.

Commodity recommendations are provided through subscription plans.

Users can purchase subscription plans for 3 durations: 1-month, 3-month, and 12-month.

Investors can purchase subscription plans from the App Store and the Play Store for free.

Why is the commodity market riskier than the stock market?

The commodity market is riskier than the stock market because the prices of commodities are influenced by numerous factors bringing drastic price fluctuations in commodity prices; factors like natural calamities, speculation by investors, seasonal factors and other macroeconomic factors are some of the major factors that affect commodity prices making them riskier than the stock markets. What is the experience level of Univest’s research analysts?

Univest has a team of 10+ SEBI-registered research analysts with a collective experience of 75+ years in market research and analysis. They are seasoned professionals who are the right fit to provide high-quality commodity recommendations to Univest users. How many commodity recommendations do I receive?

Univest provides 5-6 commodity recommendations per week. Do I receive commodity recommendations for future and option contracts?

No, Univest currently does not provide commodity recommendations for options contracts, but users receive recommendations for future contracts under the MCX market. What is the main attribute of the Multi commodity exchange (MCX)?

The main attribute of the Multi Commodity Exchange (MCX) is that it mediates the buying and selling of non-agricultural commodities. Also, it is the first exchange to offer buying and selling of future and option contracts for non-agricultural commodities. .

Best Commodities Recommendation App

Commodity trading in India has been on the rise due to various benefits such as diversification, hedging, and speculation, through which users can reduce their risk and generate returns by trading derivative contracts of commodities. However, returns and risk always go hand in hand, requiring the investors to invest intelligently in the commodity market to avoid potential losses due to drastic price changes in the commodity prices.

What Is The Commodity Market?

A commodity market is a marketplace where participants meet to buy and sell commodities at prices decided as per the demand and supply of those commodities. However, it is essential to understand that today, commodity markets have been digitised. This means that commodity trading now occurs through commodity exchanges, which offer the service of buying and selling commodities in virtual format through derivative contracts. Commodity markets are considered great avenues for investors. Hedging risk during inflationary periods by investing in commodities like gold and silver is common among investors. Along with gold and silver, investors can trade various non – agricultural and agricultural commodities through commodity markets.- Commodity markets are a marketplace where investors buy and sell various commodities.

- Investors transact in commodities through derivative contracts.

- Physical transfer of commodities does not occur in transactions through derivative contracts.

- Commodity exchange is a platform through which investors buy and sell commodities through derivative contracts.

- India has two commodity exchanges – the Multi Commodity Exchange (MCX) and the National Commodity and Derivative Exchange of India (NCDEX)

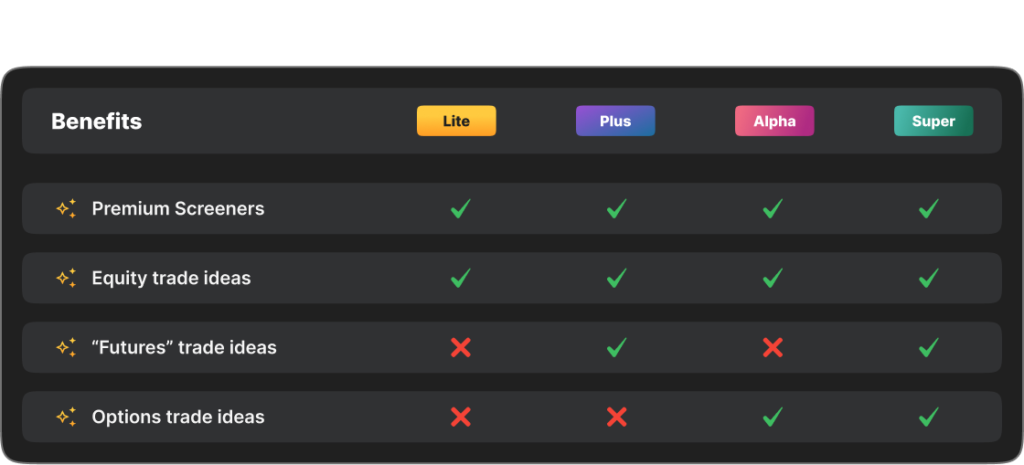

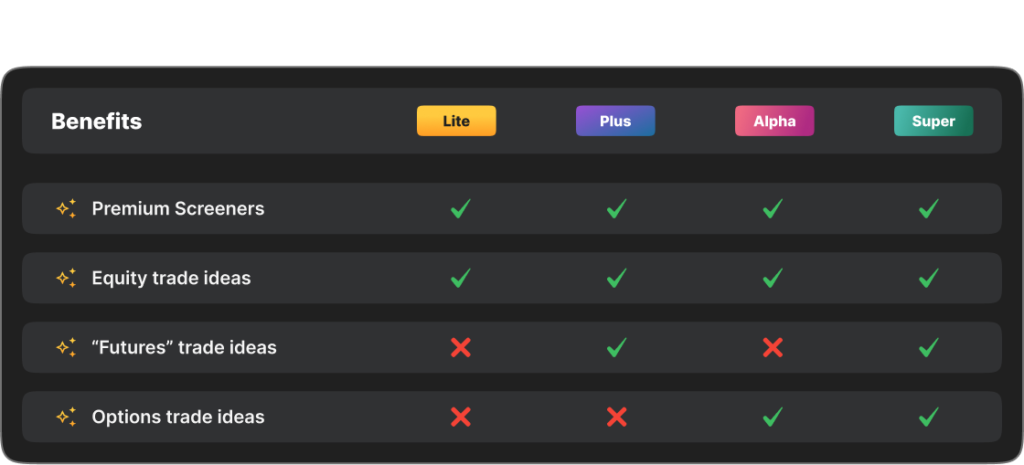

Available Membership

How Does Univest Provide Recommendations For Commodity Trading?

Univest is India’s leading investment advisory platform that provides recommendations for investing in the stock and commodity markets. Univest was started in 2022 to simplify the investing journey of investors by offering stock market recommendations to investors for investing in equity, futures, and options. Being a customer-centric company, Univest also expanded its services to commodity markets. Now, it offers recommendations in the commodity market backed by the research of SEBI-registered research analysts.Univest currently offers commodity recommendations in the MCX market for investing through future contracts. Users can invest in three segments of the MCX market: Energy, Bullion and Base metal. It provides commodity recommendations through subscription plans, available for 3 durations: 1-month, 3-month, and 12-month. Univest also understands that commodity trading is a highly risky segment; therefore, it offers exit recommendations to its users so that they can exit their bad investments or trades in a timely manner to cut down their potential losses.To receive high-quality commodity recommendations, investors must download the Univest app from the Play Store or the App Store and purchase a subscription plan available on the app to keep receiving recommendations and investing in non-agricultural commodities.Univest offers commodity recommendations for investing in non-agricultural commodities.Commodity recommendations are provided through subscription plans.

Users can purchase subscription plans for 3 durations: 1-month, 3-month, and 12-month.

Investors can purchase subscription plans from the App Store and the Play Store for free.