.

Table of ContentsToggle

Best Commodity Advisory Services Company In India

The financial sector is very dynamic, with landscapes evolving at a fast pace. From the era of floor trading to the digitised world of stock market investing, investors have seen tremendous growth in the functioning of the stock market. Along with the functioning, the span of instruments traded in the financial markets has also changed drastically. Investors today have various options for investing their funds and creating wealth over the long-term, be it stocks, futures, options, bonds, commodities, and many others. However, commodities that were previously only confined to physical trading have now turned into digitised forms of trading through stock exchanges. Today, investors or traders can trade commodities in the digitised form, which has helped them to diversify their portfolios and hedge against various types of risks.

An Introduction To Commodity Trading

India has been a producer of raw materials and agricultural products for a long time, and trading in agricultural commodities and other raw materials has been a significant component of the trading practice of Indian traders and farmers. However, with the advent of advanced technology, commodity trading has taken the face of digital commodity trading. Simply put, commodity trading refers to the buying and selling of distinct types of commodities in the digital form through commodity exchanges. Just like shares of companies are traded on stock exchanges such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), commodities such as gold, silver, crude oil, etc., are also traded on the Multi Commodity Exchange (MCX) and National Commodity And Derivative Exchange (NCDEX). Besides these two exchanges, NSE and BSE also act as commodity exchanges. These commodity exchanges act as platforms where traders or investors meet remotely to buy or sell commodities for different investment purposes. Commodity trading through exchanges does not involve the physical transfer of commodities or raw materials among traders. It is performed through the buying and selling of derivative contracts, which means the buyer and seller of such contracts agree to sell or buy a specific type of commodities in the form of derivative contracts at a price fixed in advance.

- Commodity trading is the buying and selling of agricultural and non-agricultural commodities in digitised form.

- Commodity exchange is a platform where commodity trading takes place among investors.

- Commodity trading takes place through the derivative contract of commodities.

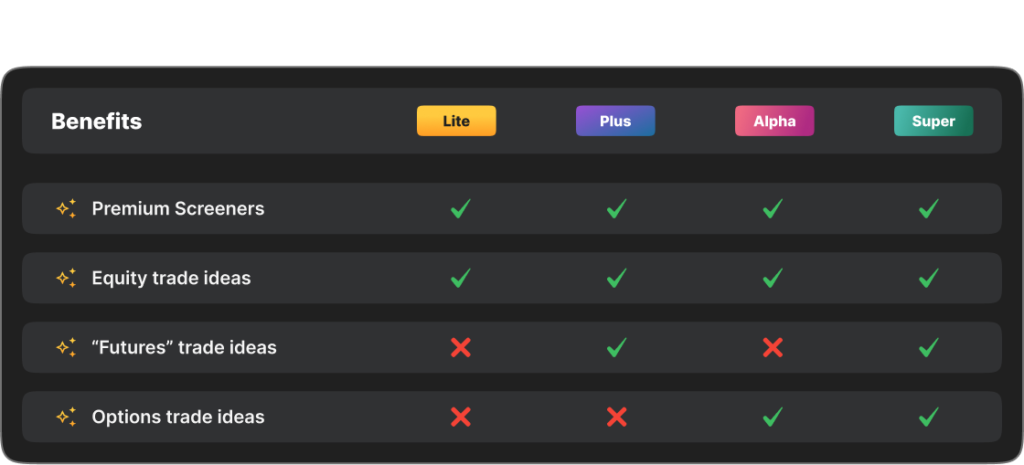

Available Membership

What Is Multi Commodity Exchange And NCDEX?

The Multi Commodity Exchange (MCX) and the National Commodity and Derivatives Exchange (NCDEX) are two major commodities exchanges that enable efficient functioning of commodity trading amongst traders and investors. The major difference between these exchanges is the type of commodity traded on them. Commodities in India are divided majorly into two main heads: agricultural and non-agricultural commodities, which are traded on the Multi Commodity Exchange (MCX) and National Commodity and Derivative Exchange (NCDEX), respectively.MCX – The Multi Commodity Exchange (MCX) is an exchange on which traders can trade non-agricultural commodities, which are categorised under three main heads: Bullion, energy, and base metal. This exchange started operating in 2003 and is the first exchange to offer commodity options and futures contracts for energy, bullion, and base metal segments. It is a high-tech platform that facilitates the successful transactions of commodity derivatives contracts among traders. Commodities traded on the MCX falls majorly into three categories:

- Bullion

- Gold

- Silver

- Energy

- Crude Oil

- Natural Gas

- Base Metals

- Copper

- Aluminium

- Lead

- Zinc

- Cereal and Pulses

- Fibers

- Oil and Seeds

- Soft

- Guar complex

- Spices

What Are The Factors That Affect Commodity Trading?

Like any other financial market, the commodity market also carries an implied risk of volatility, which causes fluctuations in the prices of the instruments traded. These price fluctuations are caused by various factors. It is important to understand these factors before trading in the commodity market.

- Supply & demand – The supply and demand of a commodity are the most basic determinants of commodity prices. Simply put, if the supply of a commodity exceeds the demand, then the prices start to fall because there are a large number of sellers and fewer buyers, which compels sellers to lower the prices to sell such commodities. If the demand for the commodity exceeds the supply, then the prices increase.

- Natural calamities – Specifically in the case of agri commodities, natural disasters such as floods, droughts, or epidemics cause severe implications on prices. For example, India is a mass producer of wheat. If, during the harvesting season, floods hit wheat-growing regions of India, then it will result in a decreased supply of wheat in the markets, resulting in an increase in wheat prices.

- Speculation Activities – Speculation is an act of holding a position in a security with the expectation of selling it at a higher price, and a lot of commodity traders do speculative trading, which leads to increased buying of a commodity derivative contract, thus resulting in increased prices of these contracts.

- Political factors: The government of a nation forms trade and tariff policies, which significantly affect trading in commodities. For example, if the government of a nation increases tariffs on the import of crude oil, then it will increase prices of oil and oil-related commodities for importing nations. The reverse is also possible.

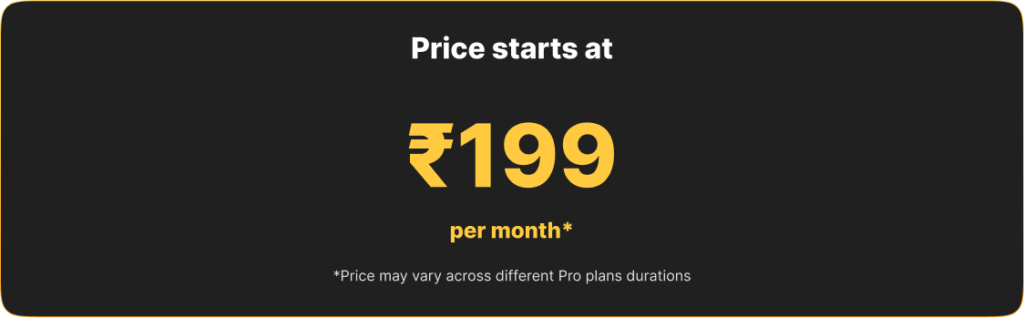

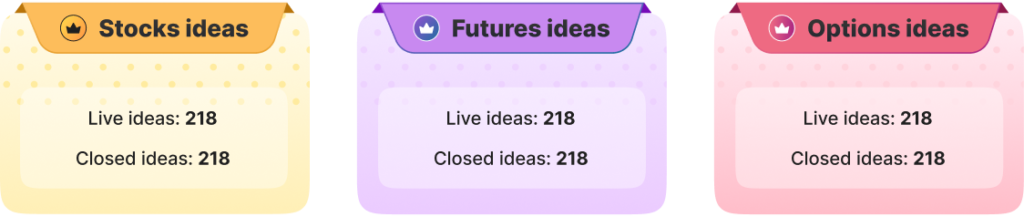

Commodity Advisory Services By Univest

Commodity trading is considered one of the most risky segments for trading because the factors affecting commodity markets are not in the control of humans; they cause drastic and large fluctuations in commodity prices. Thus, for successful trading in the commodity market, traders should seek commodity advisory services from reliable sources that can provide authentic and precise tips for trading in the commodity market.One such platform for seeking the best commodities advisory is Univest. It is India’s best investment advisory and wealth management platform, which provides advisory services to its users in the equity, futures, options, and commodities segment. With a user base of over 30 lac users, it has become the first choice of investors to receive commodities advisory services in India. Univest has an experienced team of 10+ SEBI-registered research analysts who collectively have 75+ years of experience in market research and analytics.Univest primarily focuses on providing stock market advisory to its users for taking timely entry into trades along with exit recommendations, so that users can exit their bad trades in a timely manner. To receive the commodities advisory services, traders must download the Univest app from the Play Store or the App Store. Univest users get commodity advisory services for three durations: 1-month, 3-months, and 12- months. To receive commodity trading advisory for these durations, users must subscribe to various subscription plans that are available on the Univest app. Univest only provides commodity advisory services in commodity future contracts.

Services Offered By Univest:

MCX – Univest currently offers commodity advisory services in the MCX market under three main heads:

- Bullion

- Gold

- Silver

- Energy

- Crude Oil

- Natural Gas

- Base Metals

- Copper

- Aluminium

- Lead

- Zinc

- Univest is India’s best commodity advisory company

- Univest provides commodity advisory services in the MCX market.

- It provides commodity advisory services for 1-month, 3-month, and 12-month duration

- Commodity advisory services are provided for commodity future contracts.

Frequently Asked Questions

What are the trading hours for the commodity market?

The trading hours of commodity markets vary according to the type of commodity being traded. In the agri-commodity segment, timings are 9 AM to 5 PM. Whereas, in the non agri-commodity segment, the timings are 9 AM to 11:30 PM; however, during daylight saving, the timing is extended till 11:55 PM.

On which days are commodity markets open for trading?

Commodity markets are open for trading on weekdays, i.e., Monday to Friday. Trading in commodities markets does not happen on weekends and designated holidays by the commodity exchanges.

Who regulates the Multi commodity exchange (MCX) in India?

The Securities Exchange Board Of India (SEBI) regulates the Multi Commodity Exchange (MCX) Of India.

Why is Univest the best commodities advisory services company in India?

Univest is considered the best commodities advisory services company in India because it provides high-quality commodities advisory services based on the research of its SEBI-registered research analysts. Not only does Univest offer commodity advisory for taking entry in the right trade, but it also provides exit recommendations for exiting the bad trades promptly to avoid any potential losses.

Why should I choose a commodity market for trading?

Even after being highly risky, the commodity market is considered a good avenue for hedging purposes. You can do commodity trading during adverse market conditions when other financial markets are moving in a bearish trend. For example, trading in gold while there is a downward trend in the economy or the stock market is considered a wise approach.

.