.

Table of ContentsToggle

Best Stock Market Tips Provider In India

Investing in the stock market can sometimes be a complex and overwhelming activity for a retail trader or investor, as share markets are subjected to sudden price changes triggered by various dynamic factors. Therefore, to overcome this hurdle and maximise the return on investment, an investor can seek stock market advisory services from a Registered Investment Advisor (RIA) or a Research Analyst (RA), also known as a financial advisor or an investment advisor. Both of these are SEBI-registered professionals authorised to provide advice for stock market investing.Stock market advisory is a service that provides guidance and recommendation to investors who want to invest and generate returns in the share market but lack the required skills or knowledge to do so. Share market advisory helps investors park their funds in the best possible stocks or investment vehicles with the help of the knowledge and experience of an RIA or RA who is empowered to give investment advice according to the requirements of their clients. This service includes understanding the varied factors that affect an investor’s investment decision, such as investment duration, investment objective, risk profile, etc., and advising them about the best investment opportunities available for wealth creation and generating stable income while minimising the risk.

- Investors can seek stock market advisory services from investment advisors to maximise returns

- Stock market advisory services assist investors with short, medium and long-term investing so that they can create wealth and decrease losses on their investments.

- Registered investment advisors or research analysts are professionals who provide stock market advisory

Why is stock market advisory important?

“I Just received a hot stock market tip !! I am going to invest right now.” It is a statement that we often hear around us when it comes to investing in the stock market—all credit to the advancement in internet technology and the growth of social media.With the spike in the content availability on social media in the form of blogs, articles, and videos curated by finfluencers showcasing their massive amount of profits accumulated through stock trading, many new investors get attracted to the stock market and bear losses when they invest their money based on stock market tips received through these finfluencers and various social media channels.Additionally, due to the large amounts of data and information on the internet, it becomes very difficult for investors to segregate between “noise” and research-backed share market tips, which can help them make well-informed decisions and generate high returns.In simple terms, share market tips can be understood as advice that assists you in your decision-making process while investing in the stock market. A proper stock market tip consists of robust analysis, reasoning, and research that enables a person to invest their money wisely to maximise wealth creation and profit booking.

- Investing based on stock market tips that are not backed by research is considered risky.

- Share market tips are a form of advice or recommendations in stock market investing.

- Noise refers to various unsolicited stock tips or advice that are available on the internet and other non-reliable sources.

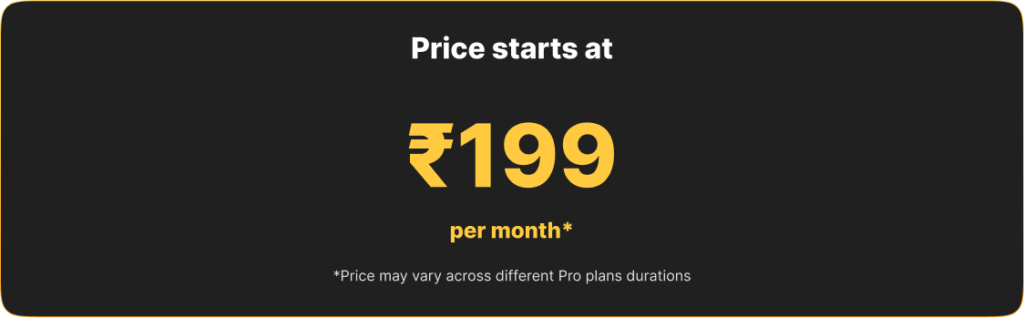

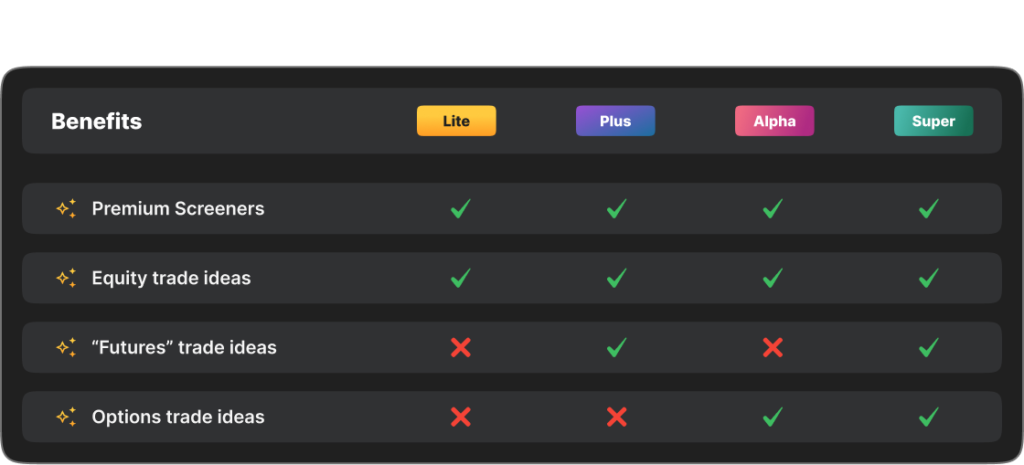

Available Membership

SEBI and Its Role In Providing Stock Market Tips

With the rising popularity of the stock market amongst the public and the increased inflow of funds, safeguarding investors from sudden losses in the stock market has become the primary duty of regulatory authorities such as the Securities Exchange Board of India (SEBI). The organisation that regulates and maintains transparency and compliance within the stock market. Hence, in the capacity of its authority and to achieve the objective of safeguarding the Indian investors, SEBI advises acting on share market tips that are received from trustworthy resources having a proven track record of providing the right and well-researched share market tips.A well-known source for receiving the best stock market tips for safe and profitable stock market investing is SEBI Registered Research Analyst (RA) and Registered Investment Advisors (RIA). These are trained professionals with a large span of experience in the field of finance and stock market investing, making themselves the right fit for providing stock market tips to investors for various investment durations.Research analysts and investment advisors play a vital role in providing the best share market tips since they possess a dynamic basket of quantitative, qualitative, and analytical skills, which enables them to research and analyse a financial instrument prudently and form suitable investment recommendations.

- SEBI – Securities Exchange Board of India is the regulatory body established to regulate the stock market.

- Research Analyst (RA) – Research analysts are professionals who analyse, track and create reports on investment opportunities for various categories of clients.

Attributes Of The Right Stock Market Tips

- Backed by quality investment research – A stock market tip is not just a mere piece of advice; but an indication for investors to invest their hard-earned money in a financial instrument. Thus, it is crucial to understand that share market tips should always be logical and rightly derived from deep research to minimise the risk of losses.

- Prioritises the interest of the investors -It is a well-known fact that investing in the stock market is a complex activity. Therefore, when investing is carried out with a lack of knowledge, the risk percentage on investments increases significantly. Hence, to protect the investors from adverse consequences in the stock market, a share market investment tip must prioritise the best interest of the investors.

- Provided by an ethical source – Nowadays, with the increased flow of information worldwide, it has become difficult to differentiate between a share market tip received from an unsolicited source and the right one. However, an essential feature of the right stock market tips that help in such differentiation is that they are received from a known and reliable source and are always in the best interest of investors.

- Clear Communication – Any information or advice, when communicated poorly, is of no use to a user. Hence, clear and fast communication is a vital attribute of good stock market tips because if investors receive timely information about their investments through tips, then they get sufficient time to act accordingly and make changes to their investment portfolio.

- Easy to understand and apply – For investors who choose to invest their money based on share market tips, clarity and convenience are two of the primary qualities they expect in a stock tip because a share market tip that investors can understand quickly streamlines their investing journey and lets them take prompt action in the stock market.

Univest – The Reliable Source For The Best Share Market Tips

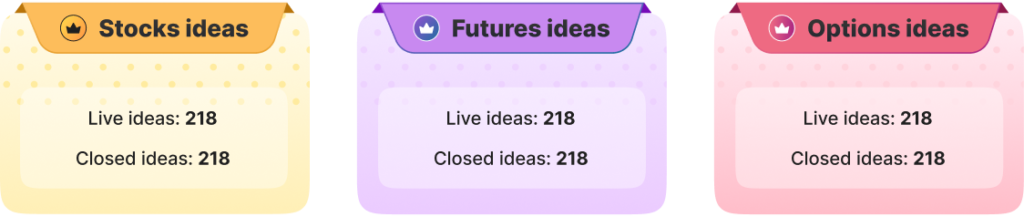

“Univest – Unifying the investment journey of Investors”. With this motto in mind, Univest was started in 2022 to solve the problems faced by many Indian investors in the stock market. Univest caters to millions of investors through the stock market tips provided by their SEBI registered Research Analyst (RA). Univest is an investment advisory platform that focuses on giving share market tips to its users for investing in the stock market. These stock trading tips are derived from the analysis done by their team of SEBI registered research analysts with a collective experience of 75+ years. Through consistent performance and high-quality share market tips, today Univest has been able to create a user base of 30 Lac+ users who are investing their money in the right instrument at the right time by applying the stock trading tips received from the team of Univest. However, it is not only concerned with providing entry range through its stock tips; it also adds value for its customers through its USP to provide share market tips to exit bad investments promptly to cut down investor’s losses. By doing so, Univest has become the number one company that provides stock market tips to investors in India. It is a customer-oriented company; therefore, to reach a large number of investors and help them grow their money, Univest provides stock market tips through its subscription plans at a cost unmatched in the segment. Through this approach, it has acquired a large consumer base and simplified various complex problems for its users in a short span of 2 years. The uniqueness of Univest lies in its ability to mitigate the hassle of its users to track and understand the stock market regularly and create a simple investing process for them. From research and analysis to providing share market tips, Univest ensures that investor’s journeys become more accessible with each passing day. Now let us have a look at what Univest offers to its customers: Univest is a platform for providing expert share market tips to its users in three segments of the stock market :

- Cash/Equity

- Futures

- Options

- Univest is the No.1 Stock market Tip provider in India

- Boasts a user base of 3 million+ users

- Provide stock market tips backed by the research of SEBI registered research analysts.

- Univest operates on a “quality over quantity” approach; therefore, users only get high-quality stock market tips daily.

Importance Of Seeking Stock Market Tips

- Convenience for investors – Be it short-term trading or investing for the long term, both types of investing need a prerequisite set of skills and knowledge, such as fundamental analysis and technical analysis, to invest successfully in the stock market. However, every retail investor can not acquire and apply such knowledge and ability to invest wisely; therefore, seeking share market tips provides investors with the convenience of avoiding the cumbersome task of understanding different investing methodologies.

- Compliance of regulatory framework and regulations – When share market tips are received from an investment advisor, it is safe to say that these professionals ensure that all the rules and compliance framework are being followed while giving any share bazaar tip so that investors, as well as the advisor, are not subjected to any kind of legal scrutiny.

- Rise in ROI of portfolio – Stock market tips are considered a great way to enhance the performance of your portfolio because an investment advisor who is providing these stock market tips infuses their expertise and experience in the given recommendations that help increase the returns on investment for an investor.

In A Nutshell: Univest The Right Stock Market Tips Provider In India

A stock market tip is basically a recommendation that contains indications for an investor to invest in a particular security in the stock market with the given entry and exit prices along with an investing duration.These share market tips are received through various resources at a swift pace all around the globe due to advancements in internet technology. Thus, the internet brings its own risk in the form of scams and other forms of fake profit-making schemes that lure investors to invest their funds in very risky instruments through which these scamsters can empty the investor’s pockets, leading to dissatisfaction and loss of trust amongst them. Therefore, to address these issues and safeguard investors, the Securities Exchange Board of India advises them to receive and act on stock market tips sourced from trustworthy channels such as Registered Investment Advisors (RIA) and Research Analysts (RA). Additionally, it is the duty of an investor not to follow a share market tip with blind faith to achieve massive profits; therefore, before beginning to invest, an Investors should acquire some knowledge of stock market investing so that he/she can understand nuances of a stock market tip properly and is not fooled by scamsters.Now, the major question here is, where can you find the right expert to receive high-quality stock market tips? The answer to this question is – Univest. A share market tip provider that provides investors with the best stock market tip backed by their SEBI registered research analyst (RA) to invest and increase their returns in the stock market. It is the best platform to receive share market tips because it not only assists investors in entering the right stock but also helps them to exit their bad investments. To sum up the whole discussion, it is not wrong to say that while receiving stock market tips, investors should move forward with caution since they can be tempted to invest their money in instruments that are very risky because these share market tips appear to be very profitable, but every investor has their own set of goals and objectives, and hence the decision to act on a particular stock market tip is subjective. Therefore, before believing in a share bazaar tip and investing in the stock market based on that tip, an investor should assess his/her risk-taking capacity and financial goal and then invest accordingly to decrease risk.

Precautionary Steps To Be Taken While Seeking Stock Market Tips

- Always do a background check on the source of a stock market tip if received from an unknown source.

- Ensure that the share market tip does not promote a guaranteed profit since stock market investing is subject to volatility, and hence, there is no guarantee of profits.

- Since every investor has their own style of investing, hence it is important to wisely review stock market tips to assess their applicability to an investment opportunity.

- Always consult a Registered Investment Advisor (RIA) or Research Analyst (RA) to receive a share market tip for safe and secure investing.

Frequently Asked Questions

Are share market tips the right investment tools for every investor?

Yes, share market tips can be the right tools for investing in the stock market only if received from a credible source and formed with an unbiased approach that keeps the interest of the investors primary.

Is it necessary to have knowledge of stock market investing before seeking stock market tips?

Yes, it is essential to have some knowledge of the stock market before seeking share market tips because this enables the investor to comprehend the information provided in a tip through which they can invest wisely.

What are the best sources from which to receive stock market tips in India?

The best sources to receive stock market tips in India are SEBI registered Research Analysts (RA) and Registered Investment Advisors (RIA), who are enabled with the expertise and skills to analyse an investment opportunity and provide the best tips to investors.

How is Univest helpful in providing the right share market tips to the investor?

Through the experienced team of SEBI registered research analysts who possess a wide array of skills in the field of research and analytics, Univest is able to provide the best stock market tips in India. This has also established Univest as a one-stop solution for all the problems Indian investors face while investing in the stock market.

Is social media the right source for seeking stock market tips?

Stock market tips received through social media channels such as video streaming platforms and various web pages can be very risky because they lack credibility. Therefore, investors must do deep background research on such sources before acting on stock trading tips sought from these social media platforms.

.