on which investors can invest in the stock market with a defined strategy and objective. Univest is India’s most prominent share market suggestions and investment advisory platform that has enabled 30 lac+ users to apply the suggestions backed by the research of SEBI-registered research analyst of Univest and build robust portfolios.

- The broad user base of 30 lac+ satisfied customers

- Share market suggestions based on the research of SEBI-registered research analysts

- Univest assists its users in investing in the stock market with the right approach and strategy

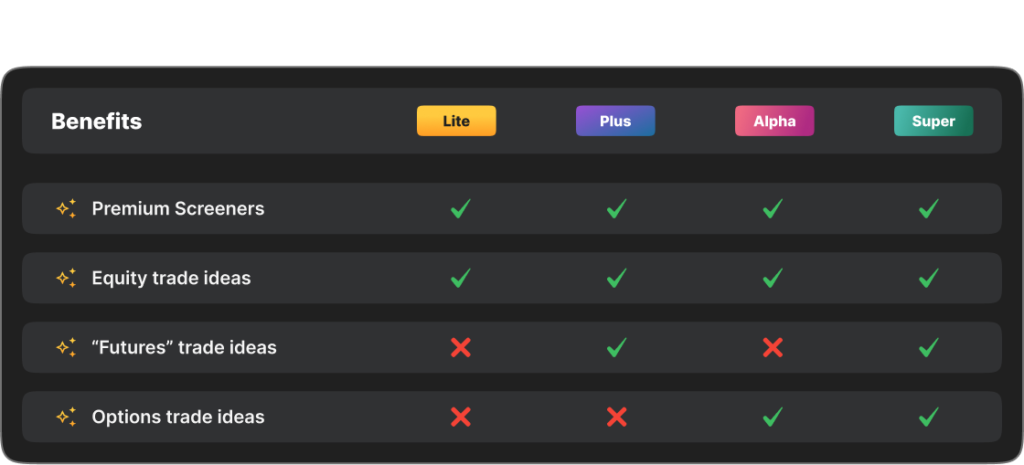

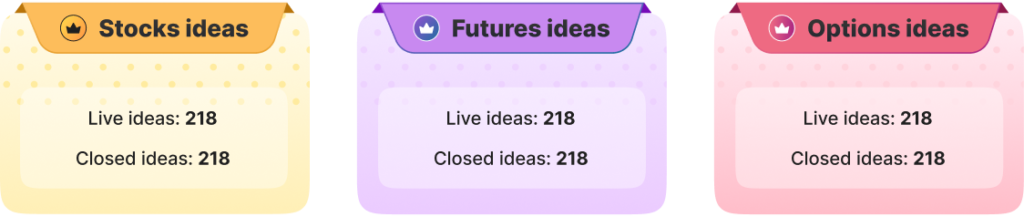

- Users receive stock market suggestions in three segments: equity, futures and options

- Under the equity segment, users receive suggestions for three durations: short, medium, and long

- After registration, the user can avail of a seven-day free trial and can unlock five free trade cards

- Market-linked products – This category includes a product range offered by Univest that provides its users share market suggestions in three segments of the stock market: equity, futures, and options. Also, the return of these products is linked with the stock market’s performance.

- Plan Duration – Refers to the period for which users can access a particular plan they choose.

- Plan type – Plan type refers to a category of plan that users choose according to their requirements to receive share market suggestions from Univest. Each of these plans entails a distinct set of offerings that are useful for investors with varied investment preferences.

- Demat linking – To provide users with a hassle-free investing journey, Univest provides a demat linking feature on its mobile application that allows users to link their demat accounts of 8 listed stock brokers to invest and track their portfolios all in one place.

- Research tools – Good research is the starting point for choosing the right investment avenue. Hence, Univest has various AI-based free research tools such as premium screeners, financial calculators, and many more for self-analysis and high-quality research.

- Informative content – Making retail investors financially literate is one of Univest’s primary goals; therefore, to achieve this goal, it provides its users with a plethora of informative content to help them understand the stock market better.

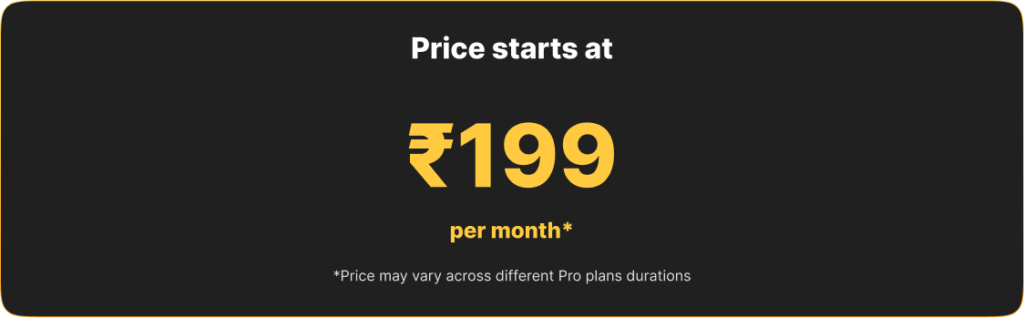

Available Membership

Things to Keep in Mind While Seeking Share Market Suggestions

- Make sure that share market suggestions are received from SEBI-registered research analysts or investment advisors.

- Do not act on suggestions that give unrealistic target prices and are provided without any logical rationale behind the suggestion.

- Investors should understand their investing preferences and risk appetite and only then proceed further to invest based on share market suggestions.

- Do not seek share market suggestions from an unknown source because such suggestions can be a part of financial fraud.

Frequently Asked Questions

How much experience do the research analysts of Univest have?

The SEBI registered research analysts of Univest have a collective experience of 75+ years and are highly skilled in research and analysis.

Is direct trading allowed through the Univest app?

Since Univest does not have a brokerage, a user cannot trade directly through Univest. Still, to simplify this concern for users, Univest has a demat linking procedure through which users can link their demat account on the app and then place the buy or sell order on the app itself.

Can a user download the Univest app on both Android and IOS?

Users can download the Univest app on Android and IOS devices through the Play Store and Apple Store, respectively.

What type of investors can invest through the Univest’s market-linked product?

The market-linked products offered by Univest are suitable for every set of investors, from beginners to experienced investors; however, the performance of these products is linked to stock market performance. Therefore, each investor should assess their risk-taking capability and must invest accordingly.

Which communication channels do Univest use to provide trade alerts?

Users can access 4 types of subscription plans through the Univest platform: Pro Lite, Pro Plus, Pro Alpha, and Pro Super. These 4 plans are structured to give users the freedom to choose the most suitable plan for themselves.

.